Little Known DeFi Token OverTakes MakerDAO in MCap, Is YFI Next?

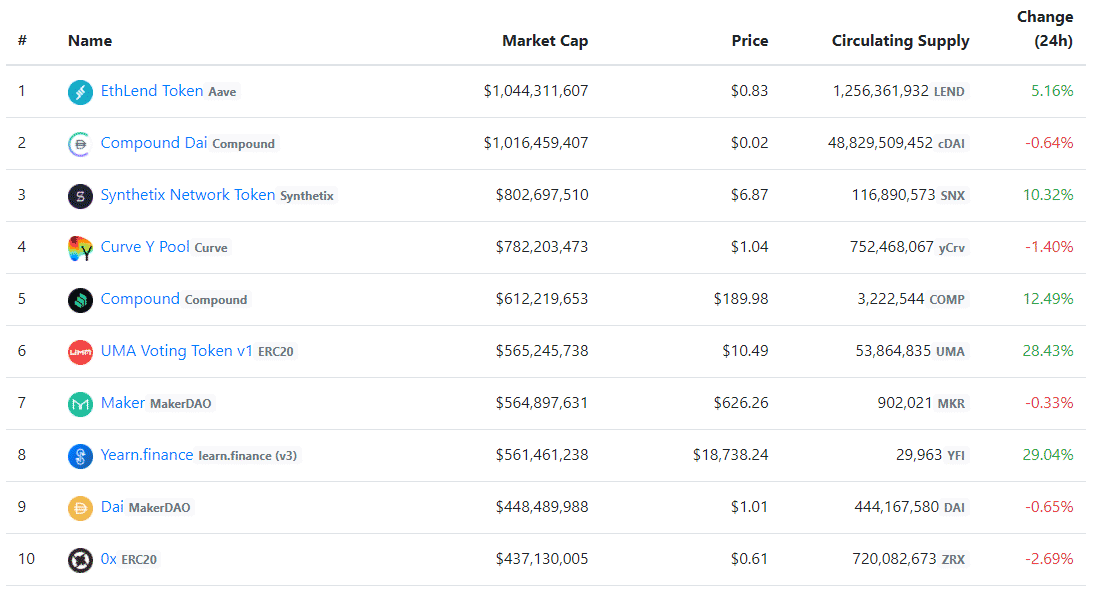

UMA, a platform for creating synthetic financial contracts is quickly rising up the ranks as it’s governance token takes on MakerDAO (a leader before May) in market capitalization. A close second to MakerDAO is yearn.finance’s $YFI token; which is only short $4 million in total market capitalization compared to MakerDAO.

UMA enables synthetic derivative contracts using a priceless financial contract and decentralized oracle mechanism. In the past few days, the APR on UMA’s liquidity pools is ranging somewhere between 70-100%. Clayton Roche, the lead developer of UMA tweeted,

I’m seeing about a 100% APR on UMA’s liquidity mining program. Few understand….. that you can actually earn that with your ETH. Except due to over-collateralization and needing to pair with USDC, you end up with about 25% capital efficiency (thus about 25% apr on ETH.).

Even then, a 25% gain over Ethereum annually is a handsome return which outperforms any staking or mining returns at the moment. The capital gain on the governance token such as $UMA voting token is an added bonus.

DeFi On Cocaine

Apart from UMA, the on-boarding on $YFI on Aave, today, was bullish for both tokens.

Oh my…

…40% LTV…

… $LINK Price feed…

…Few Understand pic.twitter.com/hvbfWnn1rc

— Aave (@AaveAave) August 28, 2020

The other exciting news for DeFi tokens is the widespread listing on Okex Exchange. It lists eight DeFi tokens including the Chinese version of $YFI, $YFII.

Yeaen.finance offers a top liquidity pool aimed to capture the highest returns in DeFi farming. YFI has been on a bullish streak for weeks has now and just surpassed $18,000. The addition of Yearn.finance on Aave is providing a big boost to the pool; it is logging 30% gains on a daily scale.

Moreover, even Curve Y Pool is keeping up with the fast pace as it continually adds new features to its contracts. Just this morning, it added a new “my” option for competitive yield for farmers. Julien Bouteloup, a DeFi expert notes,

the “My” section where you can see if your APY is optimized across all the pools (gov + boost + locks)

Imagine all the computations behind the scenePer pool: – Lowest APY (no boost)

– Highest APY (with optimized 2.5x boost)

– My

These are little known projects which are gaining momentum far too quickly. Moreover, the FOMO and participation are growing by each passing day, even in China. The DeFi space seems to be on a tremendous growth path with growing interest around the world. Dovey Wan, founding partner at Primitive Crypto tweeted on the increasing adoption in China,

the usability dev is happening very fast in China, considering the wechat/ticktock path of adoption as the root of most Chinese consumer internet products you won’t be surprised of this

What are the DeFi tokens in your portfolio currently? Please share your views with us.

- Brian Armstrong Offloads $101M in Coinbase Stock Amid COIN’s Steep Decline

- Strategy CEO Phong Le Unveils Plan to Address MSTR Stock Volatility, Boost BTC Buys

- Cardano Founder Sets March Launch for Midnight as Expert Predicts BTC Shift to Privacy Coins

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates