Bitcoin, Ethereum Price Prediction- Here’s How They Could Escape Stagnant Market Condition

Bitcoin, Ethereum price prediction: The stagnant movement in BTC and ETH prices has limited growth opportunities in the majority of altcoins. However, the market leaders continuing to walk a sideway rally has also created a narrow range in both coins. This range formation offers a trading opportunity of its own and a suitable target in the near term.

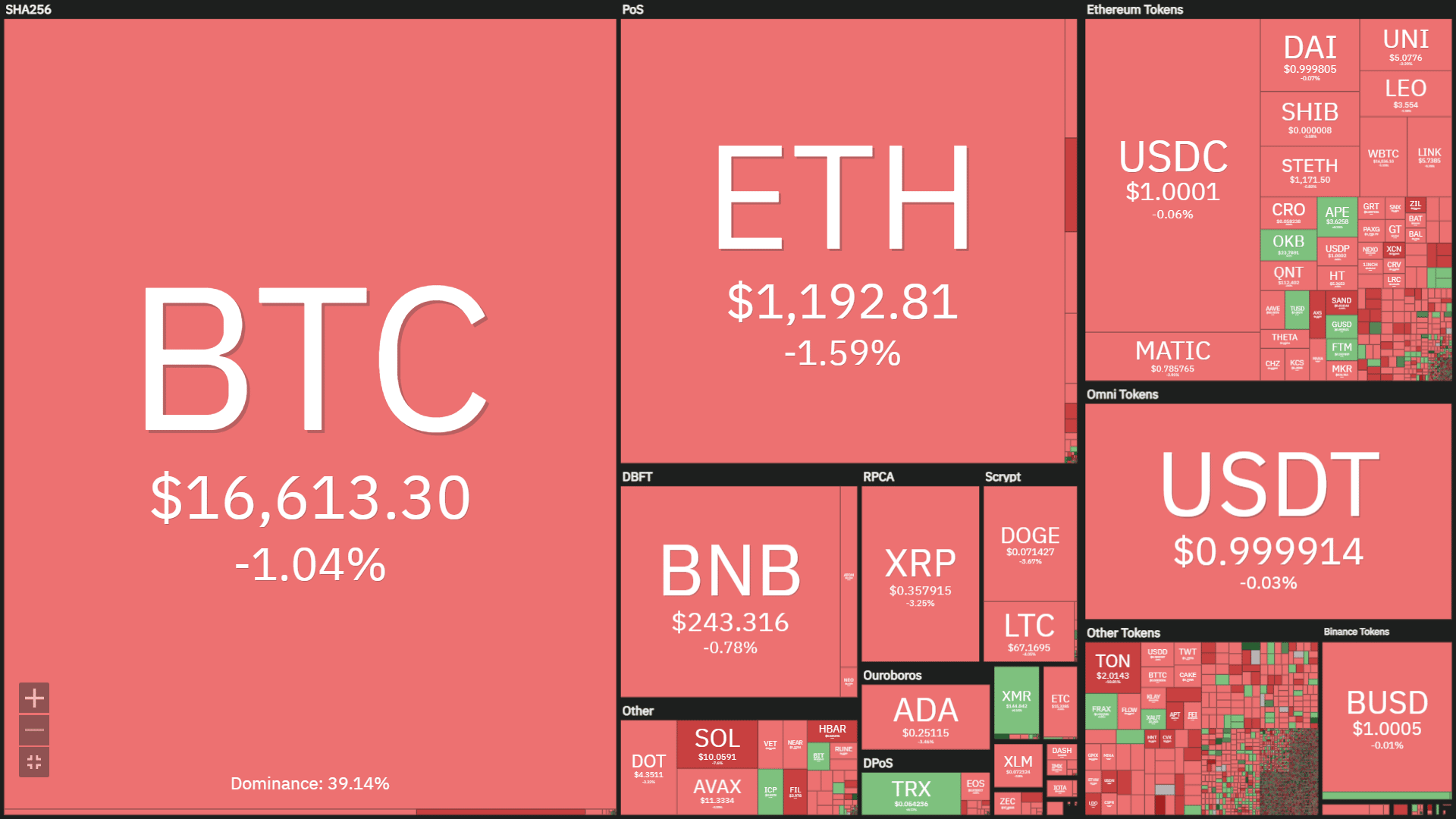

Top Gainers and Losers

While the market shows a bearish outlook, the Internet Computer and BitDAO token is one of the few from the top 100 cryptocurrencies that have gained in the last 24 hours. Thus, the ICP price trades at $3.92 with an intraday gain of 1.41%, whereas the BIT price trades at $0.2828, gaining 0.72%. On the other hand, Chain and Terra Classic tokens show the highest loss, where the XCN price is down 12.47% to trade at $0.01299, and LUNC price is 11.91% down to $0.0001557.

Bitcoin

Over the past two months, the Bitcoin price has been wobbling between $16900 and $16200. The multiple short-body candles with long wicks on both sides indicate the market’s participant struggles with indecisiveness.

Thus, Bitcoin price can be considered to be trading in a narrow range, whose breakout will release a directional rally. Moreover, with the increasing uncertainty in the market, traders should avoid entering while this no-trading zone is intact.

Thus, a possible bullish breakout from $16900 will accelerate the bullish momentum and surge the prices to the $18400 mark.

Conversely, a daily candle closing below $16200 may prolong the bearish fall to $15600.

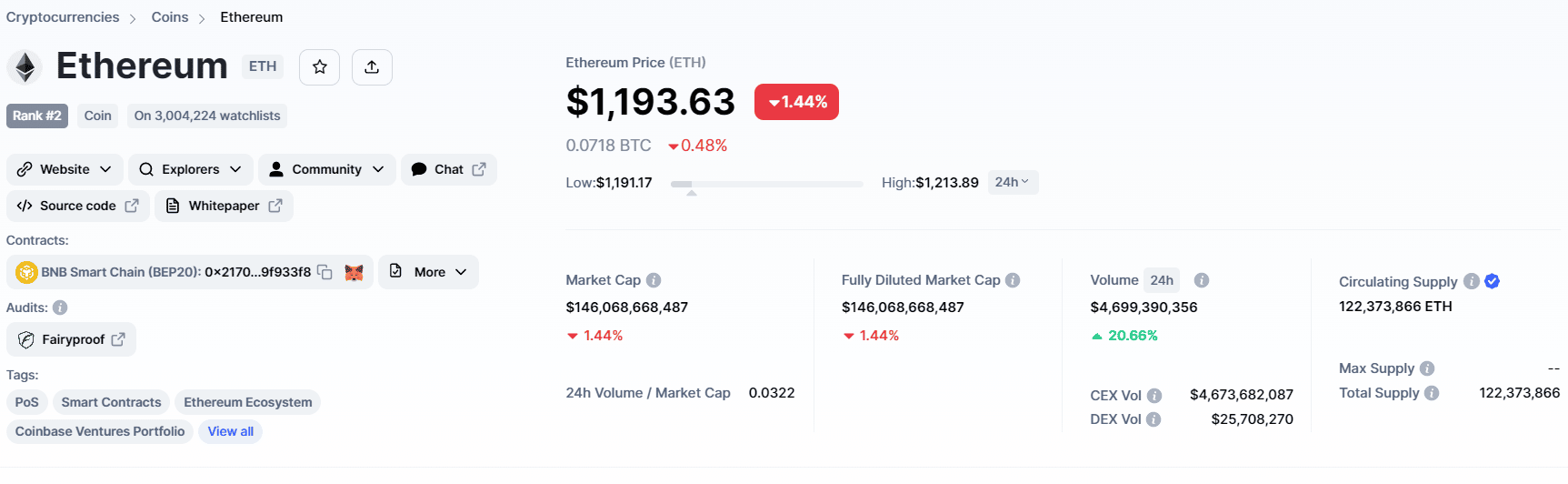

Ethereum

Similar to Bitcoin, the Ethereum price has resonated between the $1230 and $1160 levels for the past two weeks. During this consolidation, the price showcased multiple attempts to breach the overhead resistance but failed to sustain higher prices.

Thus, either side breakout from this range will bring a sustained rally in this coin price. However, on December 27th, the ETH price turned down from the $1230 resistance and tumbled 3.5% in the last two days.

If the selling pressure persists, the price will try to pierce the local support of $1160.

Anyways, a parallel channel pattern is currently governing the ongoing downtrend in Ethereum price.

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Michael Saylor Says Strategy Won’t Sell Bitcoin Despite Unrealized Loss, Will Keep Buying Every Quarter

- BlackRock Bitcoin ETF (IBIT) Options Data Signals Rising Interest in BTC Over Gold Now

- XRP and RLUSD Holders to Access Treasury Yields as Institutional-Grade Products Expand on XRPL

- Prediction Market News: Polymarket to Offer Attention Markets Amid Regulatory Crackdown

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?