Hyperliquid Announces Plans to Launch USDH Stablecoin, HYPE Price Climbs

Highlights

- Hyperliquid validators will be able to vote on the launch of USDH stablecoin through a governance vote.

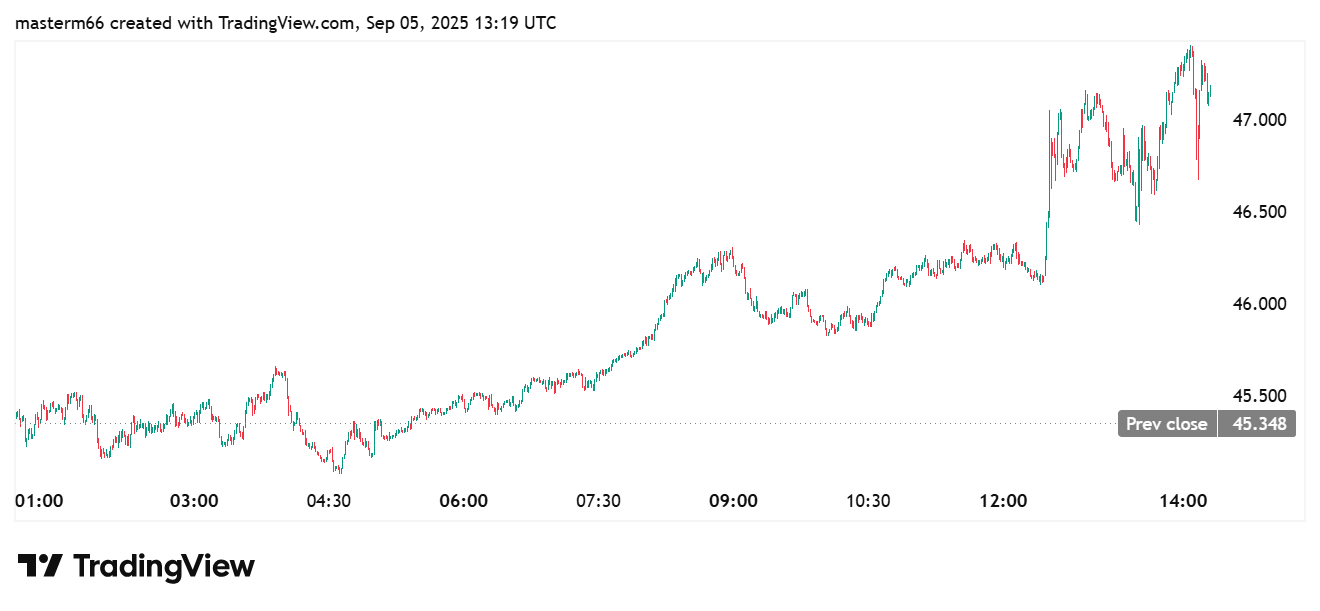

- Stablecoin launch and fee redesign lead to the 3% rise in price of HYPE.

- The aim of the USDH stablecoin launch is to make the Hyperliquid network stronger.

Hyperliquid has stated that it plans to use a validator vote to roll out its native USDH stablecoin. The team hopes the launch will in turn boost the use of its HYPE token. HYPE price climbed nearly 3% in 24 hours as traders reacted to the upgrade news.

Validator Vote to Decide Launch of Hyperliquid Stablecoin USDH

The protocol confirmed via its Telegram channel that the USDH ticker, currently reserved, will be put to an onchain governance vote. Thus, validators will decide which team earns the right to deploy the stablecoin. This makes the launch a transparent, community-driven process.

USDH is designed as a Hyperliquid-first, compliant USD stablecoin. The launch comes as regulators, including the U.S. Treasury, seek public input on the GENIUS Act stablecoin oversight.

Teams aiming to deploy the stablecoin must submit proposals in the Hyperliquid Discord forum. Proposals must include the deploying user address. If chosen by a validator quorum, the team gains the right to launch USDH.

Voting will take place fully onchain through a Layer 1 transaction, mirroring Hyperliquid’s delisting vote process. Even after approval, the chosen team must still participate in the usual spot deploy gas auction.

Hyperliquid emphasized that USDH is a reserved ticker intended to serve as the ecosystem’s primary stablecoin symbol. This makes governance over its deployment highly competitive

Validators are expected to back teams capable of building a natively minted, Hyperliquid-aligned stablecoin. The approach ensures that USDH reflects both governance consensus and long-term stability. With USDH’s deployment decided through votes, HYPE’s utility becomes more strengthened as a governance asset.

HYPE Price Soars After Governance Vote And Fee Overhaul Announcement

Hyperliquid is also making significant changes to its trading fees alongside the stablecoin vote. Spot pairs between two quote assets will benefit from 80% lower taker fees. Maker rebates and user volume contributions are also part of the upgrade, reducing friction and deepening liquidity.

The protocol added that spot assets will become permissionless in the future. A staking requirement and slashing criteria for validators will be introduced, with details expected soon.

By linking stablecoin deployment to validators, Hyperliquid separates itself from centralized issuers. The openness of this process increases trust and it could be a precedent to introduce native stablecoins. The validator vote will likely happen after the next network upgrade. However, the time hasn’t been specified yet.

If there’s a massive increase in the number of users and applications of the USDH, the Hyperliquid stablecoin would become a central settlement currency.

The news has coincided with a rise in the price of its governance token (HYPE). Based on TradingView data, it was trading at $46.68 at the time of writing. It has increased by 2.95% since the past day. The token’s rally coincides with the period when Hyperliquid has recorded its best month in revenue. This confirms the link between governance demand and ecosystem growth.

Also, HYPE has shot up 21.3% in a month and over 209% in six months. Its year-to-date returns represents 94.8% gains, indicating growing investor confidence.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs