Hyperliquid Pool Sees $4.9M Loss Amid POPCAT Whale Market Exploit

Highlights

- Hyperliquid suffered a $4.9 million hit after a whale manipulated POPCAT memecoin prices.

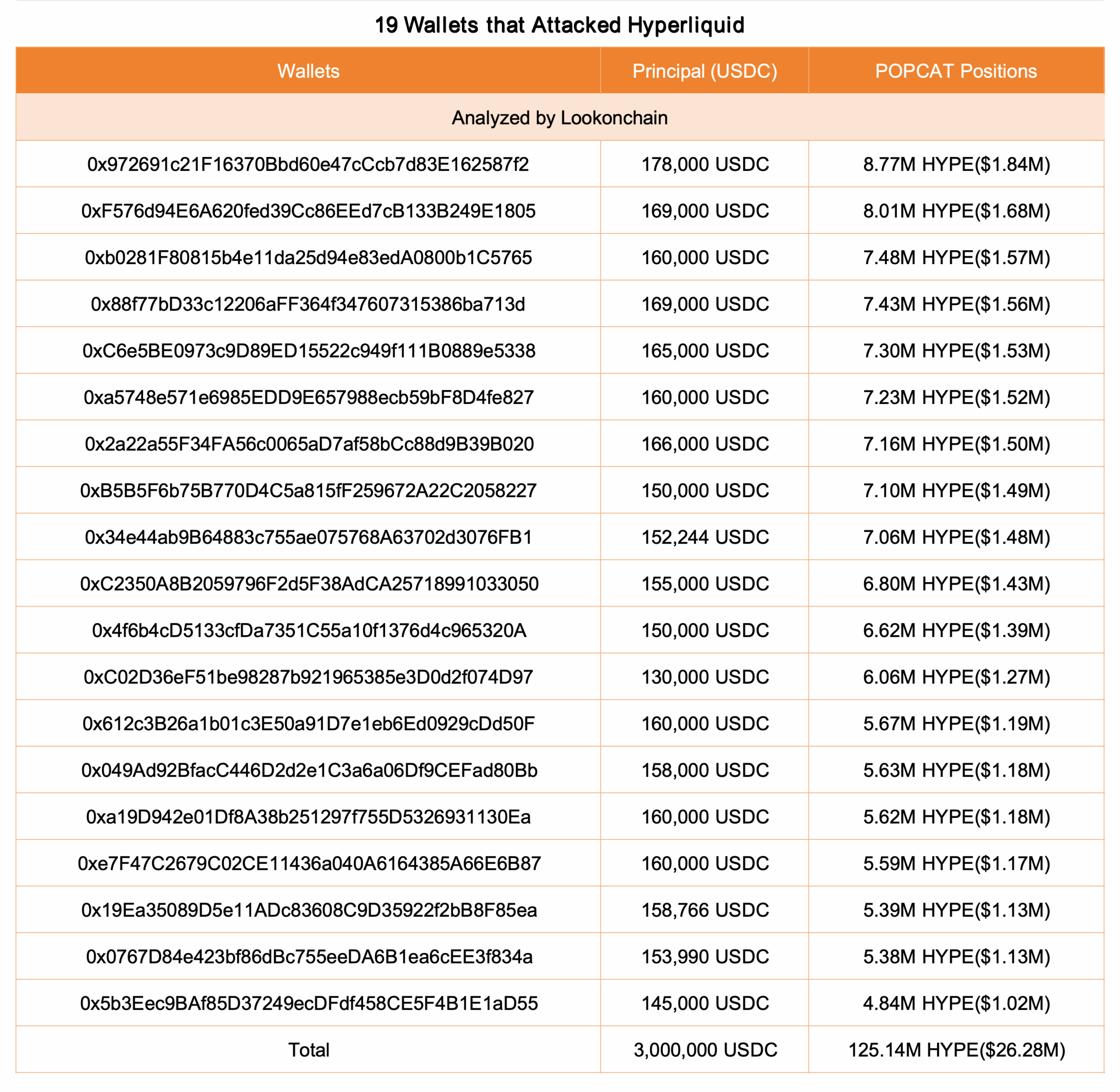

- The whale moved $3 million in USDC into 19 wallets.

- HYPE token rebounded by nearly 1% post-exploit.

Hyperliquid has reportedly recorded a loss of $4.9 million following the whale manipulation involving the POPCAT memecoin. This caused liquidations on the platform’s liquidity pool. In less than an hour, millions of dollars moved through separate wallets in the exploit.

Hyperliquid Suffers $4.9M Loss on Whale Manipulation

A whale reportedly withdrew $3 million in USDC from OKX, according to Lookonchain, into 19 different wallets. This is a common strategy for traders to hide their trading intent and allocate exposure.

These were then deposited into the platform altogether. He opened long positions on POPCAT. Buy orders worth approximately $20 million were set at $0.21 per token.

This inflated the market price of the meme coin and created a false appearance of demand. The positions eventually grew to $30 million. This created a massive buy wall that artificially supported the market.

Moments later, the trader suddenly removed the buy wall. This sent POPCAT’s price into freefall. In a matter of seconds, the inflated long positions buckled. That, in turn, automatically led to liquidations across all 19 wallets.

Under the platform’s automated market design, the Hyperliquidity Provider (HLP) absorbs losses when users lose their positions. This is to maintain liquidity balance. It therefore took the trader’s losses. This resulted in a $4.9 million hit to the pool. This is equivalent to its three months of pool profits.

In a bid to reduce losses, Hyperliquid’s team closed the remaining losing positions and temporarily paused its Arbitrum bridge. The bridge handles deposits and withdrawals between the Ethereum and Arbitrum networks.

Other operations on the platform were not affected. The exchange also assured users that systems would be restored after internal review. This comes just weeks after the leam launched its HIP-3 upgrade.

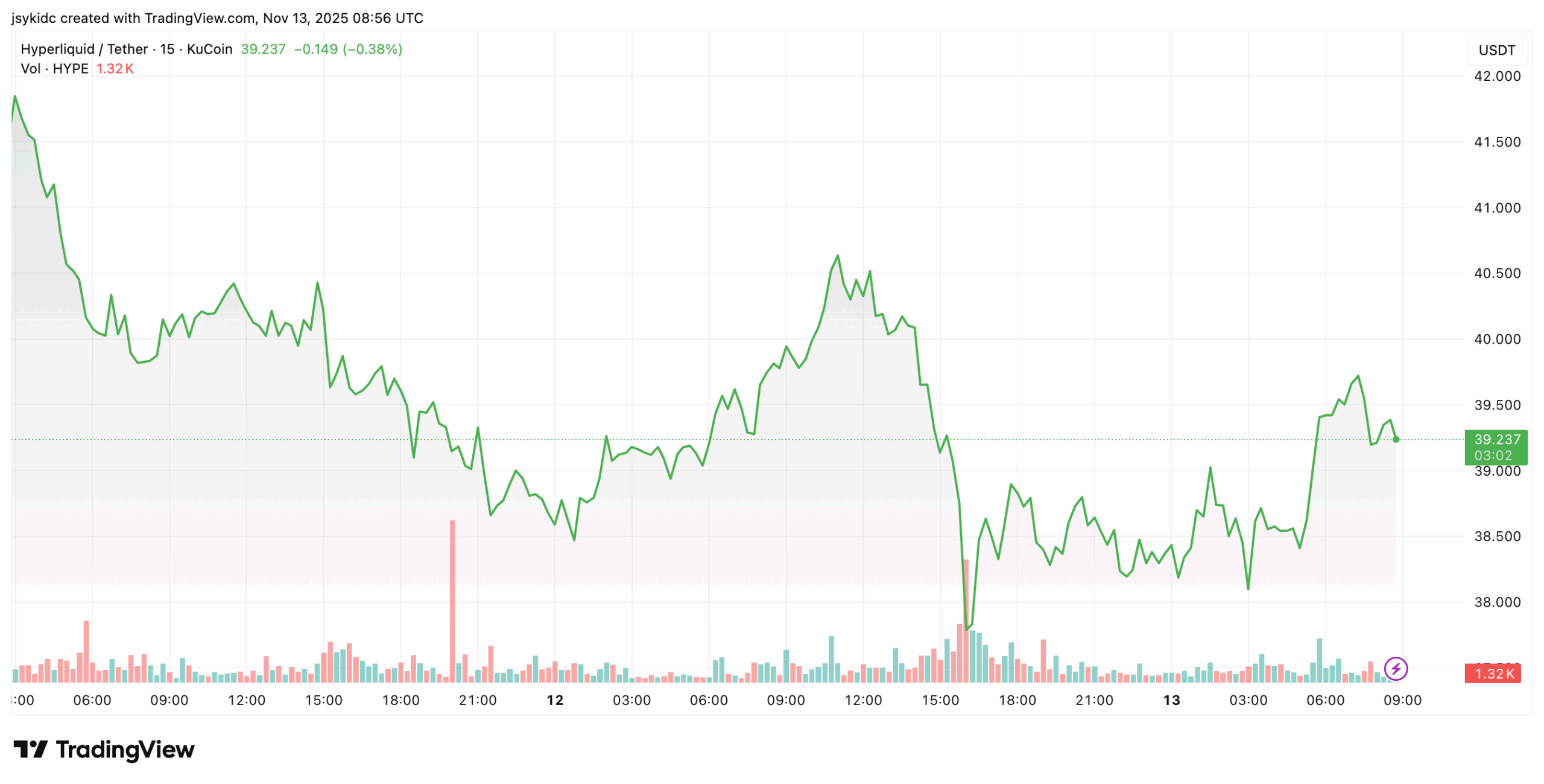

HYPE Price Performance Post Exploit

The move by the platform’s team contained further losses. The HYPE token recovered well after. It gained 0.65% to $39.72 despite the decline in the market.

At the same time, Coinglass’ futures market data showed that more than $63 million of long positions were liquidated within 4 hours after the price collapsed. On the other hand, it recorded losses of $1.6 million in shorts. However, trading volume surged over 500% for POPCAT.

In other developments that should boost the token’s adoption, Hyperliquid Strategies has filed with the U.S. SEC to raise up to $1 billion through a new equity offering. The proceeds will be used for accumulating HYPE tokens to support liquidity and governance.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- How BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei’s Death

- BREAKING: Iran Refutes WSJ’s Claims on Push to Resume Nuclear Talks with US, Bitcoin Slips

- Crypto Market Crash Deepens as Trump Confirms More Airstrikes to Hit Iran

- US CLARITY Act Likely to Pass by Mid-Year, JPMorgan Signals Major Crypto Shift

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs