Just-In: Crypto Market Cap Crosses $2 Trillion As Russia-Ukraine Conflict Boosts Adoption

Crypto market capitalization crossed the $2 trillion mark for the first time in two weeks, helped largely by speculation over growing adoption due to the Russia-Ukraine conflict. The market has now recouped its losses made during initial jitters over the invasion.

Russia-Ukraine Conflict Boosts Crypto Adoption

Preliminary talks between Russia and Ukraine, although largely inconclusive, had also inspired some optimism in markets, helping bitcoin extend its recovery past $42,000- a key resistance level. While most altcoins also rallied, bitcoin’s market dominance remained unscathed at 42%.

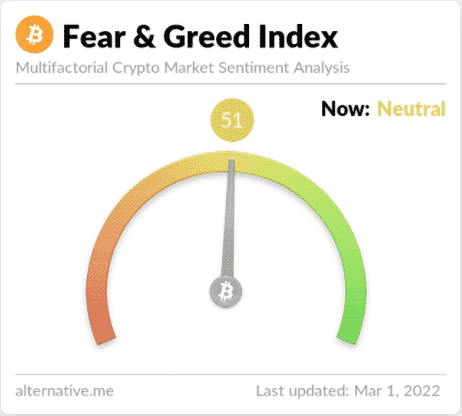

The bitcoin fear and greed index also showed sentiment had improved from extreme fear to neutral.

Crypto has also seen a jump in popularity due to the conflict, as both sides saw surging adoption rates. Ukrainians were seen turning to stablecoin tether, even paying steep premiums for the token after the central bank suspended electronic cash transfers.

Russians were seen turning to bitcoin after strict Western sanctions put the ruble in freefall. Speculation has also grown over Moscow using crypto to evade U.S. sanctions.

But both Russia and Ukraine were open to crypto adoption even before the conflict, having laws that recognized the space to some extent.

The Crypto community believes that Bitcoin is the alternative and is the ultimate global currency. Bitcoin price has crossed an important price level of 40K, and now all eyes are on the next important resistance level of 64K.

-Naeem Aslam, Chief Market Analyst at Avatrade

Bitcoin outperforms stocks

Bitcoin’s rally since last Wednesday- when the recovery trade began, has vastly outpaced the stock market. The token is up nearly 14%, while the S&P 500 has added about 0.9%. The Nasdaq, a closer parallel for bitcoin, is up 2.4%.

But it remains to be seen whether the momentum will continue. The Russia-Ukraine conflict has shown little signs of stopping, with fighting spread out across several regions around Kyiv.

Russian President Vladimir Putin has also put the country’s nuclear forces on high alert. Any escalation on that end would have devastating consequences. Given crypto’s tendency to follow stocks, it remains sensitive to geopolitical tensions.

As such, stablecoins, particularly tether, continue to dominate volumes. The token’s 1:1 peg against the U.S. dollar make it a reliable safe haven.

- U.S. SEC Ends Zcash Foundation Probe as Dubai Tightens Rules on Privacy Tokens

- Sui Network Suffers Outage as Mainnet Stalls; SUI Price Flat

- Crypto ETF News: Bitwise Launches Chainlink ETF as Institutional Inflows Return

- Breaking: Supreme Court Delays Ruling on Trump Tariffs; May Decide January 16

- Senators Make Amendments To CLARITY Act On Yield and DeFi Ahead Of Crypto Bill’s Markup

- Bitcoin Price Forecast: How the Supreme Court Tariff Decision Could Affect BTC Price

- Ethereum Price Prediction as Network Activity Hits ATH Ahead of CLARITY Markup

- Robinhood Stock Price Prediction: What’s Potential for HOOD in 2026??

- Cardano Price Prediction as Germany’s DZ Bank Gets MiCAR Approval for Cardano Trading

- Meme Coins Price Prediction: What’s Next for Pepe Coin, Dogecoin, and Shiba Inu Amid Market Rally?

- Standard Chartered Predicts Ethereum Price could reach $40,000 by 2030