Bitcoin Price Crash Likely as Bollinger Band Creator Signals End of Rally Phase

Highlights

- A bearish pattern identified by John Bollinger on the BTC/USD chart could signal the "end of rally phase" for Bitcoin price.

- Bitcoin's 30-day implied volatility has hit an 11-month low, indicating reduced expectations for significant price swings.

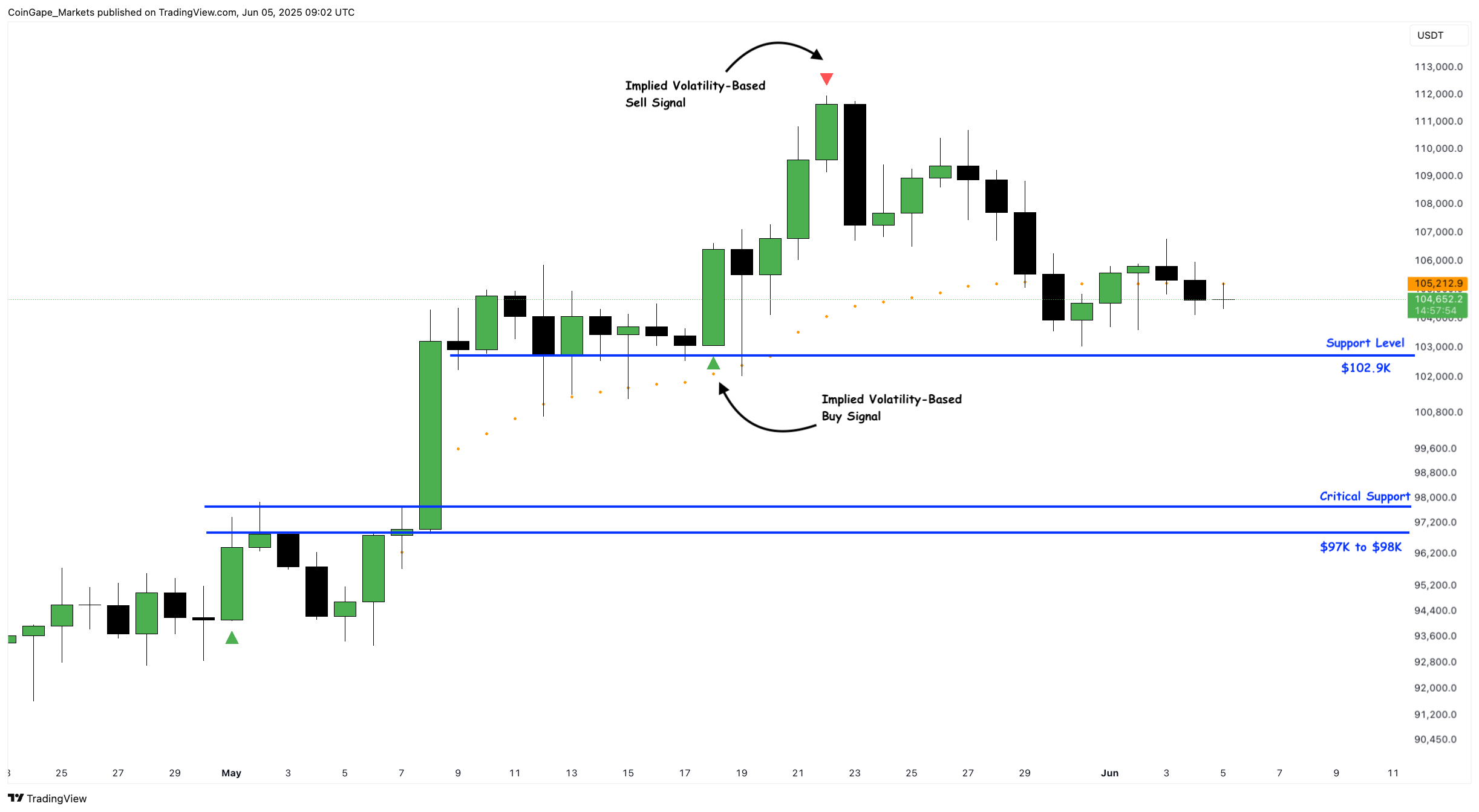

- A breakdown of the $102.9K support level could trigger a 4-6% crash to the $97K-$98K support zone.

Is a Bitcoin price crash brewing? As of June 4, 2025, investors could be bracing for a potential downturn as key sell signals emerge. Bollinger Bands creator John Bollinger identified a bearish pattern on the BTC/USD chart that could hint at the “end of rally phase” for BTC price. To make matters worse, Bitcoin’s collapsing 30-day implied volatility (IV), CME futures and options open interest warn confidence among sophisticated investors, raising concerns about a potential Bitcoin price correction.

Bollinger Bands Point to a Bearish Shift

John Bollinger, the renowned technical analyst behind Bollinger Bands, flagged a critical pattern in his Bitcoin price analysis posted to Twitter on June 4. He noted a “Three Pushes to a High” formation on the BTC/USD daily chart, where BTC price hit the upper Bollinger Band three times. This pattern typically signals the “end of rally phase”, indicating that Bitcoin’s bullish momentum may be fading. Repeated touches of the upper band often suggest overbought conditions. Failed breakout attempts further highlight the lack of buying pressure.

A picture perfect 'Three Pushes to a High' Bollinger Band Pattern marked the end of this rally phase for $BTCUSD. https://t.co/KZ3GWr7a2o

— John Bollinger (@bbands) June 4, 2025

Since May 23, Bitcoin price has crashed 6.54% and is currently sitting above $104K support. If momentum weakens, traders can expect a retest of $102,420, which is the lower Bollinger Band. A breakdown of this level suggests a shift in sentiment favoring bears. Hence, investors must exercise caution as noted by Bollinger’s bearish Bitcoin price prediction for June 2025.

Implied Volatility Crash Signals Reduced Activity

Bitcoin’s price faces further headwinds in terms of declining 30-day implied volatility (IV) hitting an 11-month low as of June 3, 2025. This drop in IV signals reduced expectations for significant price swings. Coupled with muted CME futures and options interests, the outlook for BTC remains uncertain, with sophisticated traders playing it safe.

- CME futures open interest dropped from $17.51 billion to $15.69 billion between May 29 and June 3, 2025.

- CME options open interest fell from $4.74 billion to $3.04 billion.

- The annualized basis also declined from 9.18% on May 2 to 6.29% on June 2, 2025.

A lower basis indicates reduced profitability for holding futures compared to spot Bitcoin, often a sign that sophisticated investors are scaling back. This could be driven by uncertainty around macroeconomic policies or a recent shift in institutional interest toward Ethereum (ETH). BlackRock’s recent ETH purchase after selling BTC holdings is the best example.

Additionally, Abraxas Capital withdrew 13,771 ETH worth $36.4M and the current price of $2,500 from Binance over the past 12 hours. With other whales also transferring ETH to cold wallets. This pivot also explains the recent drop in IV and the potential Bitcoin crash outlook as well.

Bitcoin Price Analysis: Key Levels to Watch

The daily Bitcoin price chart shows three lower highs formed since the ATH at $112K. A breakdown of the $102.9K support level will flip the high-timeframe market structure bearish. Such a development could trigger a crash to $101K or the $100K psychological level.

A look at the four-hour BTCUSD chart shows a string of higher highs and higher lows since the May 31 swing low of $103,032.

Currently, the BTC price trades at $104,629 after bouncing from the $104,274 support level. If the bullish market structure retains, investors can expect a short-term bounce to the next key hurdle at $107,782.

A breakdown of the $102.9K support level could catalyze a 4% to 6% crash to the $97K to $98K support zone. This area is critical as it could attract a lot of sidelined buyers to purchase BTC below $100K.

For a long-term price prediction of Bitcoin for 2025: Read This

Conclusion

The Bitcoin price is at a crossroads, with John Bollinger’s ‘end of rally phase’ signal, a sharp implied volatility crash, and reduced CME futures activity pointing to a potential Bitcoin price crash in June 2025. Traders should focus on key support and resistance levels while maintaining disciplined risk management. Although a bullish reversal remains possible, the current technical and market signals suggest a bearish tilt, urging caution in the crypto market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the "Three Pushes to a High" formation?

2. What does the decline in implied volatility indicate?

3. What are the key levels to watch for Bitcoin price?

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs