XRP Price: 7-Month XRP Chart Signals Breakout

Highlights

- Bearish Case: A breakdown below $1.89 could trigger a 44% crash toward $1.05.

- Bullish Case: Rising active addresses and Bitcoin’s strength suggest a fake breakdown and rally to $2+ is possible.

- Investors need to watch for Bitcoin price move & XRP breakout volume for directional bias.

XRP has produced negative closes for the past two weeks, resulting in an 11% loss. This drop brings the token closer to the apex of a seven-month descending triangle pattern, suggesting that the price is coiling up and poised for a breakout. The technical formation forecasts a 44% decline to $1, but several conditions must be met for this theoretical target to be achieved. Will XRP price crash lower or delay the breakout and bounce higher?

This XRP Price Pattern Threatens 44% Crash to $1

XRP price consolidation that began on December 8, 2024, has created four distinct equal lows at $1.89 and three lower highs. Connecting these swing points using trend lines reveals a descending triangle setup. This technical formation forecasts a 44% crash to $1.05, obtained by adding the triangle’s height to the breakout point at $1.89.

Investors should note that the $2 to $1.89 range is a key support zone, as previously highlighted in a CoinGape XRP analysis that outlined key levels to watch.

Confirmation of a breakout will occur if XRP price produces a decisive three-day candlestick close below $1.89. This candlestick close needs to be coupled with high volume. Despite this, XRP may pause around $1.46 to $1.40 due to the orderblock formed in late November 2024. Investors should exercise caution in this area.

Here’s Why XRP May Not Crash Lower

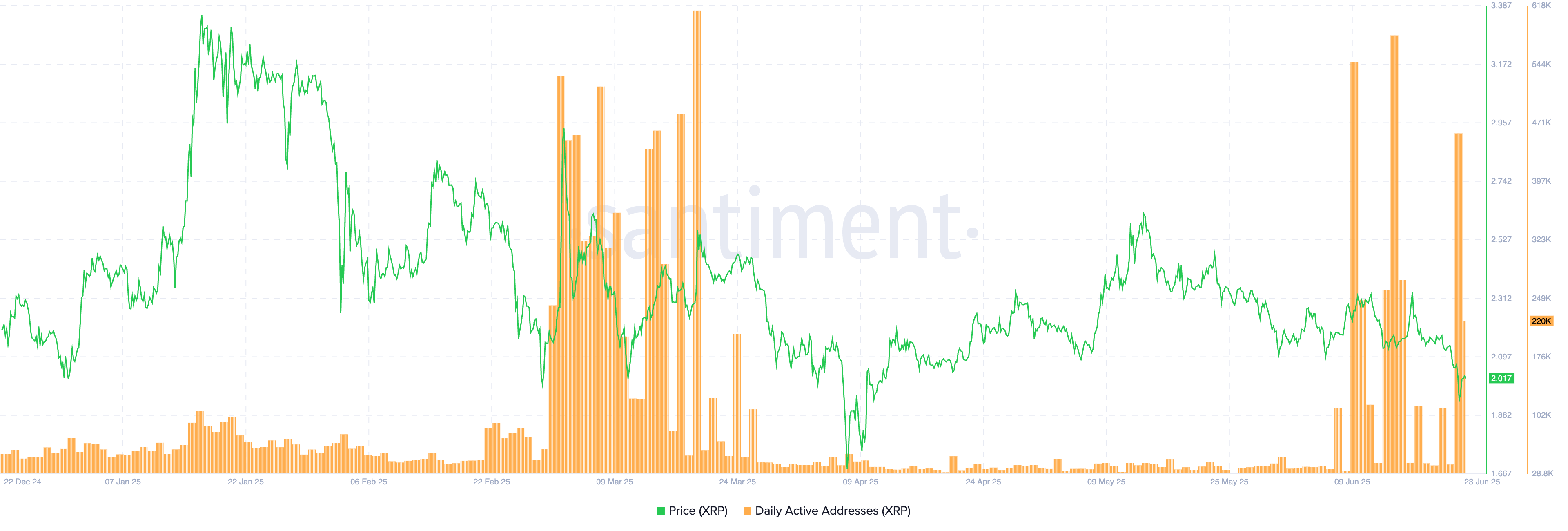

Santiment’s blockchain data shows a spike in Daily Active Addresses (DAA), noting a renewed interest in investors on recent dips. A similar spike in DAA in March 2025 was followed by price dip, but eventually resolved into a 65% rally for the XRP token. If history rhymes, then there may be a fake breakdown of the descending triangle, potentially to revisit $1.46, followed by a bounce to $2 or higher.

Furthermore, the recent crash has pushed Bitcoin price to retest $100,000. A bounce from this key support level is highly likely, especially considering the high timeframe outlook remains bullish. If BTC kickstarts its recovery, the chances of an XRP crash, regardless of the seven-month descending triangle, are highly unlikely.

As noted by CoinGape, the air around the SEC vs. Ripple lawsuit settlement delays till 2026 has been cleared, providing another reason why an XRP price recovery is more likely than a drop here.

To conclude, the outlook for XRP price remains bullish despite the bearish seven-month descending triangle’s 44% crash to $1 predictions. Investors, however, need to exercise caution as BTC sits above $100K, a critical make-or-break hurdle that could decide the fate of the crypto markets.

Frequently Asked Questions (FAQs)

1. Is XRP price about to crash?

2. What could trigger an XRP rally instead?

3. When will the XRP breakout happen?

- Bitcoin Falters as China Pushes Risk-Off, Orders Banks to Sell US Treasuries

- TRX Price Rebounds as Tron’s Treasury Push Gains Backing from Justin Sun

- 3 Reasons Why Bitcoin and Gold Prices Are Going Up Today (Feb 9)

- Why is Crypto Market Up Today (Feb 9)

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5