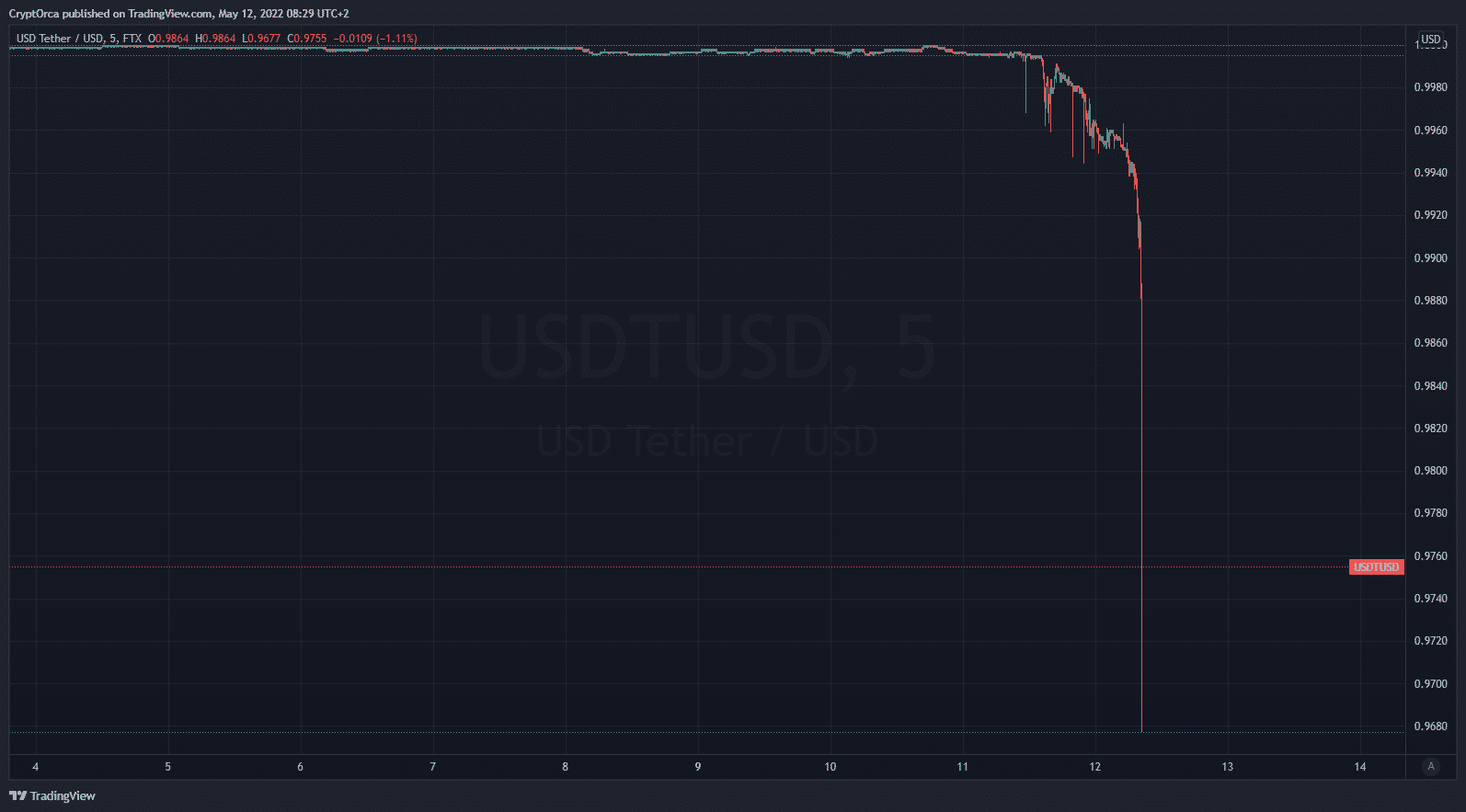

Is Tether (USDT) Following Terra’s UST In Losing Its Dollar Peg?

Tether (USDT), the world’s largest stablecoin, appears to be under extreme liquidation pressure amid the ongoing crypto crash.

The token is down 4.8% to 0.9508- its lowest level since the 2017 crypto crash.

This drop is highly uncharacteristic, given that the token is required to maintain a 1:1 peg against the U.S. dollar. Investors are wary of any depegging by a stablecoin, after TerraUSD (UST) drastically lost its dollar peg this week.

The crypto market is experiencing an extreme consolidation since last week, as total market capitalization plunged about $900 billion.

USDT is the largest stablecoin, and the third-largest cryptocurrency, at a market capital of $81.8 billion. It is by far the most used token in facilitating crypto trade.

Why is USDT depegging?

Investors appear to be pulling out of the crypto market amid the ongoing crash. Given USDT’s widespread use in facilitating crypto trades, it is likely being sold by traders for dollars, in order to reduce their crypto exposure.

Traders also appear to be buying USDT’s peers Binance USD (BUSD) and USD Coin (USDC)- indicating some positioning against the token. BUSD and USDC are up 1.6% and 0.3%, respectively.

In a move to reassure investors USDT founder Paolo Ardoino said the token had honoured $300 million redemptions to USD in the past 24 hours, “without a sweat drop.”

Tether’s reserves are shrouded in uncertainty

Bitfinex, the crypto exchange that operates USDT, claims to back USDT’s value with a massive reserve pool. According to data from the organization, nearly 84% of this pool is made up of cash and cash equivalents.

But the organization has been criticized over not having enough transparency over its reserves. This recent selldown could also be driven by uncertainty over Bitfinex’s ability to effectively back the token, if it comes under more pressure.

With UST’s crash, investor faith in stablecoins may be questioned. This could also be driving selling in Tether, given the uncertainty over its reserves.

U.S. financial regulators, including Treasury head Janet Yellen, have also used UST’s recent crash as a criticism against the broader stablecoin space.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs