Franklin Crypto Index ETF Adds XRP, Solana, and Dogecoin to Boost Investor Exposure

Highlights

- Franklin Templeton’s Crypto Index ETF will expand its holdings beyond Bitcoin and Ethereum.

- It now features XRP, Solana, Dogecoin, Cardano, Stellar, and Chainlink.

- The update comes shortly after Franklin launched its spot XRP ETF (XRPZ).

The Franklin Crypto Index ETF will add XRP, Solana, and Dogecoin to its investment portfolio. It already includes Ethereum and Bitcoin as it looks to give investors more options.

Franklin Crypto Index ETF Expands Portfolio

In a recent SEC filing, Franklin Templeton announced that, from December 1, 2025, its crypto index ETF will track more digital assets. This includes XRP, Solana, Dogecoin, Cardano, Stellar, and Chainlink.

That change came about due to the new rules adopted by the Cboe exchange which were approved by the SEC. The rule allows crypto-linked funds to hold a much broader basket of tokens. This is as long as those tokens appear in their underlying benchmarks.

“The fund is permitted to hold additional digital assets that are constituents of the Underlying Index, rather than being limited to Bitcoin and Ether,” the filing read.

These tokens will be maintained at quantities equal to the calculations by the index provider. Up until this point, the ETF had only consisted of Bitcoin and Ethereum.

The crypto index ETF will continue to change every three months. That means constituents can change due to market conditions or because of the rules of the index. Franklin Templeton also announced that authorized participants can now create and redeem ETF units using actual securities rather than through cash.

The announcement of the expansion comes less than 24 hours after Franklin Templeton launched its spot XRP fund. The Franklin XRP Trust now trades under the ticker XRPZ with an annual sponsor fee of 0.19% of NAV.

David Mann, Head of ETF Product and Capital Markets at Franklin Templeton, referred to XRP as a key part of international settlement systems.

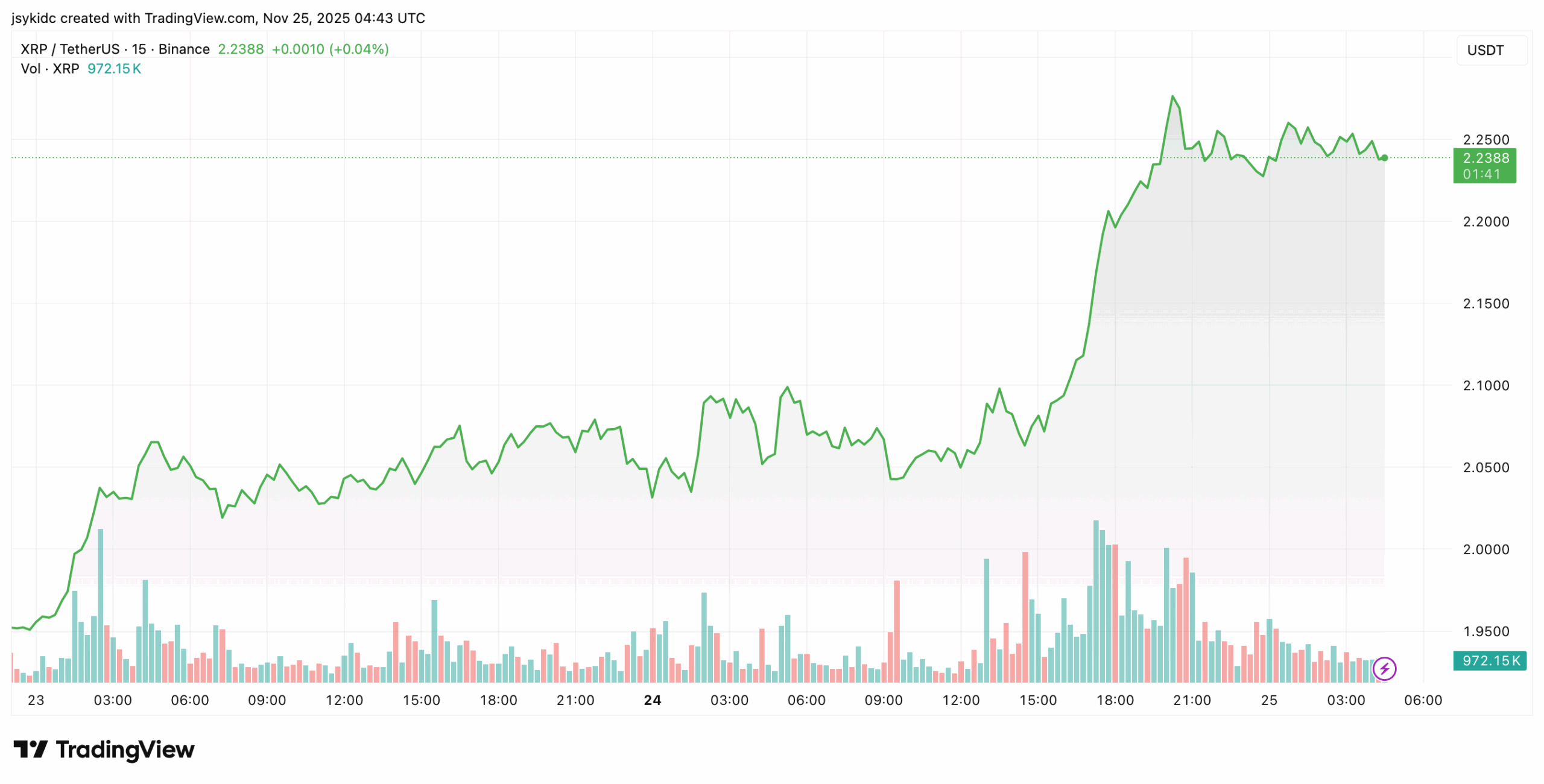

XRP Reacts To Multiple ETF Launches

XRP price has finally seen some reaction after the series of ETF launches. The token has gained more than 7% in price to $2.24 as Franklin Templeton and Grayscale released their spot XRP ETFs on the same day.

With Franklin joining Bitwise, Canary Capital, and Grayscale, the number of approved XRP investment vehicles in the U.S. has grown greatly.

Yesterday also saw the launch of the new GXRP fund from Grayscale. This comes just a week after Bitwise launched its own XRP ETF. The fund saw $25 million in trading volume on its first day. The firm’s CEO Hunter Horsley confirmed that inflows reached $118 million in its first full week.

Canary Capital was the first to launch earlier in the month. Its fund raised over $250 million on the first day. Since then, other asset managers are also pushing for their funds to launch.

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Epstein File Reveals Crypto Controversy: 2018 Emails Reference Gary Gensler Talks

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?