Bitcoin Price Analysis: BTC Trades Below 50-day EMA; More Downside In Offer?

Bitcoin price analysis indicates bearishness in today’s session. As the price fell below the $23,000 mark, the price is trading with lackluster motion due to a lack of volatility. The total crypto market cap moved above $1 Trillion according to the CoinMarketCap.

- BTC’s price fell for the fifth straight session after a weak start to the new series.

- A fall below the 50-day EMA signifies the continuation of the downside movement.

- A daily candlestick above $23, 500 would invalidate any bearish argument.

As of writing, the largest cryptocurrency by market cap is trading at $$22,980, down 1.39% for the day. The 24-hour trading volume rose more than 14% to $27,438,288,578. It is a bearish sign.

BTC price extends downside momentum

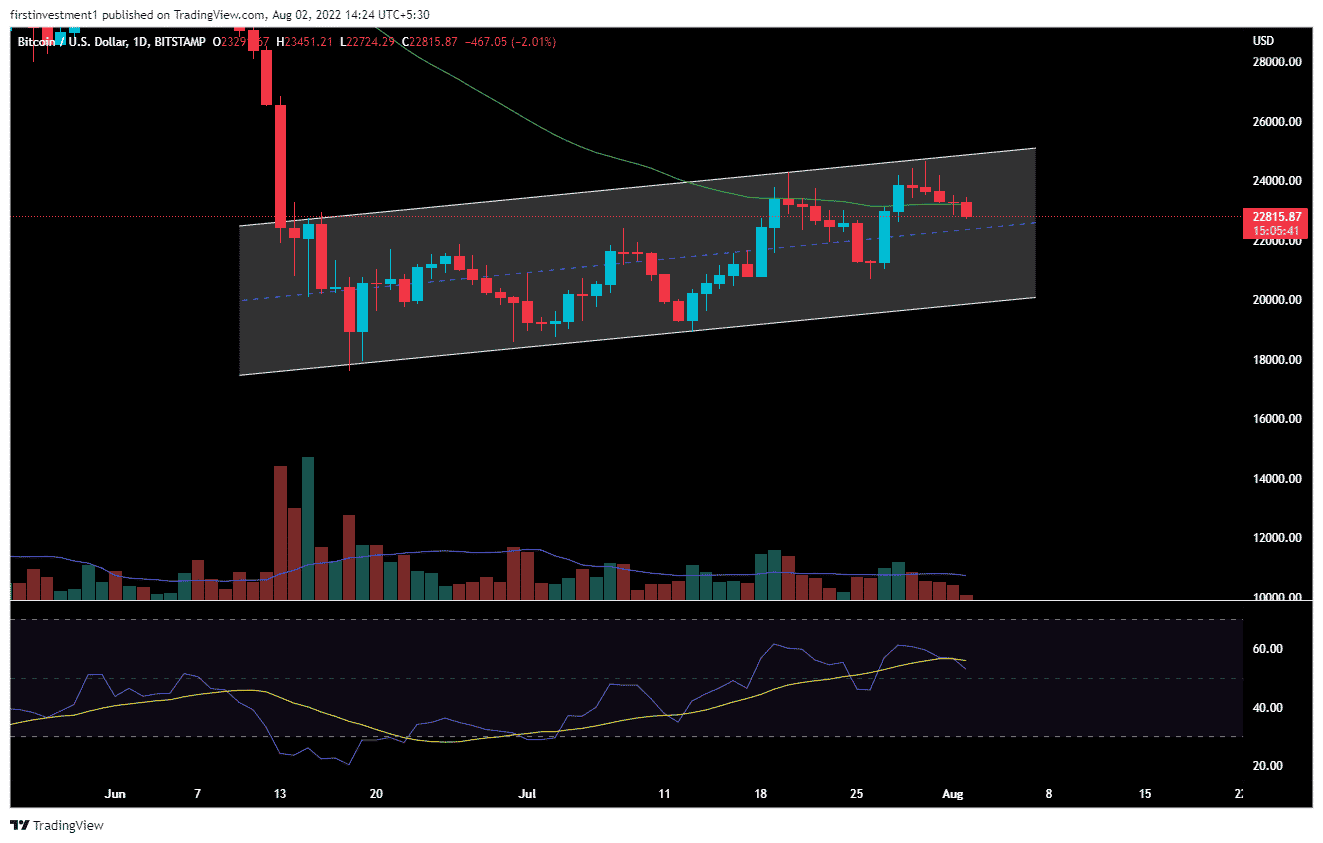

BTC price is trading in a rising wedge pattern, a bearish continuation pattern. Currently, the price faces rejection near the higher levels around $23,850.Earlier, the price moved and closed above the 50-day moving average, but couldn’t sustain above and now started to fall below with a bearish candle. The volumes are also below average indicating that the price might ignore any bullish sentiment as of now.

A daily close below the critical $22,000 level would bring more losses to the coin. On moving lower, BTC sellers would target the low of July 27 at $21,045. Further, if the price is not able to sustain the mentioned level then it might ends up in trend reversal.

The daily chart shows BTC’s price faces a strong resistance hurdle from $23,230 to $23,350.

The RSI(14) breached below the midline with a bearish bias. Currently, it reads at 58.

Lack of volume and volatility shows that the large players are not active in the market. The BTC/USD pair is unable to breach the $24,000 barrier.

1-hour chart forms a bearish pattern

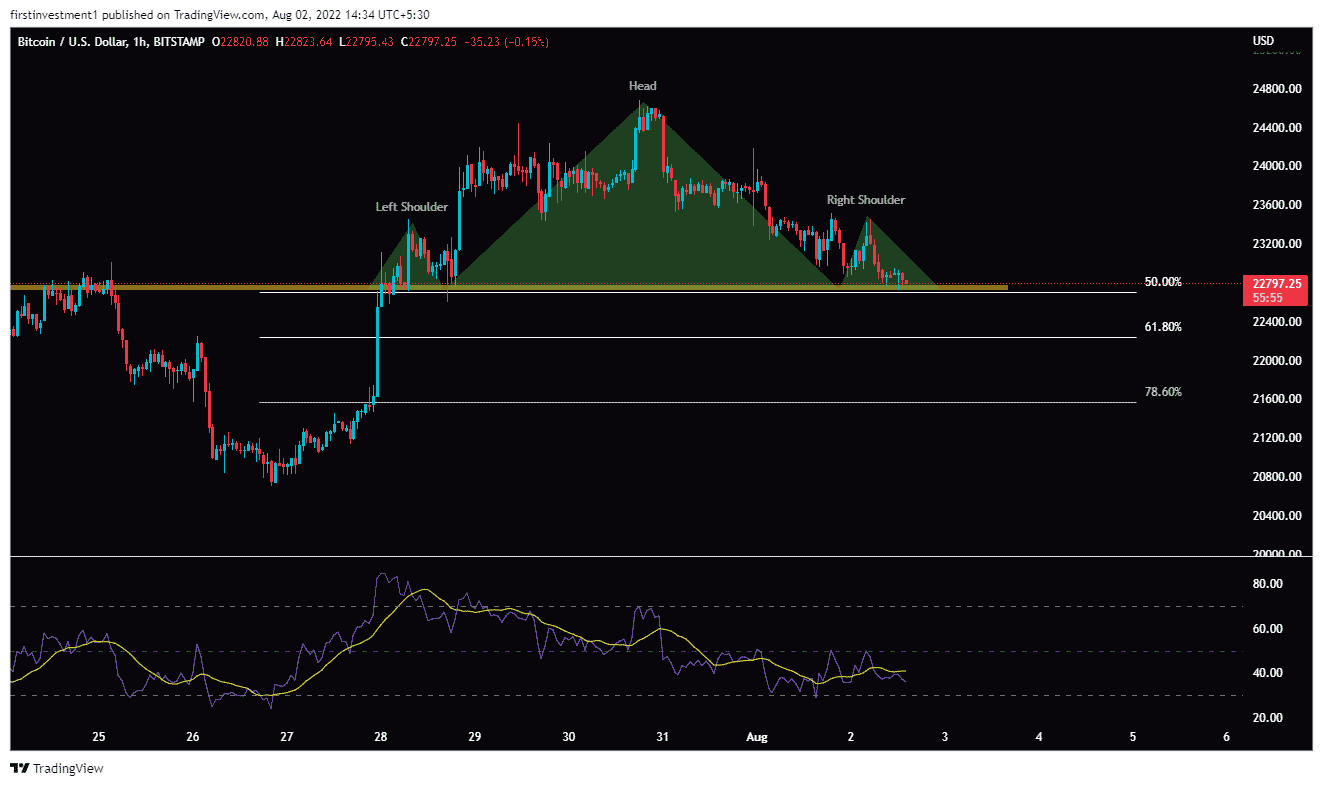

On the hourly time frame, the price formed a ‘Head & Shoulder’ pattern, indicating bearishness. According to this pattern, if the price descends below $22,600, then we can expect a further fall in the price. BTC price can test $22,400 followed by $22,000.

On the other hand, a break above the $23,500 level could invalidate the bearish outlook. This would mean the emergence of buying near the lower level and would aim for $24,000. The buying could motivate the BTC buyers to take out the $22,500 mark.

Conclusion:

Bitcoin price analysis shows that the price is bearish in all time frames. Any uptick in the price could be capitalized to initiate a short position at least in the short term.

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Stripe Eyes PayPal Acquisition Amid Stablecoin Expansion

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card