Bitcoin, Ethereum Price Prediction- Why the Bullish Recovery Has Stalled?

Bitcoin, Ethereum price prediction: The ongoing recovery in the crypto market has taken a halt since last weekend. The market leader showed higher price rejection on their daily chart, indicating the formation of a local top. However, the possibility for temporary correction is high as the excess buying need to stabilize.

Furthermore, the global crypto market cap stands at $979.20 Billion, gaining 1.13% since yesterday. Moreover, the total crypto market volume dropped 30.5% to reach the 39.3% Billion mark.

Top Gainers and Losers

Among the top 100 cryptocurrencies by market cap, the Nexo and Synthetix tokens are the highest gainers, in which NEXO price surged 18.07% to hit the $0.8467 mark, while SNX price rose 12.46% to $2.37. On the other hand, Casper and Decentraland Tokens are the top losers, with the CSPR price 1.85% down to $0.03586, whereas the MANA price tumbled 1.53% to reach the $0.6302 mark.

Bitcoin

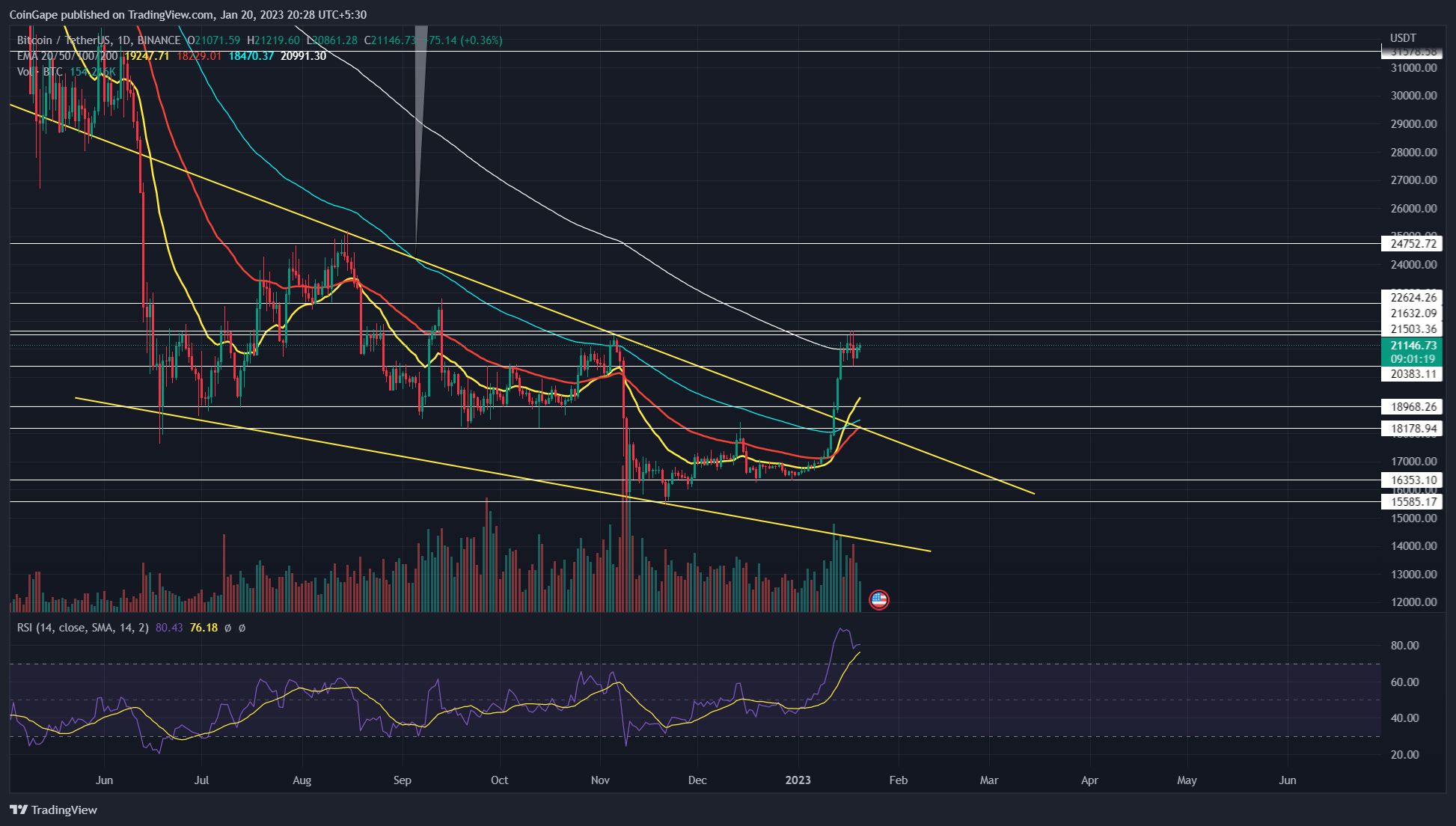

Following a remarkable bull run in the first two weeks of 2023, the Bitcoin price registered 30% growth and reached $21600. However, over the last few days, the daily chart showcased several higher price rejection candles at the mentioned level, indicating the exhausted bullish momentum.

Anyhow, a minor correction will be beneficial for Bitcoin as it will stabilize the excessive buying activity and validate whether the buyers can sustain higher levels.

Also Read: CRYPTO TELEGRAM CHANNELS LIST 2023

If the coin forms a local top at the $21600 mark, the potential retracement can tumble the prices 10-14% down to revisit the $19000 or $18200 level, respectively.

Interested buyers could enter at this pullback opportunity or wait for $21600 to add additional coins.

Ethereum

Amid the recent recovery in the crypto market, the Ethereum price gave a massive breakout from the combined resistance of $1500 and 20-day EMA. Thus, similar aforementioned Bitcoin price analysis, the ETH chart shows higher price rejection near the $1600 mark, indicating the profit booking from temporary traders.

As a result, the altcoin may witness a short-term consolidation above at retracement to neutralize the aggressive buying.

The recently reclaimed $1500 mark should switch to strong support and assist buyers in sustaining higher levels.

Thus, interested traders can grab entry opportunities near the $1500 mark or at $1420 local support in case of a deeper correction.

- U.S. Banks May Soon Issue Stablecoins as FDIC Proposes GENIUS Act Framework

- Breaking: U.S. SEC Ends Four-Year Investigation Into Aave Amid Ongoing DAO Saga

- Breaking: U.S. Jobs Data Comes In Above Expectations, Bitcoin Price Rises

- Bitcoin Risks Deeper Fall on $20 Billion Crypto Hedge Fund Redemptions

- Crypto Attack of the Century? Solana Network Resists Historic DDoS With Zero Downtime

- Pi Network Stares at a 20% Crash as Whale Buying Pauses and Demand Dries

- Here’s How Dogecoin Price Could Rise After Crossing $0.20

- Is XRP Price Headed for $1.5 as Whales Dump 1.18B XRP in Just Four Weeks?

- Bitcoin Price Weekly Forecast as Gold’s Surge Revives Inverse Correlation — Is $85K Next?

- Ethereum Price Risks $2,600 Drop Despite JPMorgan’s New Fund on its Network

- Analyst Confirm Pi Network Price Could Still Reach $1, Here’s When?