How Will Israel-Iran Tension Affect The Crypto Market Rally This ‘Uptober’?

Highlights

- The crypto market's 'Uptober' rally is at risk with Iran attacking Israel.

- The crypto market is already down following these reports, with over $9 million liquidated from the crypto market.

- Bitcoin has dropped below $62,000 and risks losing the $60,000 support level.

The crypto market has started the month in the red, and now, the projected ‘Uptober’ rally could be at risk thanks to the Israel Iran tension. Iran has launched missile attacks against Israel in retaliation for the latter’s attack on Hezbollah forces in Lebanon. This won’t be the first time that Iran is attacking Israel this year.

Crypto Market To Suffer From Israel Iran Conflict

The market is set to suffer from the Israel Iran conflict, with Iran carrying out missile attacks on Israel following the latter’s ground invasion of Southern Lebanon and the assassination of Irani-backed militia Hezbollah leader Hassan Nasrallah.

As expected, the crypto market is already responding negatively to this development. Coinglass data shows that over $351 million has been liquidated from the market in the last 24 hours. Meanwhile, crypto prices are also down, with Bitcoin dropping below $63,000 following the news about Iran’s imminent attack.

Conflicts like the Israel Iran tension typically have a negative impact on the market as they bring about uncertainty, which leads to a wave of sell-offs. It is worth mentioning that this isn’t the first time that the tensions between both countries have escalated this year. In April, Iran launched a drone and missile attack on Israel in retaliation for the latter’s airstrike that killed a top Iranian general in Syria.

Bitcoin slumped by over 8% following that development, with the broader crypto market suffering a similar fate. As such, this time is unlikely to be different if Iran follows through with its attack. Moreover, there are reports that Iran’s attack this time around will be worse than the April attack.

According to a CoinGape analysis, BTC was already likely to correct as the Bitcoin price slipped below $65,000. Therefore, this incident only acted as the catalyst for this price correction.

FUD To Return To The Market

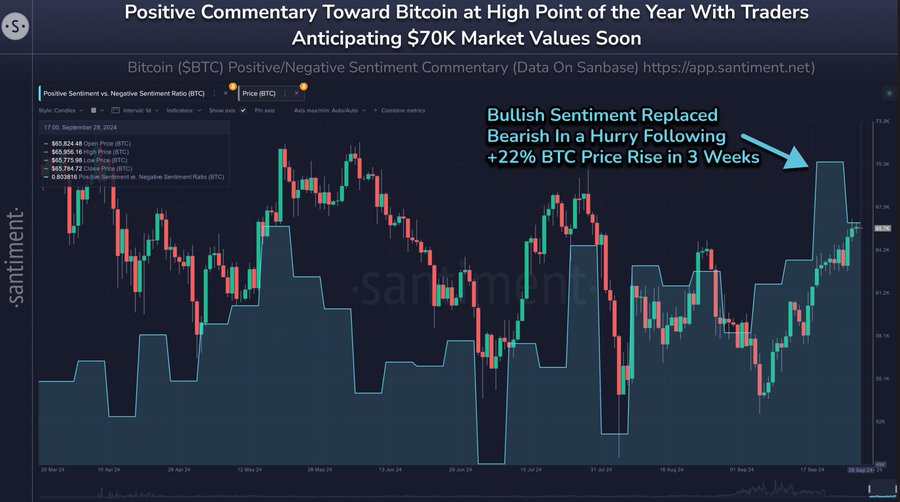

FUD is undoubtedly set to return to the crypto market amid the Israel Iran tension. The market was nearing extreme greed, with market participants increasing their risk appetite following Bitcoin’s surge above $65,000 last week. The on-chain analytics platform Santiment recently suggested that FUD returning to the market is actually bullish in the long term.

Santiment claimed that the crowd’s bullish sentiment towards Bitcoin indicated a high top probability for the crypto market. Thanks to the Israel Iran conflict, the price retrace is expected to lead to panic sells. Once that happens, the platform predicts that FOMO will turn to FUD, and the bull market can then resume shortly after.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs