How MSTR Stock Has Benefitted From MicroStrategy Bitcoin Adoption

Highlights

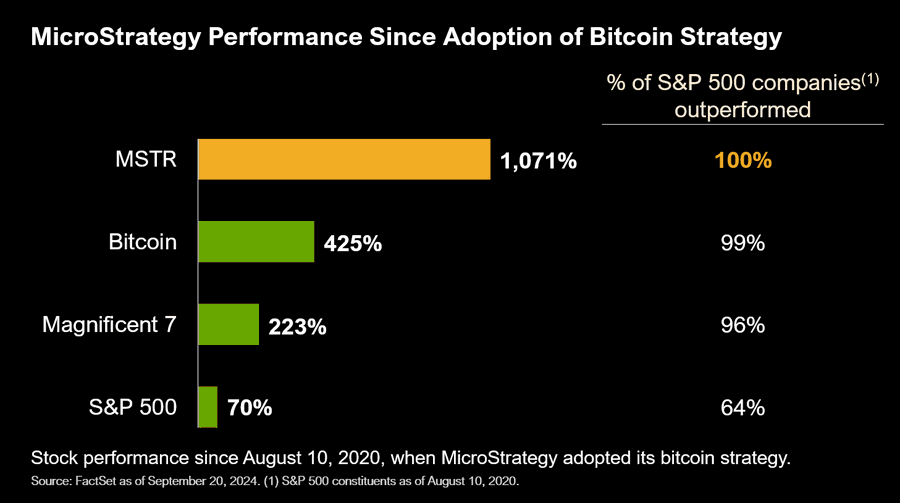

- The MSTR Stock has outperformed 100% of the S&P 500 companies since MicroStrategy Bitcoin adoption in 2020.

- MSTR has witnessed a price gain of over 1,000% while the S&P 500 has grown 70% since then.

- MicroStrategy's stock has also outperformed Bitcoin since 2020.

The MSTR stock has outperformed all companies on the S&P 500 since the MicroStrategy Bitcoin adoption began in 2020. The software company has continued to accumulate the flagship crypto thanks to its former CEO and co-founder, Michael Saylor. This move has paid off so far, considering MSTR’s performance since then.

MSTR Stock’s Performance Since MicroStrategy Bitcoin Adoption

In an X post, Micheal Saylor highlighted MSTR’s performance since the software company adopted Bitcoin in 2020. Based on the data he shared, MicroStrategy’s stock has outperformed 100% of the S&P 500 companies since they began purchasing BTC.

Interestingly, the MSTR stock price has also outperformed Bitcoin over the last four years. Since MicroStrategy Bitcoin adoption, the company’s stock has surged by over 1,000%. Meanwhile, BTC and the S&P 500 have surged by 425% and 70%, respectively.

MicroStrategy’s co-founder, Michael Saylor, pushed for the software company to begin buying the flagship crypto, and his bet on BTC has undoubtedly paid off. Thanks to this Bitcoin strategy, many institutional investors have long regarded the company as an avenue to gain exposure to the flagship crypto. This explains how the MSTR stock has achieved such immense growth.

There were projections that MicroStrategy was going to lose its Bitcoin edge following the launch of the Spot Bitcoin ETFs. However, that hasn’t been the case, with MSTR boasting a year-to-date (YTD) gain of over 120%.

Meanwhile, MicroStrategy Bitcoin adoption has continued to grow. The company recently bought 7,420 BTC ($458.2 million). Before this purchase, it had also bought $1.11 billion worth of Bitcoin, its single largest buy to date. The firm currently holds 252,220 BTC at an average price of $39,266 per Bitcoin.

Michael Saylor Expects Institutional Adoption To Grow

Michael Saylor recently claimed that the approval of options trading for BlackRock’s Spot Bitcoin ETF will “accelerate” Bitcoin adoption. The SEC approved options for the IBIT ETF on the Nasdaq exchange, which is expected to expand the Bitcoin ETF market and further attract more institutional investors, just like Saylor predicts.

Bloomberg analyst Eric Balchunas shared a similar sentiment, remarking that the options trading will “attract more liquidity, which will in turn attract more big fish.”

Binance CEO Richard Teng also recently stated that the institutional adoption witnessed so far is just the tip of the iceberg. He expects more institutional investors to allocate crypto soon enough once they have completed their due diligence.

However, it remains unlikely that any of these institutions can match MicroStrategy Bitcoin investment. For context, the company holds almost 1.2% of BTC’s total supply.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Crypto Market Is Falling Today (March 8, 2026)

- Michael Saylor Hints at Another Strategy Bitcoin Buy Despite BTC and Broader Market Weakness

- How Low Could Shiba Inu, Pepe Coin and Dogecoin Fall? Key Support Levels and Liquidation Risks to Watch

- UAE Carries Out First Iran Strike As BTC Bulls Struggle to Defend Key Support

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs