How Ethereum Price Could Race to $3K Bolstered by Accelerated Staking Post-Shapella Upgrade

The largest smart contracts token, ETH, is down 0.4% on Tuesday after bulls lost the battle around $1,900. Despite the pullback from the weekly high of $1,943, Ethereum price still upholds an 8% gain in seven days.

As the price wobbles at $1,865 and traders usher in the European session, Ethereum price is facing two conflicting scenarios.

Reclaiming resistance above $1,900 could clear the path to $2,000. On the flip side, losing support at the 100-day Exponential Moving Average (EMA), which is grounded at $1,800, might leave ETH vulnerable to declines targeting lower likes such as $1,730 and $1,600.

Ethereum Staking Accelerates Post-Shapella Upgrade

According to blockchain research platform Messari, Ethereum staking has been improving since the Shapella upgrade, which occurred in April. Before this network update that allowed investors to freely stake and unstake Ether, “staking growth was slow and perceived as riskier.”

However, market conditions changed and improved drastically following the implementation of the Shapella upgrade. Users now have the freedom to “comfortably stake and unstake ETH,” thus accelerating the rate of staking.

On-chain data reveals that May 2023 saw the highest monthly inflow since the Shapella upgrade went live.

Prior to Shapella-enabled withdrawals, $ETH staking growth was slow and perceived as riskier.

Post Shapella, users can comfortably stake and unstake $ETH. This freedom has actually accelerated the rate of $ETH staked, with May 2023 seeing the highest monthly net inflow. pic.twitter.com/z3iULVOPL0

— Messari (@MessariCrypto) June 27, 2023

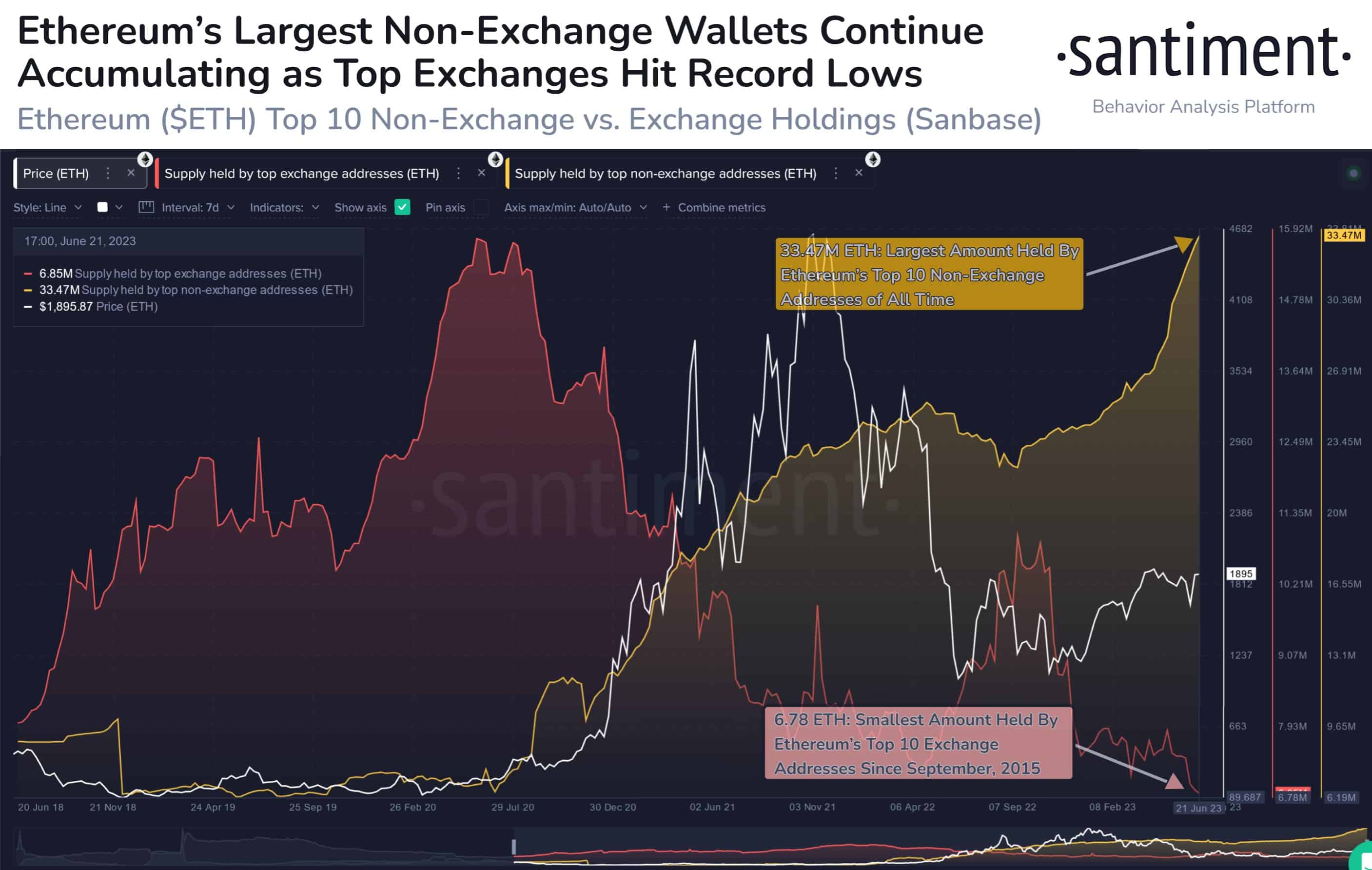

An increased staking rate means that investors prefer to HODL Ethereum as opposed to storing the tokens on exchanges where they can be sold easily. Similarly, data from another analytics platform, Santiment, shows that the largest non-exchange addresses have been growing the level of supply they hold.

On the other hand, top non-exchange wallets have seen the supply they account for dwindle and is near genesis levels. Santiment says that “ETH supply on exchanges is down to 9.2%.

Ethereum Price Slows Pullback As $3,000 Beckons

Ethereum price wobbled above $1,900 over the weekend, which handed the baton to bears, who started exerting more overhead pressure on Monday. This, coupled with resistance emanating from the upper rising and dotted trendline, forced ETH to explore downhill levels, testing support provided by the 50-day EMA (red) at $1,823.

The Relative Strength Index (RSI) affirms the growing bearish grip as it abandons the uptick to the overbought region, settling for retracement within the neutral zone. Traders should consider ETH’s reaction to support at the 50-day EMA, and especially the buyer congestion at the 100-day EMA (blue) around $1,800.

If push comes to shove and Ethereum slips below those two key levels, investors may start conditioning themselves for an extended pullback. On the bright side, these retracements are unlikely to be larger, considering the improved market structure for Ether and the rest of the crypto market in general.

The Moving Average Convergence Divergence (MACD) upholds the bullish outlook as it settles above the mean line (0.00). With the MACD line in blue above the signal line in red, the path with the least resistance will be to the upside.

In that case, a break above the psychological barrier at $2,000 would pave the way for the next recovery phase to $3,000.

Related Articles

- Bitcoin Price Steadies Uptrend Above $30,000 As Bulls Eye More Gains – Why Is This BTC Buy Signal The Key

- Crypto Draft Bill: Gary Gensler To Appear Before US House Committee

- Spot Bitcoin ETF: Cathie Wood’s Ark Invest is First in Line

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 63% of Tokenized U.S. Treasuries Now Issued on XRP Ledger: Report

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Crypto Ties Revealed in Epstein Files: 2018 Emails Point to Gary Gensler Discussions

- Bitcoin Price Prediction as Willy Woo Warns of Quantum Risks to Digital Gold

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano