India Plans Offline CBDC Accessibility, RBI Governor Says Citing Potential Risks

Highlights

- RBI governor says Indian CBDC might be available offline as authorities are working to streamline transactions.

- The Governor cracks down on cash's key feature, its offline availability.

- India advances with CBDC pilot as an effort to scale market dynamics.

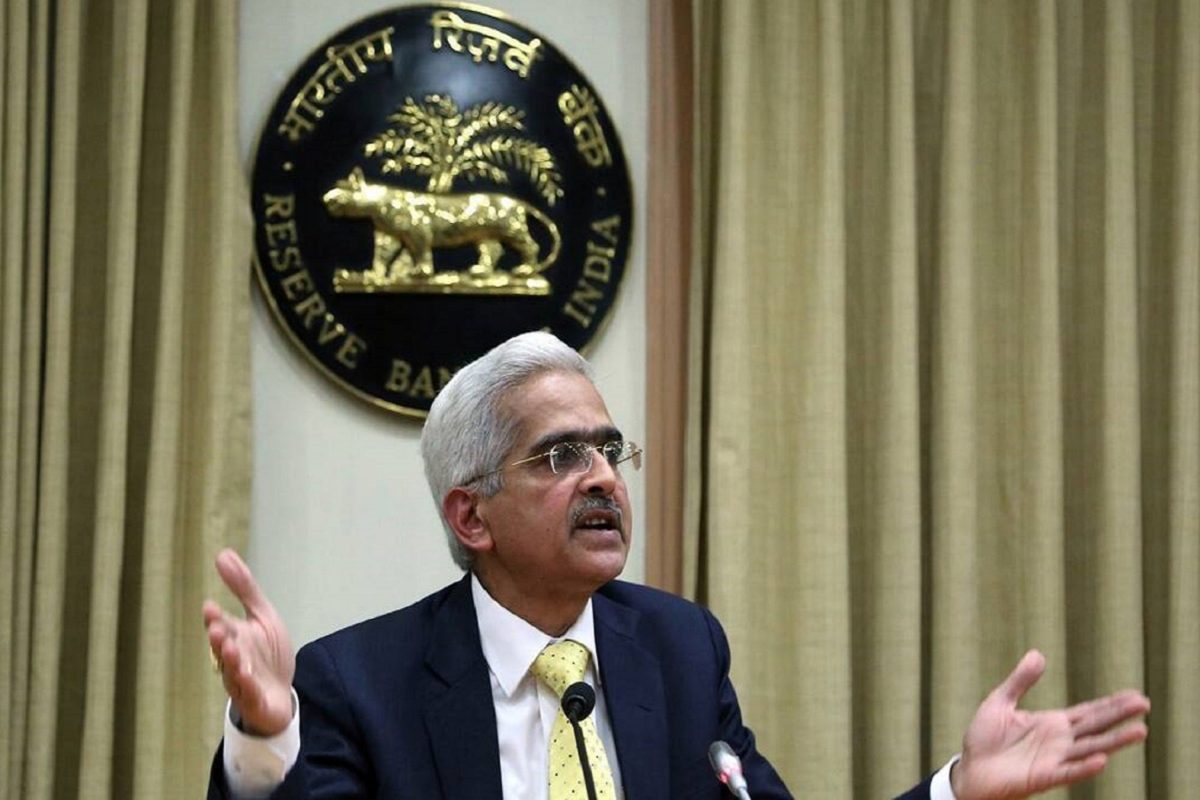

In a noteworthy development within the Indian digital assets space, RBI governor Shaktikanta Das has recently revealed that the Indian central bank is actively considering making its digital currency available offline. This announcement, which has quickly garnered substantial attention among Indian crypto market participants, underscores the Indian government’s proactive approach to regulating and supporting the yet unregulated sector.

RBI Governor Justifies Make CBDC Offline

At the Bank for International Settlements (BIS) event today, May 6, emphasizing one of the fundamental aspects of physical cash, its ability to be used offline, Shaktikanta reiterated that authorities nationwide are working on making the Central Bank Digital Currency (CBDC) transfers seamless, particularly in situations where an internet connection is not available.

Regarding this, the RBI Governor further adds that CBDC is a much safer alternative, considering that private digital currencies are potentially more dangerous, rationalizing the abovementioned decision. Das said that India stood among global economies for pioneering experimentation with a central bank-backed digital currency, a move cautiously being observed by developed nations. This sets the stage for further developments surrounding digital assets nationwide, fueling hope among Indian crypto participants.

Also read: Kraken To Offer Services In Germany In European Expansion Plan

India’s CBDC Pilot: An Effort to Gauge Market Statistics

Whereas, the country recently expanded the pilot program of its digital currency, boasting impressive participation of at least 1.3 million customers and 300,000 merchants. While the daily usage of the Central Bank Digital Currency (CBDC) in India has reached a notable 1 million transactions, the Reserve Bank of India Governor Das conversely stressed that instant mobile payments remain the preferred mode of transaction for the majority of the populace.

Nonetheless, the motive behind the CBDC pilots was primarily to observe changes in consumer behavior toward bank deposits and the need for increased transaction volumes to gauge broader economic impacts, particularly on monetary policy and the banking sector. Das reassured that by facilitating CBDCs as “non-remunerative” and “non-interest bearing,” any potential risks of bank dis-intermediation have been effectively nullified, speaking with Germany’s Joachim Nagel and and Italy’s Fabio Panetta at the BIS.

Also Read: Grayscale GBTC Stock Rose 5% Sequel To First Inflow Since Launch

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card