Algorand Price Discounted 16% Amid Recent Sell-off; Buy This Dip Now?

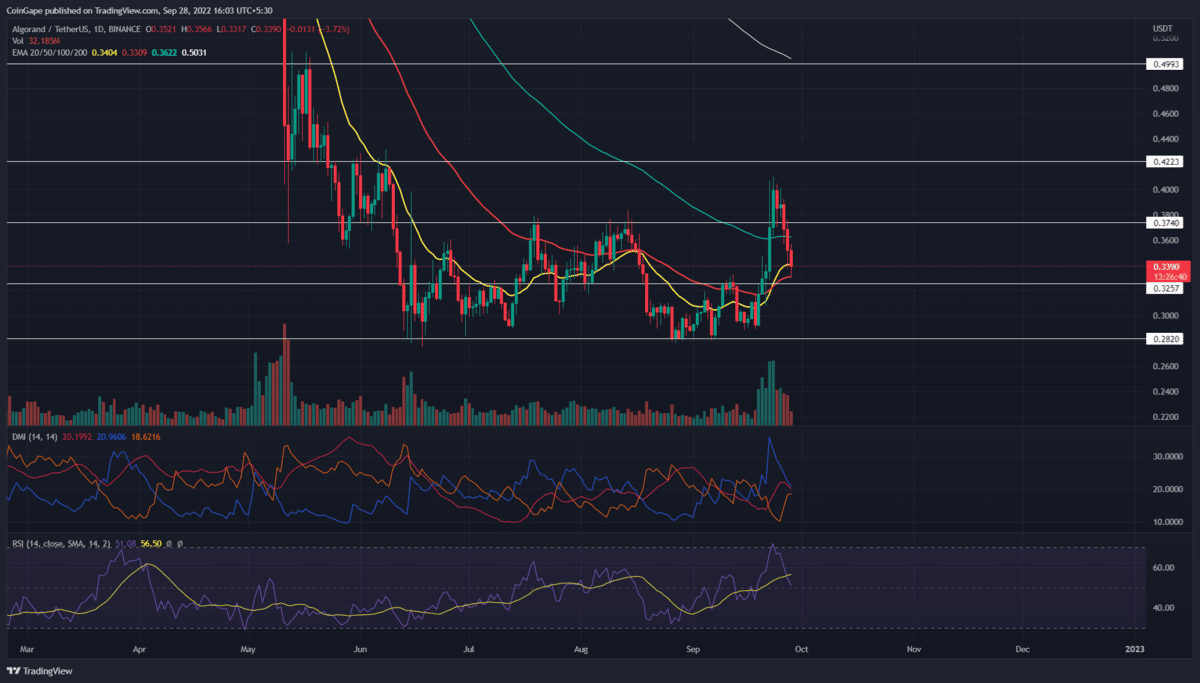

The Algorand price shows a sideways rally over the past three months. During this consolidation, the altcoin rebounded from this support multiple times, validating it as a strong accumulation zone. Furthermore, a recovery rally initiated from this support has witnessed a significant correction and plunged to $0.33 support. Thus, the coin chart displaying a recovery sign at this support should provide a good dip opportunity for traders.

Key points from Algorand price analysis:

- The ALGO holders can see a brighter future if the prices sustain above the 50-day EMA in the coming weeks.

- The long-wick daily candle projects high chances of a bullish reversal.

- The 24-hour trading volume in the Algorang coin is $195 Million, indicating a 5.87% gain.

The Algorand price action showcased a bullish reversal rally failing to sustain above the 100-day EMA due to the increased selling pressure at the $0.40 mark. The bullish failure leads to a price drop of 13% back under the 100-day EMA and the previous consolidation range.

The increase in the intraday trading volume supporting the bearish correction rally endangers the bullish dominance at the 50-day EMA.

However, the lower price rejection in the daily candle implies the correction as the retest to local support of $.33. Hence the price action analysis hints at a post-correction reversal.

The sideline buyers can find entry opportunities at the current prices due to this long-wick candle, taking support at the 50-day EMA, and the declining trend in the trading volume. The reversal rally can reach $0.37, where it will face double opposition from the 100-day EMA and the $0.37 resistance level, which can prove to be a solid roadblock.

Nonetheless, a more encouraging trend can give a bullish breakout entry, prolonging the uptrend to the $0.42 mark.

However, if reversal fails, the Algorand price could eventually lose the 50-day EMA and plummet price to $0.281.

Technical indicators:

DMI- The sharp fall in the Algorand price sabotages the bullish gap in the DI lines leading to a higher possibility of a bearish crossover.

RSI- The daily-RSI slope reverted from the overbought region and witnessed a significant downfall. This retracement indicates the prior aggressive buying has stabilized, and prices can continue their upward march.

- Resistance levels: $0.37 and $0.42

- Support levels: $0.33 and $0.28

Recent Posts

- Price Analysis

Cardano Price Outlook: Will the NIGHT Token Demand Surge Trigger a Rebound?

Cardano price has entered a decisive phase as NIGHT token liquidity rotation intersects with structural…

- Price Analysis

Will Bitcoin Price Crash to $74K as Japan Eyes Rate Hike on December 19?

Bitcoin price continues to weaken after breaking below its recent consolidation range, now trading within…

- Price Analysis

Bitwise Predicts Solana Price Will Hit New All-Time Highs in 2026

Solana price declined by 4% over the past 24 hours, breaking below the key $130…

- Price Analysis

Bitcoin Price Outlook: Capriole Founder Warns of a Drop Below $50K by 2028

Bitcoin price narratives continue to evolve as long-term downside risks regain attention. Bitcoin price discussions…

- Price Analysis

XRP Price Rare Pattern Points to a Surge to $3 as ETFs Cross $1B Milestone

XRP price dropped by 1.2% today, Dec. 17, continuing a downward trend that started in…

- Price Analysis

DOGE Whales Add 138M Coins in 24 Hours: Will Dogecoin Price Rebound Above $0.15?

Dogecoin price traded at $0.1304 on Tuesday, up 1.39% in the last 24 hours.…