Indian Banks are Reportedly Using RBI’s Quashed Circular From 2018 to Warn Users Against Crypto

Indian banks are reportedly citing the 2018 circular issued by the Reserve Bank of India(RBI), the Indian Central Bank, to caution customers against dealing in cryptocurrencies, reported Bloomberg. The said circular prohibited banks from offering any service to crypto exchanges and platforms, but it was quashed by the Supreme Court in March last year. Despite the Supreme Court ruling, a majority of Indian banks are hesitant in offering their services to crypto exchanges due to uncertainty over crypto regulations in the country.

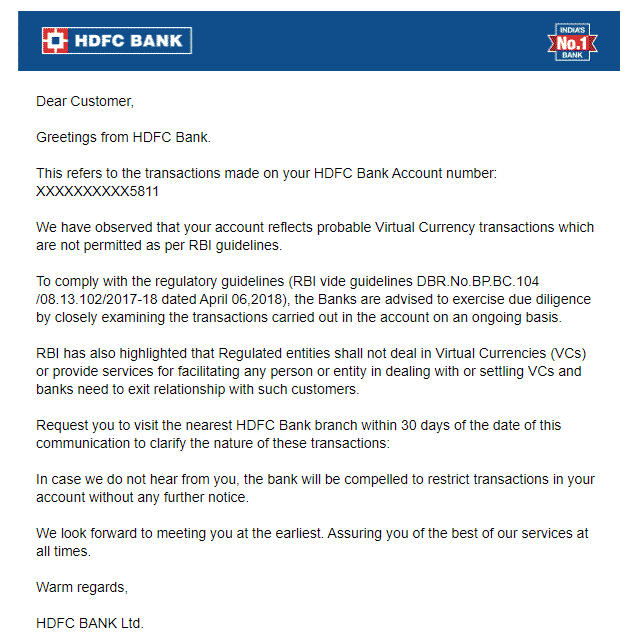

Recently, HDFC and SBI have released a similar circular citing RBI’s warnings in 2018 to caution users against dealing in crypto assets. The warning email from HDFC read,

To comply with the regulatory guidelines (RBI vide guidelines DBR.No.BP.BC.104 /08.13.102/2017-18 dated April 06, 2018), the Banks are advised to exercise due diligence closely examining the transactions carried out in the account on an ongoing basis.

Many crypto exchanges in India faced several disruptions especially during peak bull season as banks withdrew their support leading to complexities in fiat deposit and withdrawals.

Regulatory Uncertainties Reason Behind Bank’s Non-Compliance

The March 2020 verdict by Supreme Court that quashed RBI’s circular was seen as a big relief for the budding Indian crypto ecosystem following which many crypto exchanges added direct fiat deposits and withdrawals, however even back then industry experts have cautioned about such behaviors owing to lack of clarity over crypto regulations in the country.

Banks have also reached out to customers asking them to close their accounts for dealing in crypto assets. However, many experts say the users must not comply with the bank and close their account on their own rather they should ask the bank to do the same. This is because if a bank closes the account citing crypto transactions then it can be challenged in court. Apart from reaching out to customers, the banks have also approached NPCI, the authority overlooking UPI transactions to prohibit UPI payments for crypto transactions, but their requests were denied.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise