Indicators Point US Recession Coming Soon, But Crypto Is Giving Investors Hope

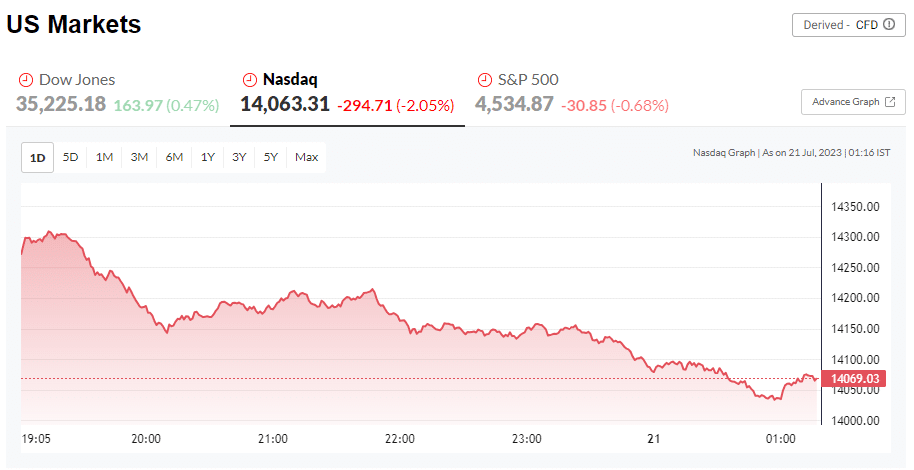

The US Market has been witnessing quite tough times and now there is one more addition to it. In June, a gauge used to monitor changes in U.S. business cycles declined for the 15th consecutive month, pulled down by deteriorating consumer confidence and rising jobless claims, Reuters reported. This is the longest run of declines since the period preceding the 2007–2009 recession.

Crypto To The Rescue And Give Hope

The Conference Board reported on Thursday that its Leading Economic Index, which forecasts future economic activity, fell by 0.7% in June to 106.1 after a May loss of 0.6% was downgraded. In a Reuters poll, economists’ median projection for a loss of 0.6% was slightly higher than the actual decline.

“Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead,” Justyna Zabinska-La Monica, senior manager of business cycle indicators at The Conference Board, said.

Despite the worries, many are turning to cryptocurrencies and digital assets for rescue. Celebrity investor and trader Hugh Hendry, while talking about the recession, stated in an interview with CNBC that he would choose Bitcoin over gold any day.

Traders and investors are also taking a dig at which will be the best-performing assets if the U.S. recession happens. Another analyst took to Twitter and stated he is confident that one of the top-performing cryptocurrencies if the U.S. experiences a recession, will be Kaspa.

The Other Opinion

Some in the industry think otherwise and do not consider crypto as a haven. Many investors are looking for assets to shield them from the impending storm as they consider the likelihood of a recession. However, according to experts, you won’t find it in crypto. Due to its volatility, Scott Sheridan, CEO of online brokerage Tastytrade, questioned if cryptocurrency could be regarded as a safe space.

Popular cryptocurrencies like Bitcoin and Ethereum fell more than 70% from their record highs as investors shied away from risky investments as interest rates rose. Although major cryptocurrencies are still significantly below their highs, 2023 saw a rise in cryptocurrency as traders changed their views on the market due to predictions that rate hikes would come to an end.

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026