Is Crypto Market Headed for a Big Crash as $5.72B in Bitcoin, Ethereum Options Expires Today?

Highlights

- Crypto market crash deepens as Bitcoin breaks below $104K and Ethereum tumbles under $3,600.

- Western Alliance Bank and Zions Bank fraud triggers banking sector risks.

- Whales and investors selling heavily amid Trump tariffs and macro fears.

- Outflows from spot Bitcoin and Ethereum ETFs causing panic in the crypto market.

- Binance and other crypto exchanges face investigations in France.

Bitcoin breaks below $104K and Ethereum tumbles under $3,600 today, causing the total crypto market cap to crash more than 5% to $3.53 trillion. Traders are further bracing $5.72 billion in BTC and ETH options expiry. Is the “Uptober” narrative fading for a big crypto market crash?

Selling pressure on BTC and ETH triggered a broader 8-20% correction in altcoins BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, SUI, and others. Let’s look at the possible reasons behind the crash.

Top Reasons Behind the Crypto Market Crash

In just a week, the total crypto market cap has tumbled from over $4.30 trillion to $3.5 trillion. This accounts for almost $830 billion erased from the crypto market, raising panic among investors.

Western Alliance Bank and Zions Bank Fraud

Global equities are under pressure after two US banks, Western Alliance Bancorp and Zions Bancorporation, reported bad loans linked to alleged fraud. Banking stocks fell into the red on Friday as signs of credit stress raised concerns over loan quality in the United States.

The prolonged U.S. government shutdown and bad loans at Western Alliance and Zions have primarily triggered a global stock market selloff. The selling pressure in the banking sector has triggered liquidity and crypto off-ramp concerns among crypto investors.

Trump Tariffs and Macro Jitters

Last week, US President Donald Trump’s announcement of 100% tariffs on China wiped out $500 billion from the crypto market. The crypto community also blamed USDe, wBETH, and BNSOL depeg on Binance’s Unified Account margin system flaw and $700 million transfer by market maker Wintermute.

“Trump insider whale” shorted $700 million BTC and $350 million ETH just before the crypto market crash, making $200 million in profit.

Similar situations formed before Bitcoin started falling below $112K. ‘Trump Insider Whale’ has started opening short positions before key Trump announcements and key macro events. As CoinGape reported, whales, including the “Trump insider whale,” increased their BTC shorts before Jerome Powell’s speech.

Investors panicked as the whale opened a $127 million Bitcoin short position before an important announcement by President Trump. Jim Cramer criticized the market’s reaction ahead of Trump’s upcoming remarks on China. However, Trump didn’t mention anything related to the tariffs against China in his announcement, still Bitcoin fell and gold continued upside momentum as investors now await CPI inflation data.

Crypto Market Crash Ahead of $5.7 billion in Bitcoin, Ethereum Options Expiry

Traders are bracing for huge volatility due to crypto options expiry amid rising uncertainty. Markets became more dependent on derivatives amid massive trading volumes on CME, Deribit, and spot Bitcoin and Ethereum ETFs.

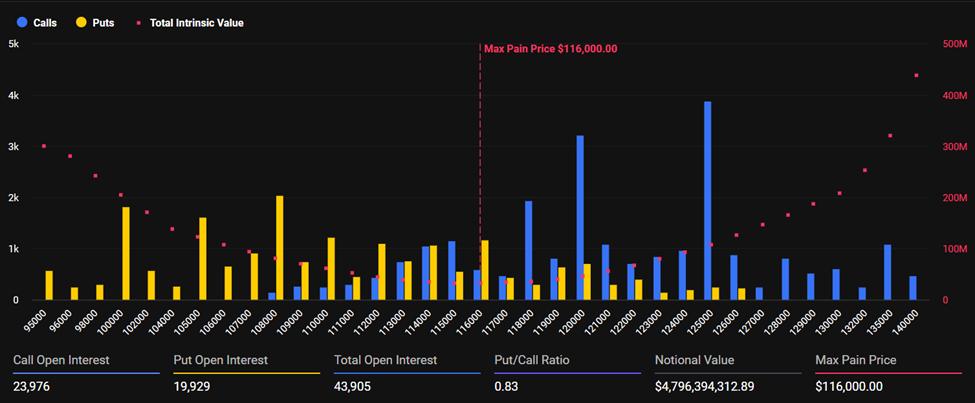

Almost 44K BTC options with a notional value of $4.8 billion are set to expire on the Deribit derivatives crypto exchange today, with a put-call ratio of 0.83. The max pain point is at $116K.

Meanwhile, over 251K Ethereum options with a notional value of $0.990 billion are set to expire on Deribit, with a put-call ratio of 0.81. In the last 24 hours, the put volume was significantly higher than the call volume, with a put-call ratio of 1.37. It shows traders are leaning bearish and anticipate downside amid rising volatility.

Spot Bitcoin and Ethereum ETFs Outflows

United States-based spot Bitcoin ETFs saw a total net outflow of $536 million, according to SoSoValue data. with none of the twelve ETFs recording net inflows. Notably, none of the twelve BTC ETFs registered net inflows. This suggests investor caution amid recent market volatility. This is the largest single-day outflow since August.

In addition, spot Ethereum ETFs saw a total net outflow of $56.88 million. BlackRock’s ETHA recorded a net inflow of $46.9 million.

Binance and Other Crypto Exchanges Face Anti-Money Laundering Investigations

French regulators have expanded anti-money laundering (AML) checks on crypto exchanges, including Binance. France’s financial watchdog ACPR is carrying out investigations into compliance frameworks, risk controls, and anti-money laundering systems. Binance says it is cooperating fully and complying with EU and local regulations.

Bitcoin fell more than 7% in the past 24 hours, with the price currently trading at $103,978. The 24-hour low and high are $103,905 and $111,990.81, respectively.

Ethereum and XRP prices are trading at $3,696 and $2.21 as traders and investors move to liquidate their holdings. CoinGlass data shows $1.2 billion in liquidations amid the crypto market crash, with almost $600 million liquidated in the last 4 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Faces $1.8B in Panic Selling as U.S.-Iran Airstrikes Escalate; Will BTC Crash Below $60k?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs