Fidelity Unexpectedly Outperforms BlackRock in Bitcoin ETF Mania

Highlights

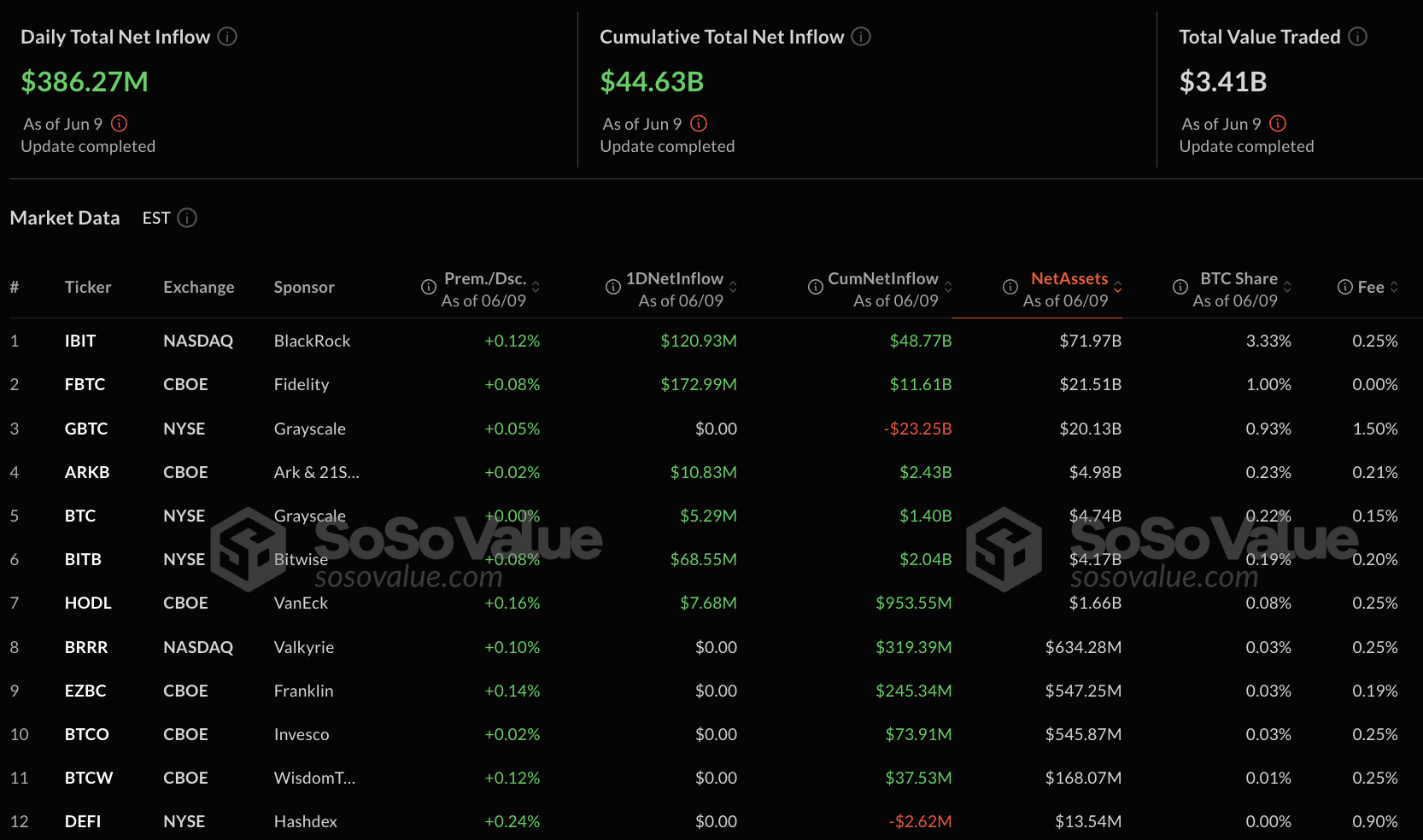

- Fidelity's Bitcoin ETF ouptaces BlackRock's IBIT in daily inflows on June 9

- Fidelity recorded a $172.99 million inflow, while BlackRock came second with $120.93 in daily inflows to Bitcoin ETFs

- Meanwhile, the price of Bitcoin continues to march towards its all-time high at $112,000 with BTC now quoting shortly behind $110,000

Fidelity has unexpectedly topped BlackRock in the daily inflows for the first time in a long while. BlackRock’s Bitcoin ETF usually leads the way in this metric, recording millions of dollars in inflows.

Fidelity Outpaces BlackRock In Daily Bitcoin ETF Inflows

On June 9, Fidelity led with daily Bitcoin ETF flows, pulling in $172.99 million through its FBTC fund, just edging past BlackRock’s IBIT, which brought in $120.93 million, according to SoSoValue data. It was a bit of a surprise because BlackRock’s IBIT usually records the most daily inflows.

This development follows IBIT’s record of becoming the fastest ETF to hit the $70 billion mark in assets under management (AuM). Bloomberg analyst Eric Balchunas noted that IBIT hit this milestone five times faster than Gold.

IBIT is still way ahead in terms of overall assets, with $71.97 billion compared to FBTC’s $21.51 billion. Its total net inflows are still strong at $48.77 billion, while Fidelity’s fund has pulled in $11.61 billion so far. Even so, the daily lead shift is the first time in a while that another issuer has really gone up against BlackRock in terms of new demand.

Grayscale’s GBTC, on the other hand, hasn’t changed much. There’s been no net inflow, and it keeps posting outflows. So far, it has taken out a total of $23.25 billion since its launch. GBTC still holds over $20 billion in assets, but it’s struggling to bring in new money. This shows a bigger trend: investors are choosing low-fee, high-liquidity options over the older structures.

Other issuers also saw healthy growth. Bitwise’s BITB had $68.55 million in daily inflows, which brought its total to over $2 billion. Meanwhile, Ark Invest’s ARKB brought in $10.83 million and has now got over $2.4 billion in total net inflows. VanEck’s HODL has been on a roll, adding another $7.68 million, even though they’re operating on a smaller scale.

Meanwhile, Valkyrie, Franklin Templeton, and Invesco didn’t have any daily inflows, but they’re still doing better than the rest of the competition. This shows a clear difference between the top performers and everyone else.

All in all, Bitcoin ETFs saw a total net inflow of $386.27 million for the day, bringing the total assets of these ETFs to over 6% of Bitcoin’s total market cap. The Bitcoin price was trading around $108,800, staying close to its recent highs according to data from CoinMarketCap.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs