Just-In: US Labor Shock Raises Rate Cut Bets, Bitcoin Still Down

Highlights

- US layoffs surged sharply in October raising December rate-cut expectations.

- Bitcoin price stays down despite rising odds of Fed easing.

- Analysts warn that labor shifts and ETF outflows could deepen Bitcoin’s ongoing market decline.

US employers announced a sharp rise in job cuts in October, adding new pressure on the Federal Reserve ahead of its December policy meeting on rates. It was the highest total for any October since 2003.

Layoffs Surge Boosts Expectations For December Fed Rate Cut

Challenger Gray reported 153,074 layoffs, up 183% from September and 175% from the same month last year. It was the largest number of fourth-quarter cuts since 2008. Total job losses for the year have reached 1.1 million, the most since the COVID-19 outbreak in 2020.

The rise in job cuts also renewed debate about how deep the economic slowdown may become. Many companies cited cost reductions and AI efficiency gains as major drivers of workforce reductions. Economists said this trend may continue into early next year as firms adjust to rising expenses and slower revenue growth.

The data triggered immediate reactions across markets. Analysts at the Kobeissi Letter hint that the labor shock increases the chances of a rate cut at the next Fed meeting.

BREAKING: US employers announced 153,074 jobs cuts in October, marking a +175% surge and the highest for any October since 2003, per Challenger Gray.

Employers cite cost-cutting and AI as the primary drivers of these cuts.

We need more rate cuts.

— The Kobeissi Letter (@KobeissiLetter) November 6, 2025

Rate Cut Bets Rise, But Bitcoin Shows Limited Reaction

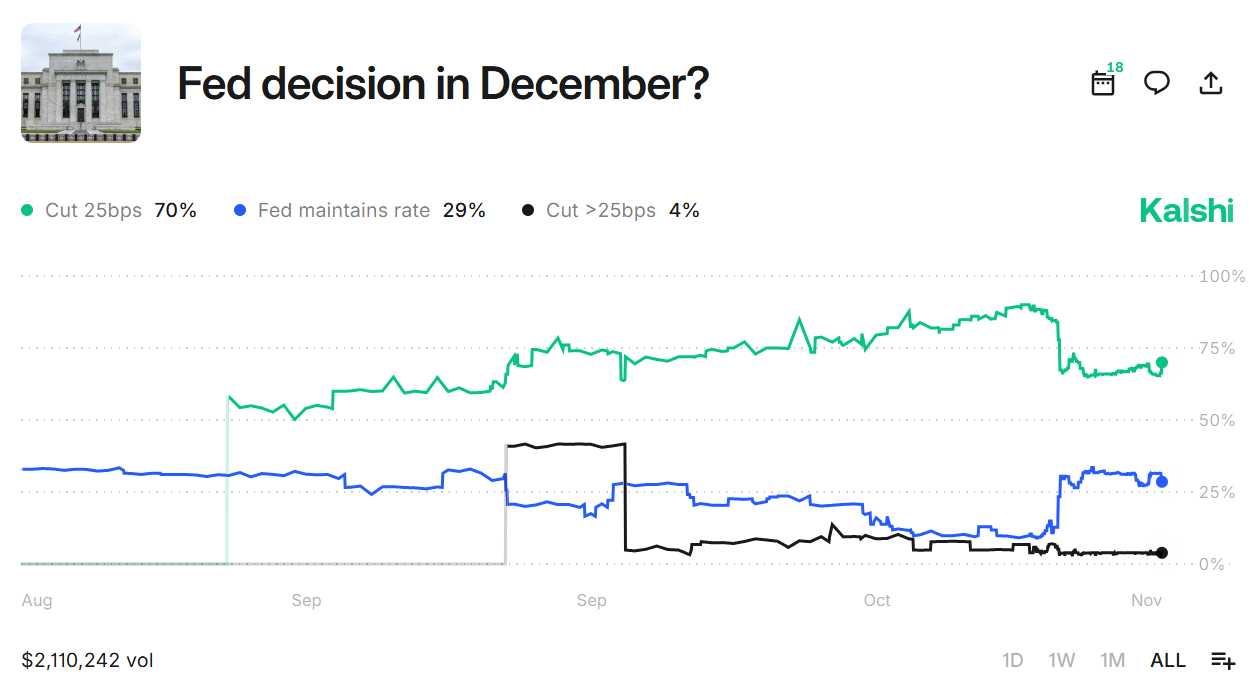

On prediction market Kalshi, the probability of a 25-basis-point cut rose to nearly 70%. The odds of the Fed holding rates fell toward 30%. Traders said the weak labor report strengthens expectations that economic conditions are slowing faster than policymakers anticipated.

This shift contrasts recent warnings from Fed Chair Jerome Powell. Powell signaled cautious expectations about December cuts.

Some market commentators disagreed on how much rate cuts could help. Scott Melker said monetary policy cannot fix structural changes caused by cost-cutting and accelerating adoption of artificial intelligence.

He argued that the labor market is adjusting to new technologies that reduce the need for human workers. Melker further said this shift may continue regardless of what the Fed does. However, Bitcoin struggled to gain momentum despite the higher odds of easing.

Bitcoin Struggles Near Support As Market Caution Persists

BTC price hovered near $102,800 after a volatile trading session, according to TradingView. The drop extended a broader decline that has weighed on the market for several weeks.

The chart showed repeated failed attempts to break above short-term resistance near $103,500. Traders said the market remains cautious as liquidity conditions stay tight and risk appetite weakens.

Some analysts also warned that Bitcoin may revisit the CME gap at $92,000. The sharp rise in outflows from ETFs add pressure to the current downtrend.

Bitcoin could benefit once the Fed clearly signals a shift toward easing. It is historically known that crypto assets tend to recover once there is a policy pivot.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs