Too Big To Fail? What If Strategy’s Bitcoin (BTC) Holdings Fell Below NAV

Highlights

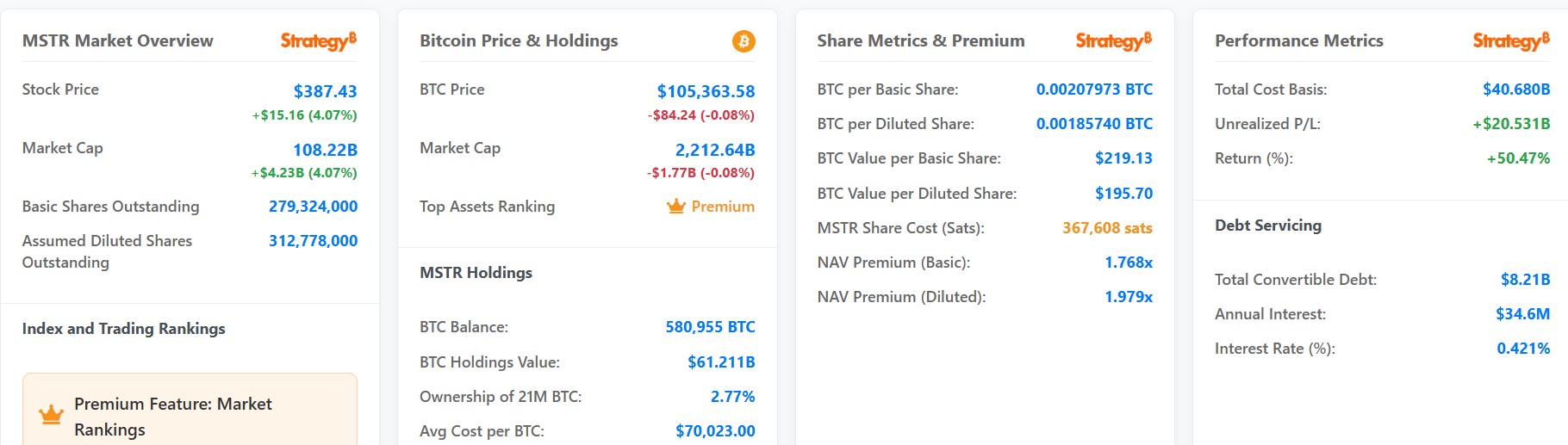

- Strategy currently holds 580,955 BTC valued at more than $61 million, with an average acquisition price of $70,000.

- An SEC filing discloses that if the BTC holdings fall below the acquisition price, Strategy may be forced to sell BTC.

- Analysts also note that such a decline could trigger a market-wide selloff similar to the 2022 FTX bankruptcy event.

Strategy (MSTR) continues its Bitcoin (BTC) accumulation strategy, with fresh purchases nearly every month. This has seen the company emerge as the fourth-largest BTC holder. However, as Bitcoin’s price rises, the company’s BTC cost basis rises, increasing the risk that a steep price correction could push its holdings below the net asset value (NAV). If this happens, what would happen to Strategy’s BTC holdings and the company’s Bitcoin bet?

Strategy’s $61B Bitcoin Bet

According to Strategy Tracker, Strategy holds 580,955 BTC worth $61 billion at the current Bitcoin price of $105,000. Its most recent purchase occurred on June 2 when Strategy purchased 705 BTC. The company’s total holdings are valued at $61 billion, purchased at an average price of $70,023 per coin.

After Strategy Executive Chairman, Michael Saylor, announced the recent purchase, anti-Bitcoin investor Peter Schiff observed that the company’s purchase price keeps getting higher. He said,

“Congratulations, you’ve now raised your cost to over $70k per Bitcoin. That’s $40 billion spent buying nothing!”

The concern stems from the likelihood that the company’s Bitcoin holdings will fall below the total buying price, resulting in the company holding massive unrealized losses.

What Can Happen If Strategy’s BTC Holdings Go Below NAV?

Crypto Analyst Mippo on X noted that if Strategy’s Bitcoin accumulation plan fails and the company’s BTC portfolio falls below its net asset value (NAV), it could trigger a massive selloff event in the crypto market similar to the fall of FTX in 2022. He said,

“Saylor financed the majority of his BTC buys with [convertible bonds], so there’s plenty of equity risk for investors. It’s an extremely reflexive feedback loop that, if it gets large enough, ends in a 2022-like sell-off.”

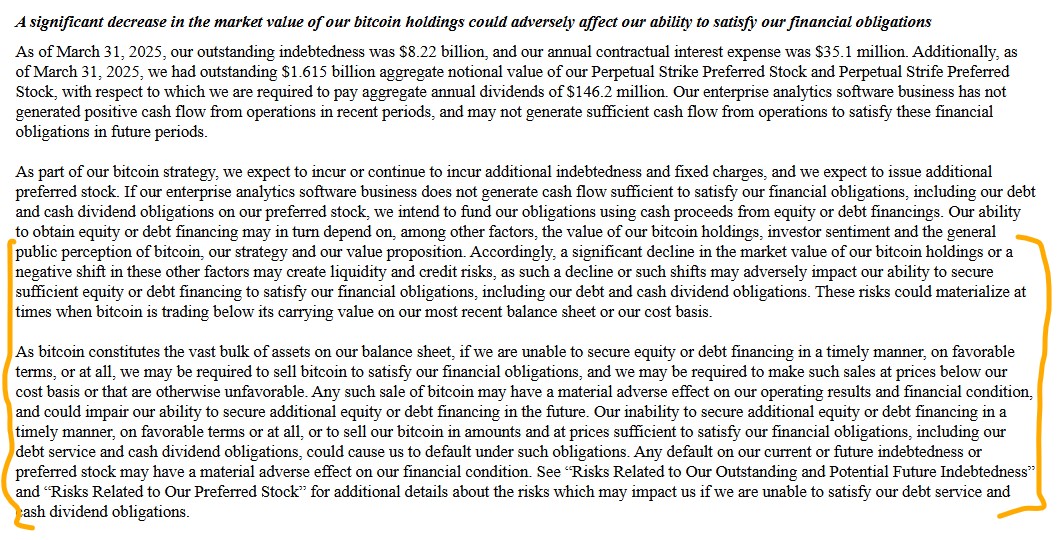

Meanwhile, Strategy, in a filing made with the SEC, stated that if the market value of its BTC investment declines significantly, it could create liquidity and credit risks, making it hard for the company to obtain fresh capital. This could force it to sell Bitcoin.

Despite these concerns, Saylor noted that even if the company’s NAV falls below 1, Strategy has an “anti-fragile structure” in place. While speaking at the Bitcoin 2025 Conference, he said,

“We’ve structured the company such that the company can generate yield and profit even at NAV or below NAV… If you’re an operating company, we trade at a discount to NAV, we can profit from it, and that’s good for me…. If you short our stock down to 10% of NAV, we could make billions of dollars a day.”

During the event, Saylor also dismissed calls for portfolio diversification, saying that purchasing altcoins would invalidate the company’s BTC strategy and bond issuance plans.

Bitcoin Accumulation Strategy Garners Momentum

Despite the growing concerns around Strategy’s BTC strategy, other publicly traded companies are seeking exposure to Bitcoin. Recently, Metaplanet stock reached a record high amid investor optimism due to its recent Bitcoin purchases.

GameStop also recently purchased 4,710 Bitcoin for its crypto treasury, and this caused a surge in the value of its stock. Moreover, altcoins such as Solana and Ethereum are also getting institutional backing, after Sharplink closed a $425M deal to buy Ethereum. Pantera Capital believes that this wave of crypto-focused treasuries will continue adding,

“The strong demand for products like MSTR, the ETFs, and the new wave of [Digital Asset Treasury Companies] suggests a large pool of capital has been sidelined by the onboarding complexities of crypto-native products.”

The company also believes that demand for these products could remain high as traditional investors seek exposure to digital assets as companies convert crypto assets into stocks.

Bottomline

Strategy has acquired 580,955 BTC valued at more than $61 billion at the current Bitcoin price, acquired at an average purchase price of $70,000. If Bitcoin price records a steep decline below $70,000, Michael Saylor may be forced to sell Bitcoin to cover the company’s equity and debt obligations per an SEC disclosure.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs