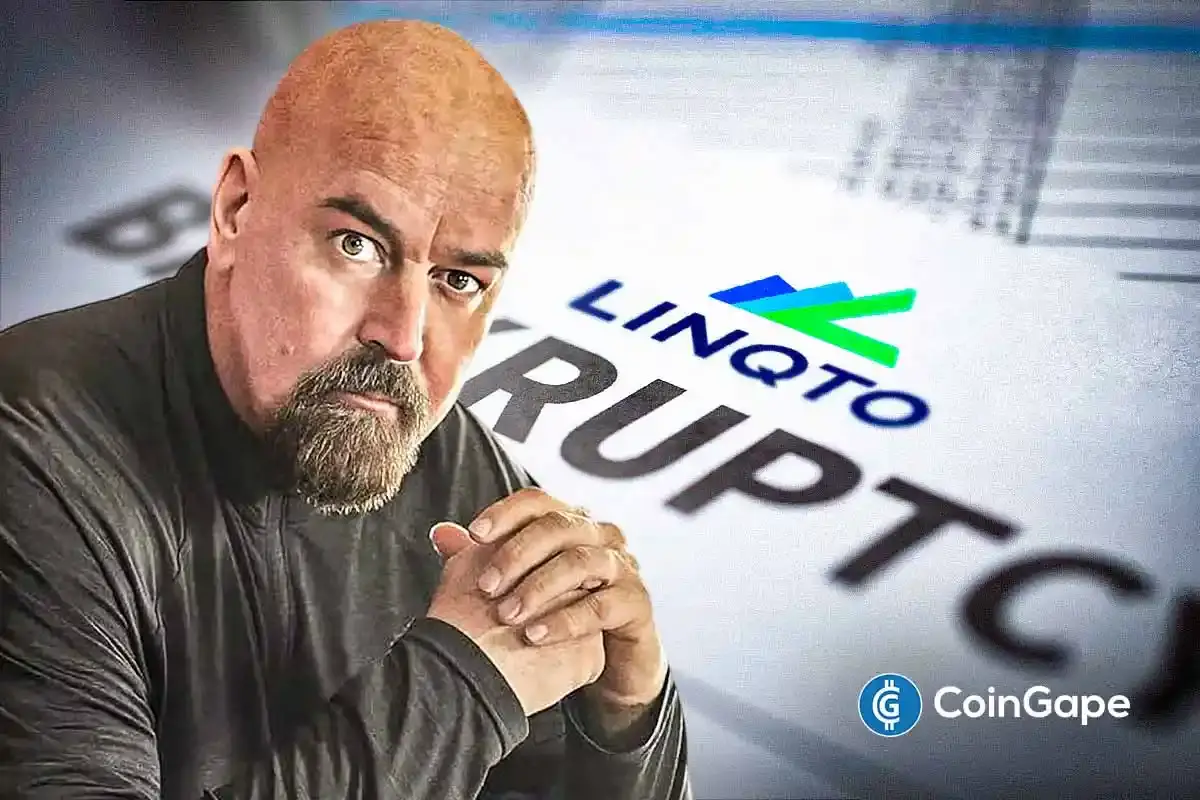

Linqto Bankruptcy: XRP Lawyer Says Customers May Get Full Recovery

Highlights

- John Deaton remains commited to protecting users from losing investments in Linqto.

- Deaton cited the priority for customers.

- The lawyer raised alarms over Linqto’s controversial refund strategy.

XRP lawyer John Deaton has recently shared an optimistic outlook amid the Linqto bankruptcy proceedings. According to Deaton, customers may have priority over equity shareholders, potentially leading to full recovery or significant returns.

Linqto Bankruptcy: Customers at Top Priority

In a recent X post, XRP lawyer John Deaton shed light on the Linqto bankruptcy proceedings, offering a glimmer of hope for customers. Despite Linqto’s financial woes, John Deaton remains hopeful for customers, citing their priority for customers. He stated, “GREAT news is that there are NO CREDITORS in line before Linqto customers.”

Expressing his commitment to protecting customers from losses, Deaton wrote,

Some people have their life savings on the platform and I will do whatever I can to make sure they don’t lose it. In fact, they SHOULD get MORE than the value of their initial investments.

Further, Deaton added that Linqto customers, including 11,500 Ripple SPV unit holders, will be prioritized over Linqto equity shareholders in court. Additionally, the shares of invested companies such as Circle, Ripple, and SpaceX are accounted for. He added that there will be an exception for the 3% of Ripple shares that were sold without customer knowledge; however, the funds from that sale are available.

Moreover, Deaton revealed that six individuals-three former employees and three influencers-claimed to have substantial investments on the platform. They claimed that they were ignorant of the “shenanigans” and the malpractices within the platform that violated the securities laws. He added,

The good news is EVERYTHING will be public and everyone will get to know who invested what and who knew what. Internal emails, emails to third-parties, including related to advertising and marketing can be part of the process.

What Happened to Linqto?

Notably, Linqto, a San Francisco-based investment platform, is on the brink of bankruptcy due to allegations of illegal business practices and securities law violations under former CEO William Sarris. The company, which allowed customers to buy shares in privately held crypto companies like Ripple and Circle through pre-IPO shares, is facing investigations by the SEC and the US DOJ.

Sarris has allegedly sold Ripple shares at a 60% markup without informing customers, resulting in a $2 million profit. However, Ripple CEO Brad Garlinghouse clarified that Linqto acquired 4.7 million Ripple shares from existing shareholders in the secondary market, not directly from Ripple. He emphasized that Ripple has no formal business relationship with Linqto and did not sell any shares to the platform. CTO David Schwartz also provided clarity to the matter, stating, “You don’t own the shares directly, but you own a portion of a legal entity that owns the shares.”

Linqto Refund Strategy Sparks Investor Concerns

Previously, John Deaton raised alarms over Linqto’s controversial refund strategy. He warned investors that they may lose out on significant profits.

Significantly, Linqto’s proposal to refund only the original investment amounts has sparked outrage among investors. Particularly, investors who have invested in assets like Ripple and Circle are panicking, as these shares have seen substantial value increases. Deaton highlighted his own experience, where a $30,000 investment in Circle grew to $157,000, illustrating the potential losses investors may face. This situation has sparked urgent questions about investor rights and protections in the crypto space.

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Epstein File Reveals Crypto Controversy: 2018 Emails Reference Gary Gensler Talks

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?