Kimchi Premium on the Rise Again, Can it Pull BTC Out of Consolidation ?

Bitcoin price is currently consolidating just above $57,000 with its market dominance on a continuous decline, currently at 44.41%. Bitcoin registered a sharp correction of over $17k, falling from an ATH of $64,863 to a monthly low of $47,159. The price of the top cryptocurrency has recovered nearly half of the losses, currently 12% short from testing its previous ATH.

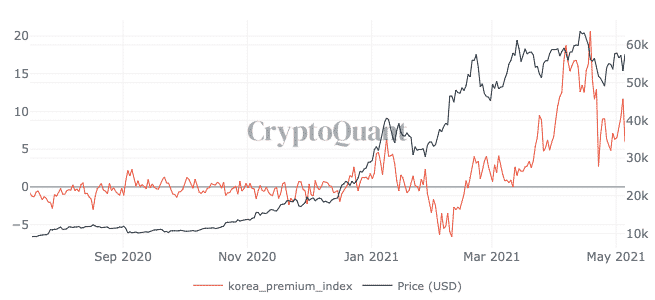

Kimchi premium and Coinbase premium have proven to be important market indicators this bull season, where the price of Bitcoin starts selling at a premium price in Korean markets amid growing demand. This creates a price difference between US markets and the Korean market known as Kimchi premium. Kimchi premium registered a significant drop during the last sell-off dropping to negative, but it is on the rise again as it rose to a monthly high of 11%.

Bitcoin this year has set a price pattern where it has risen to an all-time-high (ATH) every month for the past five months, followed by a sharp correction ranging between 12%-27% and then 2-3 weeks of consolidation before starting the next leg. The consolidation phase has gotten longer with each new ATH as we are entering into the fourth week of consolidation since the last ATH.

Can Rise Kimchi Premium Pull BTC Out of Price Slumber?

With every new price correction, many have declared Bitcoin price top, but most of them overlook the on-chain fundamentals and growing adoption which doesn’t seem to stop for now. The on-chain suggest that exchange outflows have continued despite the consolidation phase, at the same time more public listed companies keep buying Bitcoin that is only going to deplete the already acute market supply of the top cryptocurrency.

Bitcoin has risen to a new ATH proving those predictions wrong. The rising kimchi premium could be the first bullish indicator for the next leg of the bull run.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand