Impact of China’s Crackdown on Bitcoin Miners In Charts, BTC Block Interval Hits 10 Year High

China’s recent crackdown on cryptocurrency miners over the last month has resulted in a massive exodus of mining operations to overseas locations. This has had a severe impact on the Bitcoin price which came crashing down under $30,000 levels last week.

With the recent Chinese crackdown, the on-chain activity on the Bitcoin network has significantly changed hitting multi-year milestones. Let’s take a look at how things have changed w.r.t different on-chain parameters.

Key changes on Bitcoin (BTC) Network Amid China’s Crackdown

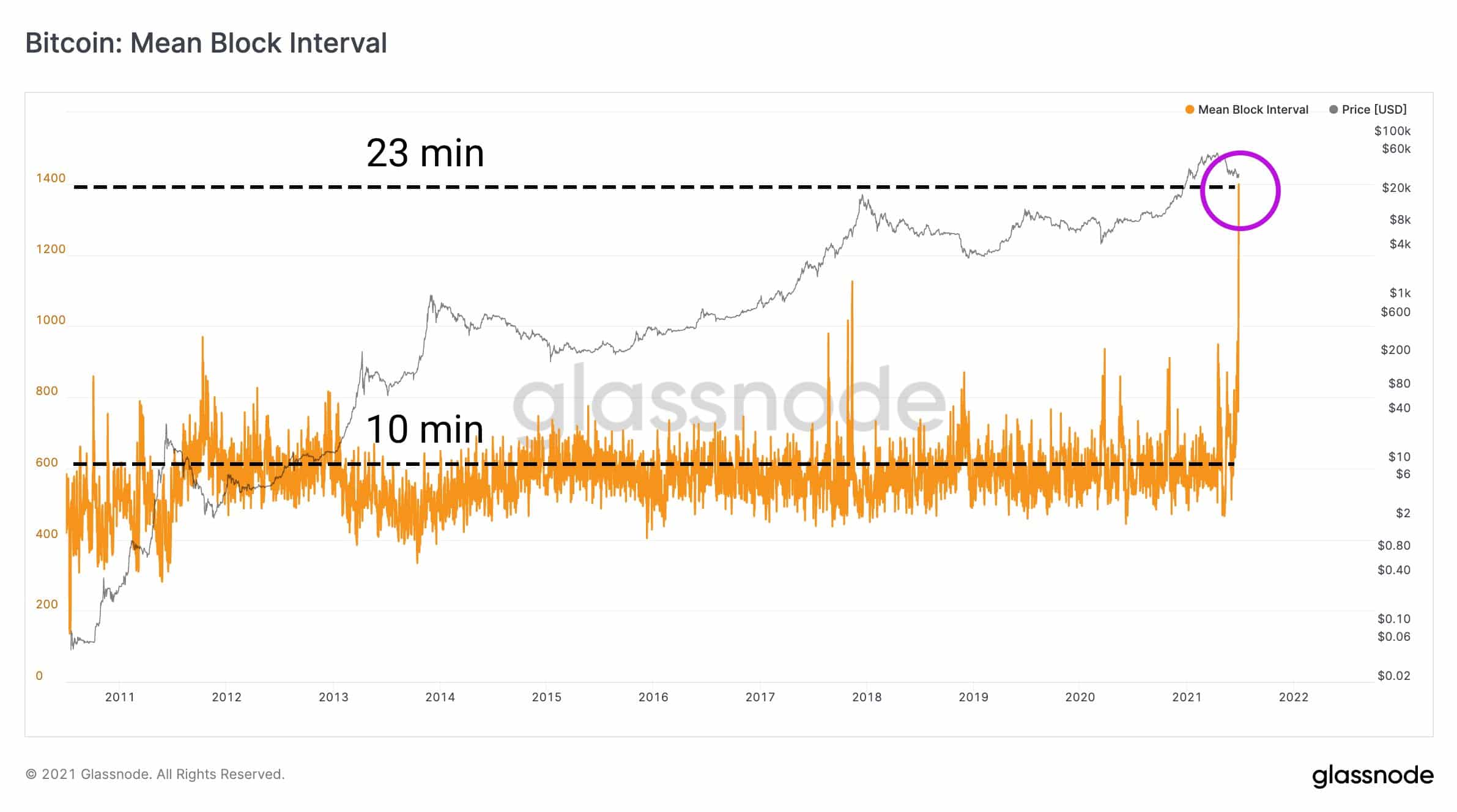

Bitcoin’s daily mean block interval, the time interval between adding two consequent blocks on the Bitcoin network, has shot to 1400 seconds or over 23 minutes. This has been the largest daily mean block interval over the last decade. This is also 100% more than the baseline of 10-minute block interval.

Earlier on Sunday, June 27, only 58 blocks were minted throughout the day. This was a massive 60% from the average of 144 blocks minted every single day.

On the other hand, there’s an 80% drop in the daily average Bitcoin miner revenue from $70 million in May last month to now at just $12.8 million per day. This is the same revenue that miners were earning back in November 2020 last year when BTC was trading at $13,000 levels.

On-chain data provider Glassnode further reports: “This is in consequence of the shakeup of Bitcoin‘s hash rate following China’s mining crackdown. It is the largest drop in hash rate in the era of industrial mining. As of today, mining difficulty is expected to drop by ~25% this Friday”. The BTC hashrate has dropped 50% since its May 2021 high.

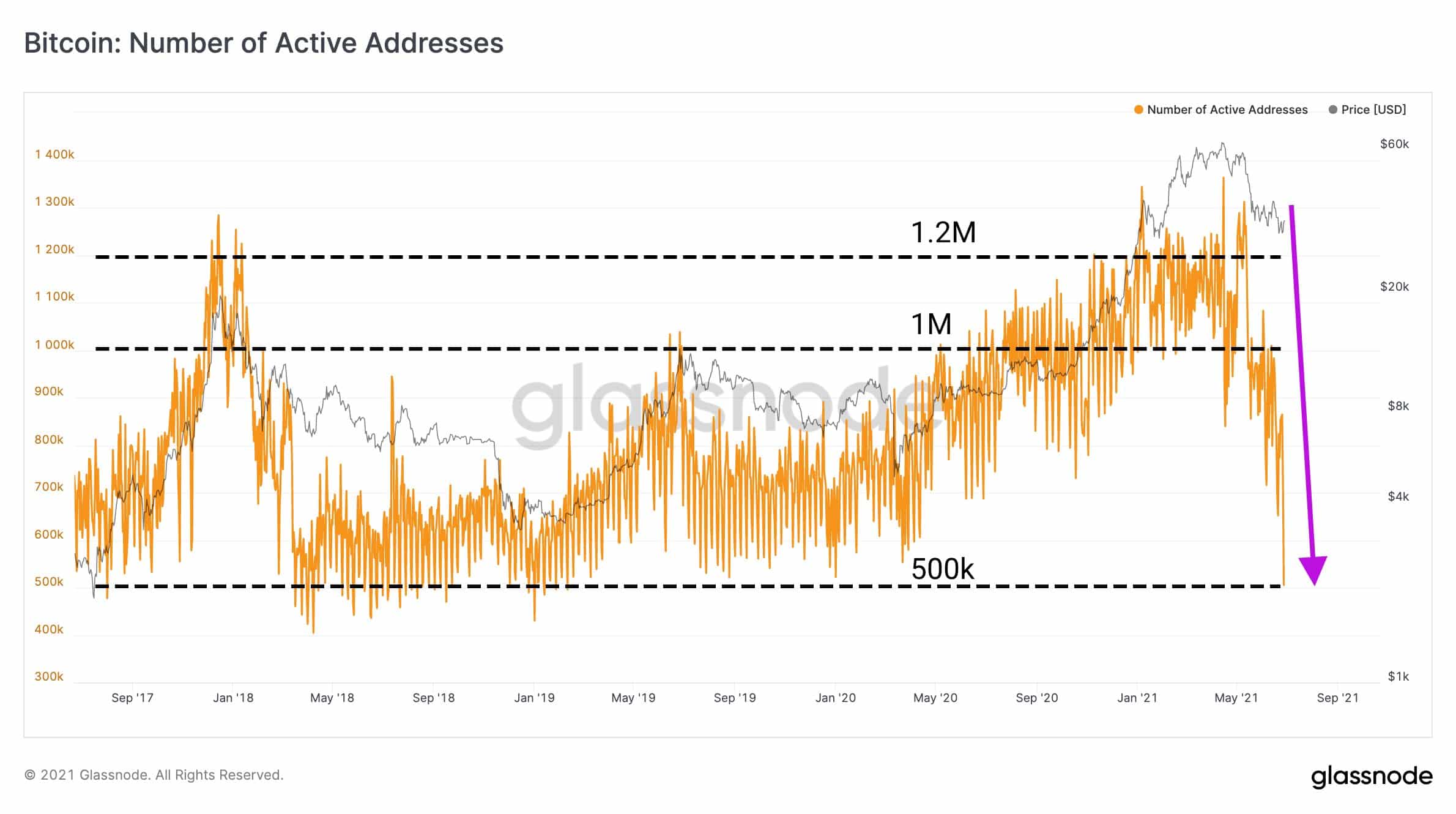

As a result, there’s also been a significant decline in Bitcoin network activity. The number of active Bitcoin addresses has dropped to levels last seen during 2019.

As CoinGape reported, for the first time in history, the Ethereum (ETH) active address has surged past that of Bitcoin’s.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs