Jim Cramer Calls Bitcoin a Safe Haven Amid Growing US Debt Concerns

Highlights

- Cramer calls Bitcoin a safety net as debt fears rise—fearful selling is the real risk.

- Bitcoin holds strong above $103K as open interest surges to $74B.

- Market panic? Not so fast—Cramer says fear benefits short sellers, not smart investors.

Investor fears spiked again after Moody’s downgraded the U.S. government’s debt rating, but CNBC’s Jim Cramer advised a different response. He urged investors to manage their emotions rather than panic, suggesting that digital assets like Bitcoin could serve as a protective option in uncertain times.

Jim Cramer Warns Against Fear-Driven Selling

Jim Cramer, host of CNBC’s Mad Money, addressed investors on Monday following Moody’s decision to downgrade the U.S. debt rating. The announcement, made after market close on Friday, triggered a volatile start to the week. Markets opened lower, with the Dow Jones falling by 300 points and the S&P 500 slipping by 1% in early trading.

Despite the initial drop, markets recovered during the session. The Dow closed up 0.32%, the Nasdaq rose 0.02%, and the S&P 500 gained 0.09%. Jim Cramer urged investors to resist fear, calling it a repeated pattern following previous downgrades, such as those by S&P in 2011 and Fitch in 2023.

“You are being given an early warning to invest more—not more aggressively—but more of what you can save,” Jim Cramer said. He added that selling after a downgrade has not been a reliable strategy in the past.

Bitcoin and Gold Suggested as Safety Nets

Jim Cramer advised those concerned about rising national debt to consider assets outside of traditional markets. He specifically mentioned gold and Bitcoin as alternatives during times of fiscal uncertainty. “Fear is what must be tamed if you want to be a good investor,” he explained, emphasizing that panic often leads to poor decisions.

Bitcoin, in particular, has shown resilience in recent days. Following the downgrade news, Bitcoin’s price showed volatility but continued to hold above key support levels. Cramer noted that digital assets like Bitcoin might offer a buffer for those wary of excessive government borrowing.

He also suggested that some fear narratives are driven by individuals or entities with their own financial interests.

“The people who write these are either fools who know nothing or incredibly shrewd short sellers who really need to spread fear because of their business model,” Jim Cramer said.

Bitcoin Open Interest Soars Price Hits $107k

Bitcoin’s open interest in the futures market reached $74 billion, according to data from Coinglass. This marks one of the highest levels seen in recent weeks and suggests growing trader activity.

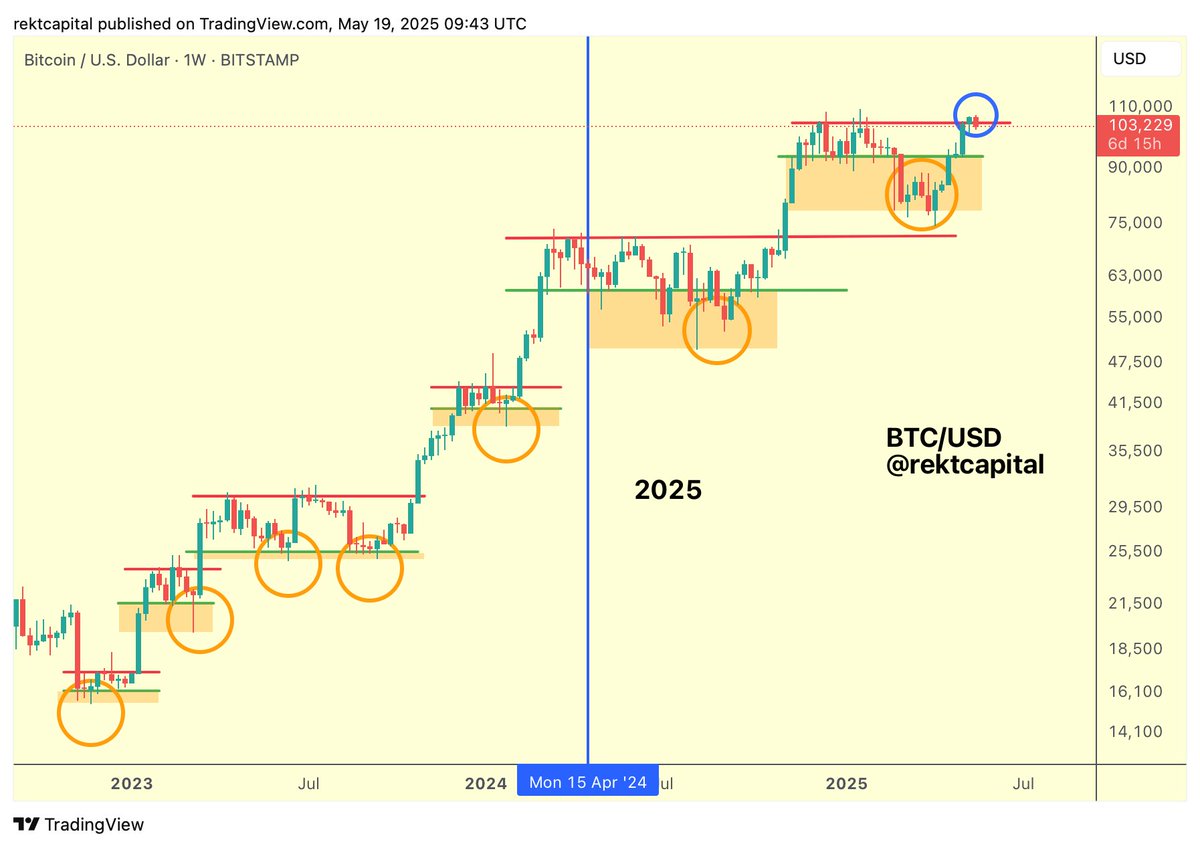

Bitcoin price is currently trading around $105,000 after a brief move to $107,000. It has rejected that level twice in recent sessions, indicating resistance. Despite the fluctuations, Crypto expert Rekt Capital said that the asset closed the previous weekly candle above $103,000, which had been a key resistance point.

Analysts are attributing the activity to sentiment that interest rates will come down and inflation will moderate, both of which are favorable for things like Bitcoin. This rising number of financial firms ramping up their crypto exposure like Michael Saylor-led Strategy, is also pointed at by some as one of the reasons behind Bitcoin’s stability.

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand