FOMC Meeting: Experts See ‘Hawkish’ Cut as Crypto Traders Price In Third Cut This Year

Highlights

- JPMorgan predicts that today's cut will be a hawkish one.

- They also project that Fed Chair Jerome Powell will signal fewer cuts ahead.

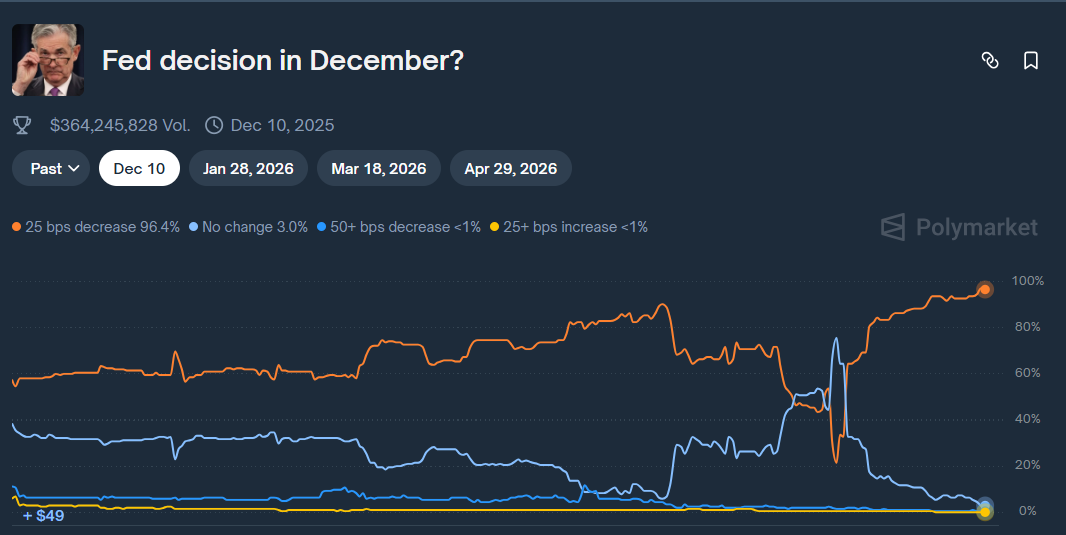

- Polymarket data shows a 97% chance that the Fed lowers rates by 25 basis points today.

Major U.S. banks and experts have predicted that the Fed is likely to make a ‘hawkish’ cut at today’s FOMC meeting, with Fed Chair Jerome Powell likely signaling a potential slowdown in monetary easing. This comes as crypto traders fully price a third rate cut this year, with the committee lowering rates by 25 basis points (bps) again.

Experts Predict Hawkish Cut Ahead of Today’s FOMC Meeting

Banks such as JPMorgan have stated that they expect the Fed to make a ‘hawkish’ cut today, with Powell’s statement hinting at fewer cuts ahead. The bank, however, predicts that the Fed will make one final cut in January before it raises the bar for future cuts.

Bank of America expects the Fed to make a 25 basis points (bps) cut at today’s FOMC meeting. Furthermore, they predict that Powell will give a statement about raising the bar for further cuts. Meanwhile, the bank expects the next cuts to come in June and July.

Goldman Sachs predicts that the Fed will make another cut today due to the softening labor market, while Powell’s statement is likely to stress a higher bar for future cuts. Citi also sees the Fed making a hawkish cut. The bank projects that Powell won’t rule out further cuts in January or March, but will also likely avoid a dovish tone.

Crypto traders are also pricing in a third rate cut this year at today’s FOMC meeting. Polymarket data show a 97% chance that the Fed will lower interest rates by 25 bps today, following similar moves at the September and October meetings.

A Possible Surprise From Today’s Meeting

Economist Alex Krüger stated that a possible surprise at today’s FOMC meeting is the announcement of T-Bill Reserve Management Purchases to increase banking system liquidity. He noted that this is mechanically identical to quantitative easing (QE) without removing duration from the market.

My base case for today’s FOMC

1) 25bp cut – almost fully priced-in (~90%).

2) Powell raises the bar for additional cuts – highly anticipated.

3) No major surprises on the dots.

=> priced-in Hawkish cut = chop

The possible surprise: announcement of T-Bill Reserve Management…

— Alex Krüger (@krugermacro) December 10, 2025

This came as he provided his base case for today’s meeting, noting that Powell is widely expected to raise the bar for additional cuts. Krüger further stated that a priced-in hawkish cut equals more chop for the market.

Meanwhile, the economist also elaborated on the T-Bill RMP, noting that many anticipate it happening next year, which could make it a surprise at today’s FOMC meeting. He described this T-bill RMP as a quantitative easing (QE) ultra lite, which would represent a “mild tailwind.”

It remains to be seen how the crypto market will react after the meeting. However, crypto research firm Matrixport has predicted that Bitcoin and the broader market will likely remain range-bound after the meeting.

Notably, Bitcoin and the broader crypto market had surged yesterday ahead of the FOMC meeting. BTC reached a high of $94,500 but has since corrected alongside the broader market. Meanwhile, it is worth noting that the flagship crypto has declined following six out of the seven Fed meetings this year.

- Michael Saylor’s Strategy Challenges MSCI Over Bitcoin Treasury Exclusion Plan

- Trump-Backed American Bitcoin Surpasses GameStop as Holdings Reach 4,783 BTC

- Who Will Be the Next Fed Chair? Trump to Interview Finalists to Replace Powell Today

- Ripple Releases XRP Ledger (XRPL) Upgrade to Boost Stability, DeFi: Details

- Another Solana ETF Incoming? Invesco Galaxy Makes Final Filing to Begin CBOE Trading

- Top Analyst Sees Ethereum Price Having a “Big” Breakout as Catalysts Align

- Sui Price Breaks Out of Falling Wedge: Is $2 Next Target?

- Chainlink Price Prediction: Why $20 is Next Key Target

- Solana Price Targets $200 Amid Increased Whale Accumulation

- Cardano Price Outlook: Expecting a 30-40% Bullish Wave Soon

- XRP Price Eyes Big Breakout as Triangle Pattern Signals 16% Move