Just-In: Here’s How Ethereum (ETH) Price May Move After The Merge

The Ethereum (ETH) price is set to be deflationary after the Merge due to a drop in ETH issuance and the EIP 1559 burning mechanism. Glassnode data reveals Ethereum (ETH) issuance will increase after the Merge only when more validators enter the pool. Therefore, Ethereum’s deflationary or inflationary price will vastly depend on validators.

Ethereum (ETH) Price Increase After the Merge

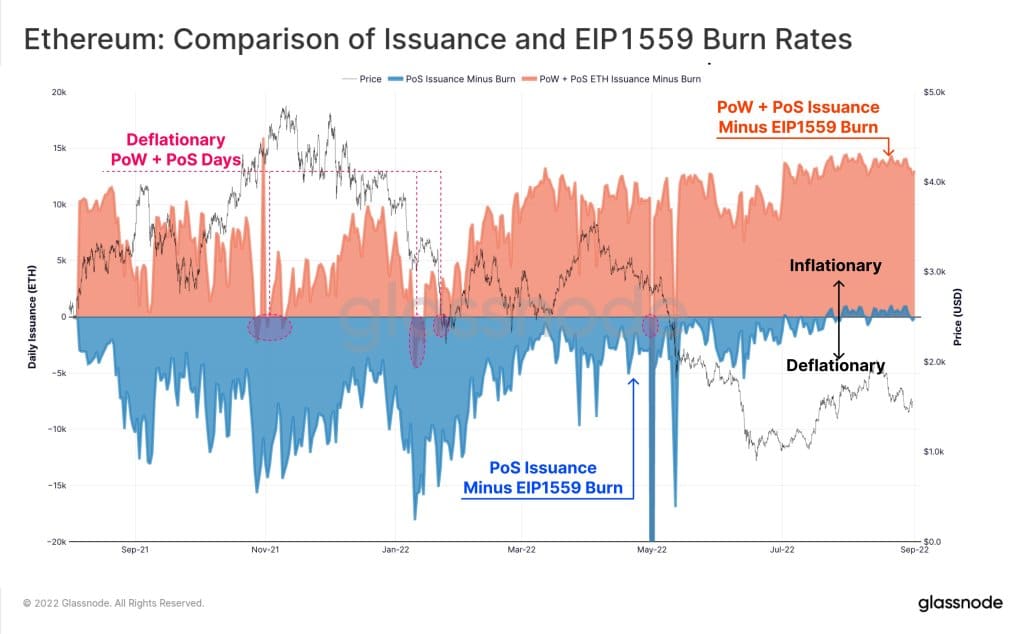

According to Glassnode’s simulation of Merge in August 2021, Ethereum (ETH) issuance can depend on a set of chains that decides its deflationary or inflationary nature. On the PoW + PoS chains, with the EIP 1559 burn mechanism, Ethereum issuance will be inflationary. Thus, the price will increase.

However, on PoS with EIP 1559 burning mechanism, the Ethereum (ETH) issuance will be deflationary. Hence, the price will decrease.

It indicates that the deflationary or inflationary price after the Merge will depend on chains and not majorly on the EIP 1559 burning mechanism. The balance between the rate of issuance and burning determines the inflation or deflation rate of ETH.

The Ethereum (ETH) supply will be deflationary on the simulated PoS chain with EIP 1559 burning mechanism. The ETH supply after Merge may become deflationary with the increase in gas fees.

“With exception of Aug this year, where average gas prices are sub 20-GWEI, the simulated condition PoS chain + EIP1559 burn is net deflationary.”

The Merge will have no impact on the gas fees, but gas fees will impact the Ethereum (ETH) price after the Merge. Any increase in gas fees will decrease the ETH supply, which will impact its price.

Moreover, the Merge is likely to witness an increase in the number of validators. Also, the transition to PoS will help users to become non-block-producing nodes that don’t require ETH staking.

ETH issuance on Beacon Chain increases as the number of validators in a pool rises. It helps address investor concerns regarding technical risks. However, yields per validator decline after the Merge.

ETH Price Risks Falling

The Ethereum (ETH) price is currently trading above the $1550 level. However, the Merge is likely to push the price downwards, along with present market conditions.

The possibilities of ETH falling to $1000 are higher, but prices will not immediately fall after the Merge. The staked Ethereum will be locked until the Shanghai upgrade. Moreover, there will be 6-8 months of waiting period for the Merge to be priced in.

At the time of writing, the ETH price is trading near $1750. The trading volume has jumped over 65% as the dominance rises to 20.4%. Moreover, the Bellatrix upgrade on the consensus layer and Paris upgrade on the execution layer prepare the chains for the Merge on September 14.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs