Just-in: Poly Network Awards $500,000 Bug Bounty to $610 Million Hacker

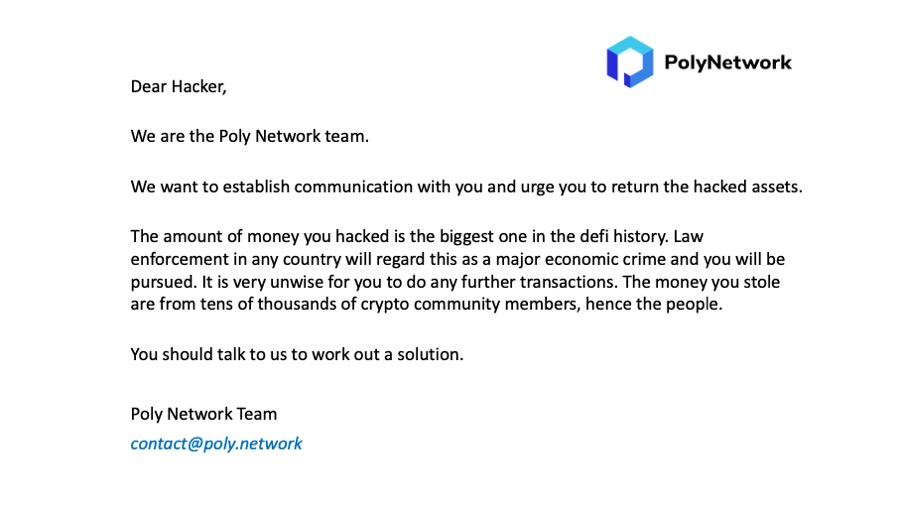

Poly Network, a cross-chain defi protocol that suffered the largest defi hack amounting to $610 million has decided to award the hacker $500,000 as a ‘Bug Bounty,’ as per a report in Reuters. The hacker managed to exploit a cross-chain verification signature to drain funds into three accounts on three different blockchains. The Defi protocol alerted exchanges and miners about the hack and requested them to freeze transactions originating from the hacked address.

As our communication with Mr. White Hat is going on, the remaining user assets on Ethereum are gradually transfered to the multisig wallet (0x34D6B21D7B773225A102b382815e00Ad876E23C2) requested by Mr. White Hat. pic.twitter.com/FdSfJ6ZIUt

— Poly Network (@PolyNetwork2) August 12, 2021

Poly Network requested the hacker to return the funds, which were obliged and the attacker started returning the funds starting a couple of days back. The defi protocol confirmed earlier today that the majority of the funds have been returned. It dubbed the hacker “white hat” in its address suggesting they are in continuous touch as the funds are being processed.

The heist is being deemed as the largest in crypto history while highlighting the security vulnerabilities in the defi ecosystem. The hacker behind the network tried laundering the stolen amount but due to the risks involved in laundering such high amounts, he decided against it. The EtherScan copy of the transactions made by the attacker even claimed the exploit would have been in billions had he decided to rug other “Shitcoins” as well.

Three More Defi Networks Attacked Since Ploy Network Hack

The Poly Network attack was followed by three other network hacks including DAO Maker and Necko network resulting in millions worth of losses. While DAO Maker hacker stole money from USDC accounts, Neko network hacker exploited smart contract vulnerability.

The high popularity of the defi network makes it more prone to hack attacks as many new projects spring up in the defi market, gaining instant liquidity within weeks and then get rugpulled or exploited. Defi market’s security vulnerability could pose a roadblock in its rapid growth.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible