Bitcoin Price Could Drop to $92K as Analyst Warns Amid $2B ETF Outflows

Highlights

- Analyst expects the Bitcoin price to retest the $92K–$93K zone before a rebound.

- Over $2 billion exits U.S. spot Bitcoin ETFs, signaling weaker institutional sentiment.

- Government shutdown and corporate BTC sales intensify caution across crypto markets.

Since the start of November, the Bitcoin price has struggled to maintain stability above the $103,000 mark. The sentiment remains fragile after an analyst projected that Bitcoin could fill the CME gap near $92,000 before any sustainable rebound. Meanwhile, U.S. spot Bitcoin ETFs recorded over $2 billion in outflows, marking one of the worst redemption streaks on record. This combination of technical weakness and capital flight has increased the risk of another sharp correction.

Analysts Expect a Deeper Pullback for Bitcoin Price

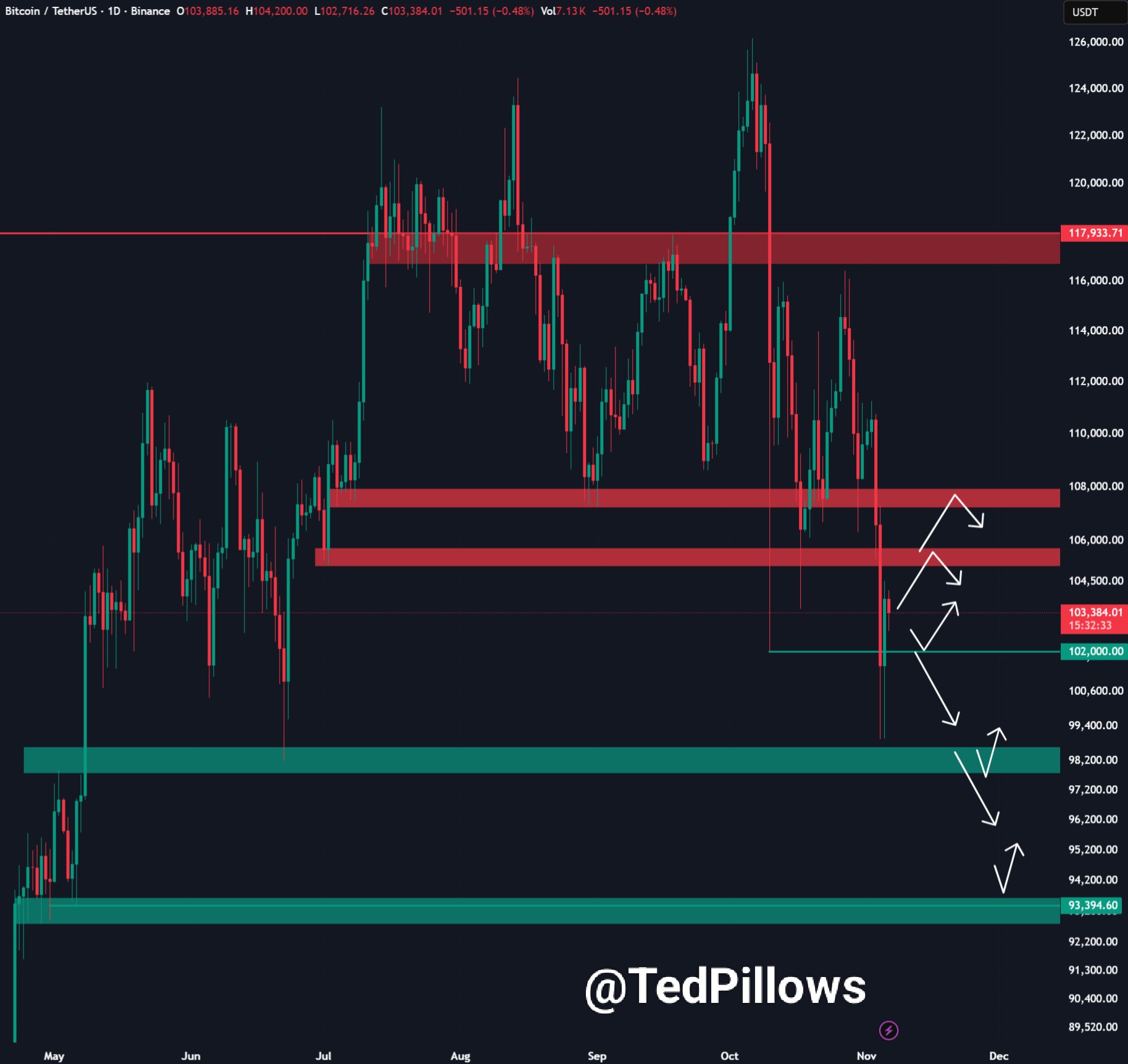

Analyst Ted Pillows emphasized that Bitcoin remains in a vulnerable state after reclaiming the $103,000 level. At the time of press, Bitcoin value traded at $102,910.82, holding just above a fragile floor.

Notably, the repeated rejections between $102K and $95K indicate weakening buying strength, suggesting that sellers still dominate near key resistance zones. Ted highlighted the unfilled CME gap near $92,000 as a likely target, where price could rebalance liquidity before any reversal.

He noted that such retests are not uncommon during cooling phases, which help flush excessive leverage and reset investor expectations.However, this deeper pullback might serve as the last leg before renewed accumulation begins.

Additionally, another market expert echoed similar views, projecting that Bitcoin could retest the $92K–$93K range before a stronger recovery unfolds. His broader analysis points to a Wyckoff-style accumulation pattern with one more downward phase to complete.

The analyst notes that Bitcoin continues to respect the ascending macro channel formed after the 2024 bottom, implying that this retracement could be a controlled reset rather than a breakdown. He believes that panic-driven selling near $93K would likely mark a key emotional turning point for the market.

Once selling pressure fades, the analyst expects Bitcoin to regain strength and reclaim $110K as confidence gradually rebuilds. Ultimately, this corrective phase fits within a long-term BTC price outlook that envisions a healthier, longer-term continuation of the current bullish cycle.

Institutional Outflows Mount as $2B Leaves Bitcoin ETFs

The U.S. spot Bitcoin ETFs have seen over $2 billion withdrawn within six consecutive trading days, marking their second-worst outflow streak in history. Data from Farside showed that withdrawals began on October 29, accelerating sharply during the first week of November.

Notably, Tuesday alone saw more than $566 million pulled, following sessions of $470 million, $488 million, and $191 million. Analysts attribute this exodus to growing caution among institutions as volatility persists and liquidity tightens.

The pressure has intensified further as the U.S. government shutdown continues, raising concerns about delayed economic data and fiscal disruptions. Meanwhile, Sequans Communications reportedly sold 970 BTC, trimming its holdings to 2,264 BTC amid rising market uncertainty.

Although Solana ETFs recorded seven straight days of inflows, Bitcoin and Ether funds continue to bleed. These redemptions highlight fragile confidence, keeping the Bitcoin price vulnerable until institutional inflows return.

Cautious Path Ahead

The combination of heavy ETF withdrawals and aligned analyst projections reinforces a cautious near-term outlook. Both experts foresee a retest of the $92K–$93K zone before Bitcoin begins its next rally phase. While short-term sentiment remains fragile, their analysis implies the pullback may serve as a reset rather than a collapse.

Frequently Asked Questions (FAQs)

1. How do analysts interpret the current market cycle?

2. What could trigger the Bitcoin pullback analysts anticipate?

3. Why are U.S. Bitcoin ETFs facing heavy outflows?

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week