Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

Highlights

- Matrixport flags more bear market signs, indicating Bitcoin bottom still far.

- Bitcoin bottom sentiment fail despite cooling US CPI as on-chain price levels slip.

- CryptoQuant’s Bull Score Index shows Bitcoin remains extra bearish.

Bitcoin has crashed more than 50% in a few months and every buy-the-dip is facing further downside pressure. Experts such as Matrixport and Glassnode have identified emerging bear market signals, suggesting Bitcoin may not have reached its bottom yet.

Matrixport Flags Bitcoin Bear Market Signs, But Opportunities Still Exist

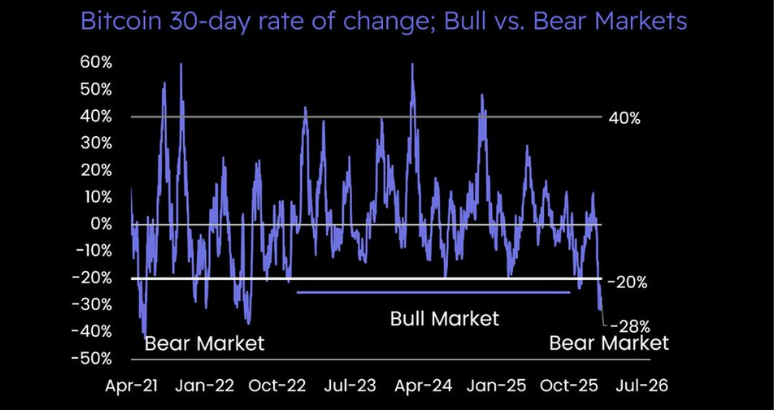

One indication that Bitcoin has entered a bear market is the frequency of large drawdowns. During bull markets, more than 20% correction over a 30-day period are rare, whereas such drops are more common during bear markets.

Matrixport said “Momentum had already begun to weaken by mid-2025.” Experienced crypto investors understand that bear markets are a recurring part of cycle that ultimately leads to the next bull market. This was the reason long-term Bitcoin holders and OG whales began profit booking from July last year.

However, Matrixport claims bear markets are rarely linear, with powerful counter-trend rallies occurring despite broader downtrends. While cooling US CPI inflation failed to sustain upside momentum in BTC, investors should continue to identify opportunities as declining network activity, deleveraging, and Bitcoin ETF outflows subside.

Glassnode Highlights Key On-Chain Price Level to Watch

Blockchain analytics firm Glassnode claims that BTC options put buying has dominated flows since Bitcoin dropped below $82K. Open interest and implied volatility are rising, but driven by hedging flows rather than an uptrend sentiment.

Their latest data reveals key on-chain price models, as BTC price trades near $68.8K. STH Cost Basis dips to $90.9K, with Active Investors Mean at $85.8K. It means recent buyers are sitting on unrealized losses, signaling a bearish trend and high risks of panic selling or capitulation.

Moreover, the True Market Mean and Realized Price have also dropped lower. Bitcoin Realized Price has slipped from $55.6K to $54.9K in a week.

Bitcoin Is Still Extra Bearish

The crypto market continues to face uncertainty, with recent analysis from Matrixport and Glassnode indicating that Bitcoin may not have reached its bottom yet.

CryptoQuant’s Bull Score Index Mapped to Price metric shows Bitcoin remains extra bearish, with bull score index at zero. OG whales such as Garrett Jin are liquidating their BTC and ETH holdings.

BTC price fell 3% in the past 24 hours, with the price currently trading at $68,277. The 24-hour low and high are $68,052 and $70,939, respectively. Furthermore, trading volume has decreased by 7% in the last 24 hours, indicating a decline in interest among traders.

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- 8 Best Multisig Crypto Wallets in 2026 – Top List Reviewed

- Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs