Is Crypto Really Dead? Here’s What Exchange Outflows Convey

The FTX contagion has spread pretty fast across all crypto exchanges and investors have been opting for a self-custody solution. There have been massive outflows of Bitcoin and stablecoins from the exchanges following the fall of FTX.

As per data from Glassnode, the speed of Bitcoins moving off exchanges is so high that all the BTC that flowed into exchanges since 2018 has now been withdrawn. The demand for self-custody and spot-driven Bitcoin markets is rising fast. Although Bitcoin has been through several bear markets in the past, this kind of behavior has been unprecedented.

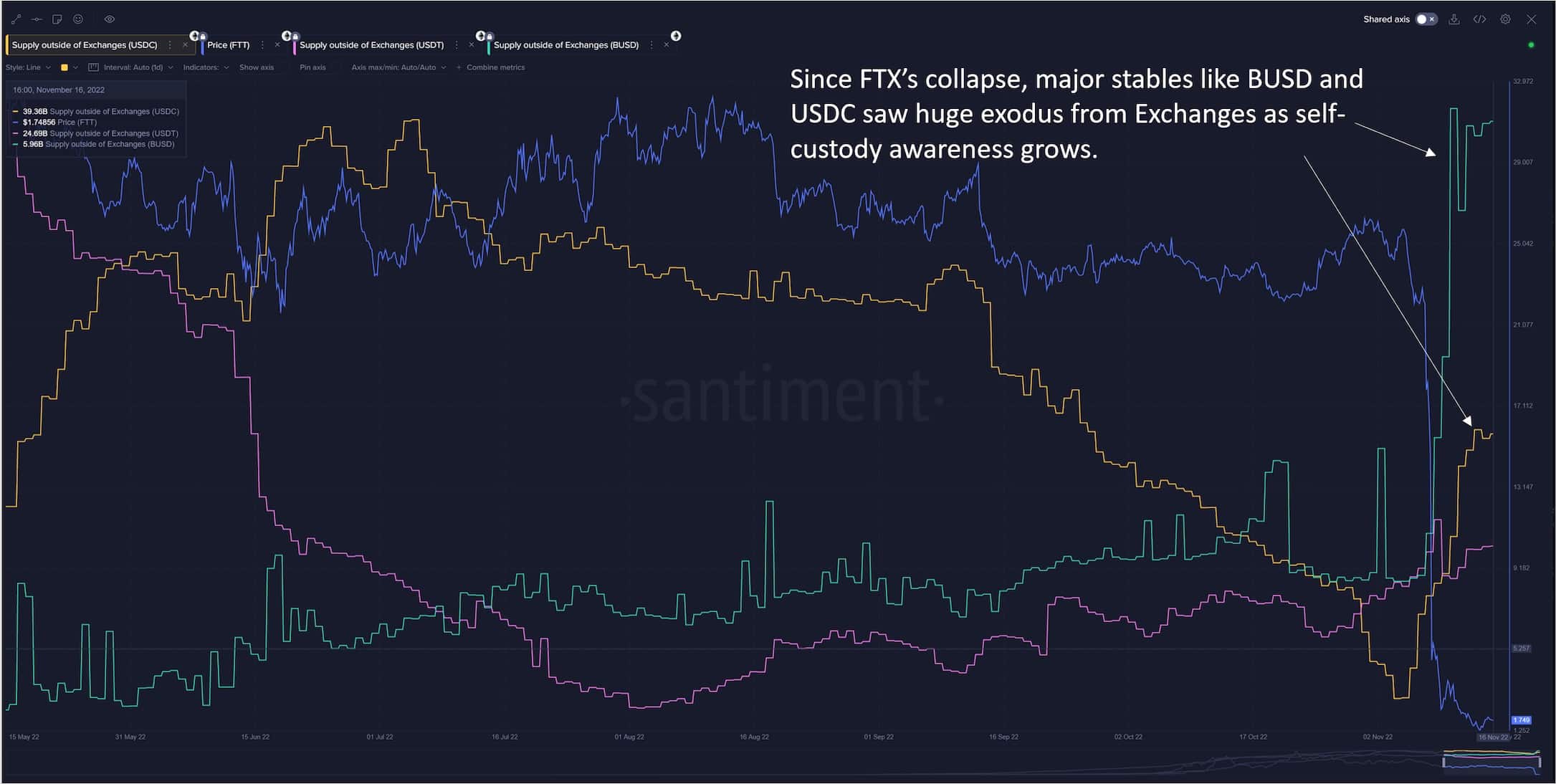

In addition to Bitcoin, there’s been a massive outflow of popular stablecoins like BUSD and USDC, from exchanges, over the last week. All these stablecoins have been moving into self-custody in large numbers. In their recent report, on-chain data provider Santiment wrote:

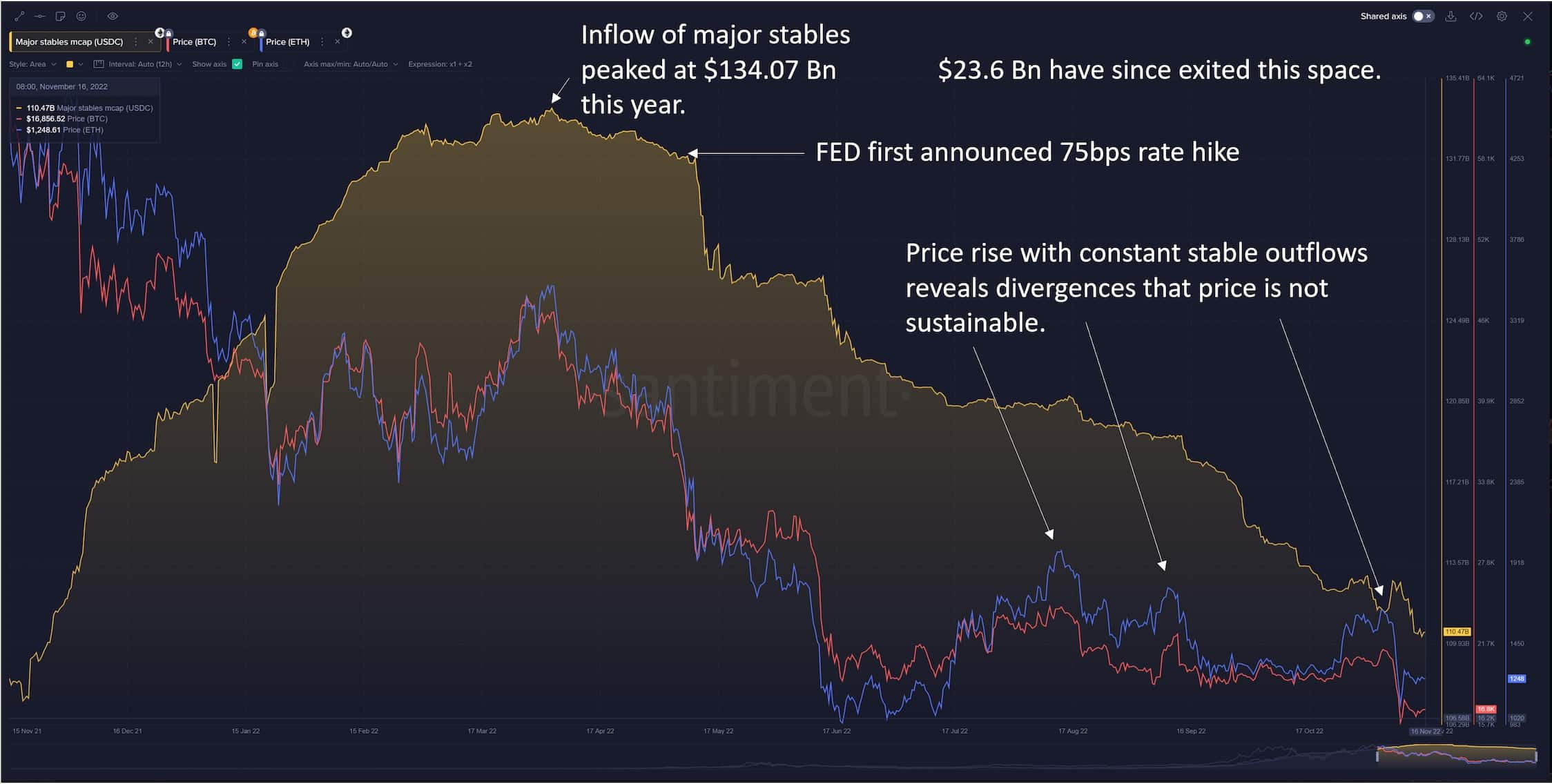

The start of the year was rather positive as we saw constant inflow of major stables (USDC, BUSD, USDT) into the cryptomarket, suggesting that new money is coming to perhaps buy the dip (as prices were falling). Major stables’ marketcap eventually peaked out at $134.07 Bn around the same time as the BTC and ETH topped out this year. Since then, it has been a downward slope, accelerated by FED’s first 75 bps hike announcement in June.

Also, there’s been a massive reshuffle in the stablecoin holdings ever since Binance announced that they would convert USDC stablecoins to BUSD. “If there’s one major lesson the recent events have taught us, it’s self-custody. Market learns fast as we saw huge spikes in Supply outside of Exchanges for USDC and BUSD recently,” notes Santiment.

Is Crypto Really Dead?

The FTX contagion has spread pretty fast and several players in the crypto space have been impacted heavily. Crypto venture fund Multcoin Capital faced losses to the tune of a billion dollars by holding its assets on FTX.

The way the crypto market has collapsed has led many to question whether is crypto really dead. However, instances like FTX have happened in the past with exchanges like Mt. Gox collapsing overnight.

Considering that people are opting for self-custody instead of selling their coins shows the fact that people still continue to believe in good crypto projects, blockchain, and the concept of decentralization. However, there have certainly been some short-term headwinds like institutional players selling their BTC post-FTX collapse, but it would be too early to say if crypto is really dead at this stage. At $800 billion, it is still a sizeable market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Oil Prices Climb as Iran Set To Deploy Mines in Strait of Hormuz

- Why Is Crypto Market Up Today? 5 Key Reasons Behind the Rally

- Top U.S. Banks Weigh Lawsuit Against OCC Over Crypto Firm Charters

- CLARITY Act: Key Democrat Says Banks May Have to Compromise as Senate Eyes Crypto Bill’s Markup

- XRP News: Brad Garlinghouse Predicts ‘Defining Year’ For Ripple With XRP At The Center

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

Buy $GGs

Buy $GGs