FTT Token Rallies as Sam Bankman-Fried’s Account Tweets Amid Prison Sentence

Highlights

- FTT token surges 60% after a “gm” tweet from Sam Bankman-Fried’s X account, sparking speculation about account control.

- A friend clarified that SBF’s account is being managed on his behalf, as U.S. federal inmates cannot access social media.

- Trading activity also spiked sharply, spot volumes jumped 670%, and FTT derivatives volume soared over 2,000%.

The FTT token surged remarkably following a tweet from Sam Bankman-Fried’s X account. This led to speculation about who might be running the account, given that the FTX founder is in prison.

FTT Surges After Unlikely Tweet

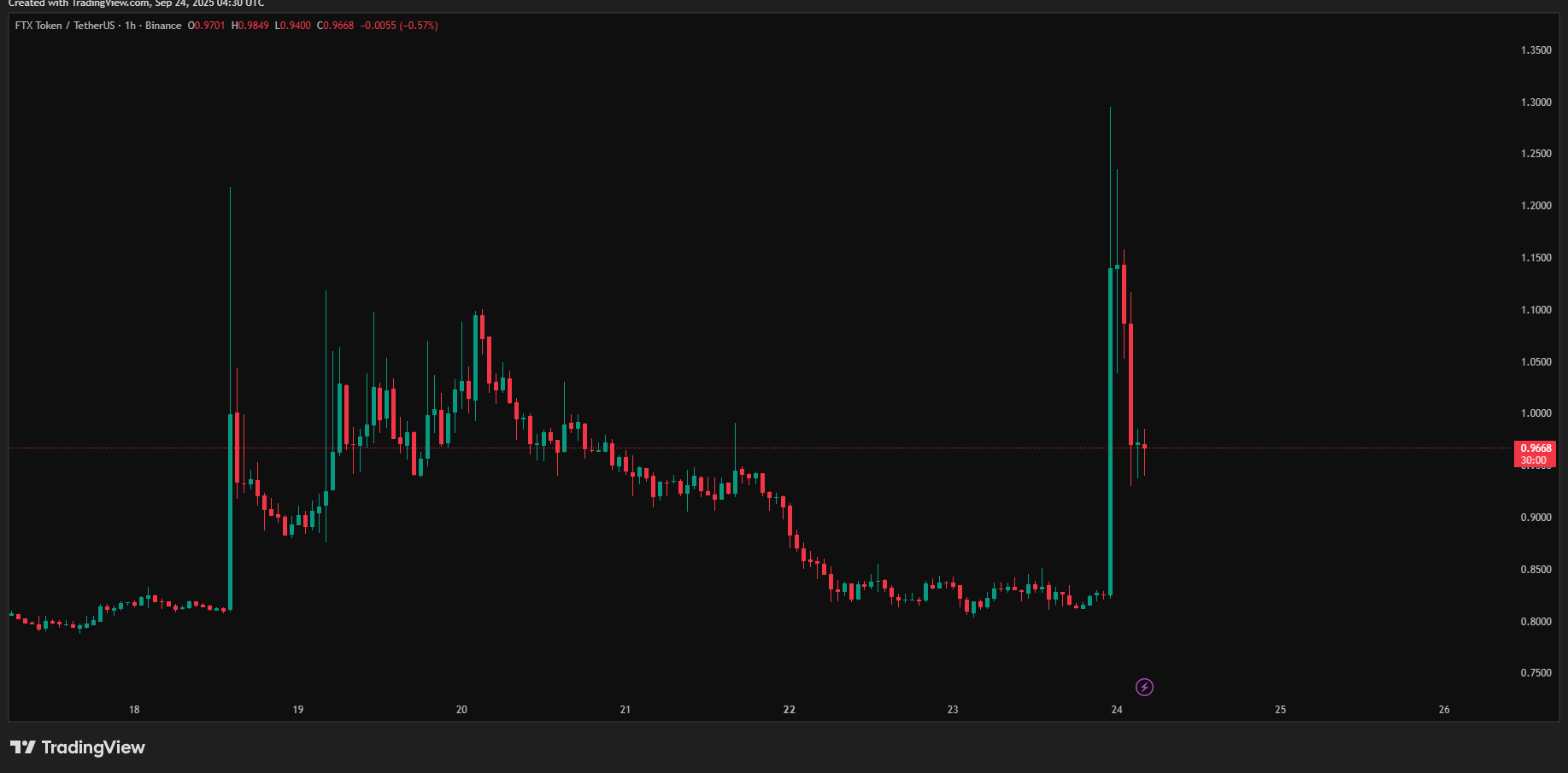

The FTT token spiked nearly 60% within minutes after a simple “gm” appeared on Sam Bankman-Fried’s account. The token reached an intraday peak near $1.23, a 30% increase. The altcoin then eased back toward $0.98 as traders locked in their gains.

Despite the pullback, FTT is still up about 20%. This extends its weekly advance to around 23%, marking an almost 12% gain over the past month.

The timing of the tweet caused a stir because federal inmates in the United States are not permitted direct access to social media. A follow-up reply clarified that the message was posted by a friend managing the account on Bankman-Fried’s behalf.

[No, SBF is not posting himself from prison. I'm a friend posting on his behalf.]

— SBF (@SBF_FTX) September 24, 2025

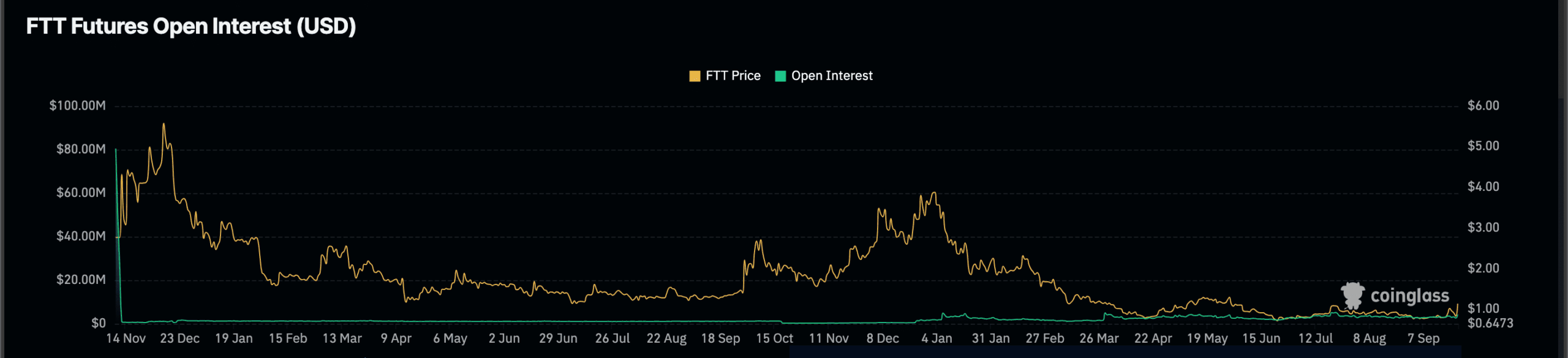

The price jump also coincided with a sharp rise in activity. Daily trading volumes for the token surged 670% to $69.9 million. Derivatives markets are also heating up. According to Coinglass data, open interest in FTT futures increased by 37% to $3.58 million, and total derivatives volume surged 2,100% to $34 million.

Analysts caution that such rapid inflows suggest highly leveraged speculation. This could lead to sharp swings in either direction. However, the surge underscored how closely tied the token remains to headlines surrounding its former founder.

Tweets from Prison: Sam Bankman-Fried’s Limited Communication

Since April, Sam Bankman-Fried has been housed at the Federal Correctional Institution Terminal Island in Los Angeles. This followed an 18-month stay at the Metropolitan Detention Center in Brooklyn. Inmates are permitted to use TRULINCS, a secure email-like system that restricts attachments and outside internet access.

His X account, which includes a monitored mailing address for FCI Terminal Island and notes that a friend shares access, has occasionally sprung to life with brief posts. Earlier in the year, it carried cryptic threads on responsibility and management, but activity has remained sporadic until this week’s post reignited attention.

The renewed spotlight on FTT comes as the FTX estate prepares a payout of $1.6 billion to creditors on September 30 under its Chapter 11 restructuring plan. This distribution is expected to provide fresh liquidity to the market.

Creditors with allowed claims in the plan’s Convenience and Non-Convenience Classes who have completed requirements will be eligible for repayment, according to the estate.

Meanwhile, the bankruptcy process continues to face some roadblocks. Last month, creditors filed a class-action lawsuit against Kroll Restructuring Administration over its 2023 data breach. This is the claims agent responsible for the case. Plaintiffs allege negligence in handling sensitive information across the FTX, BlockFi, and Genesis bankruptcy proceedings.

Adding to the drama, the cost of the case itself has reached high levels. Reports indicate legal and advisory fees are approaching $1 billion. This further cemented FTX’s collapse as one of the most expensive bankruptcy cases in U.S. history.

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value