Bitcoin Price: How Low BTC Could Fall by the End of 2025?

Highlights

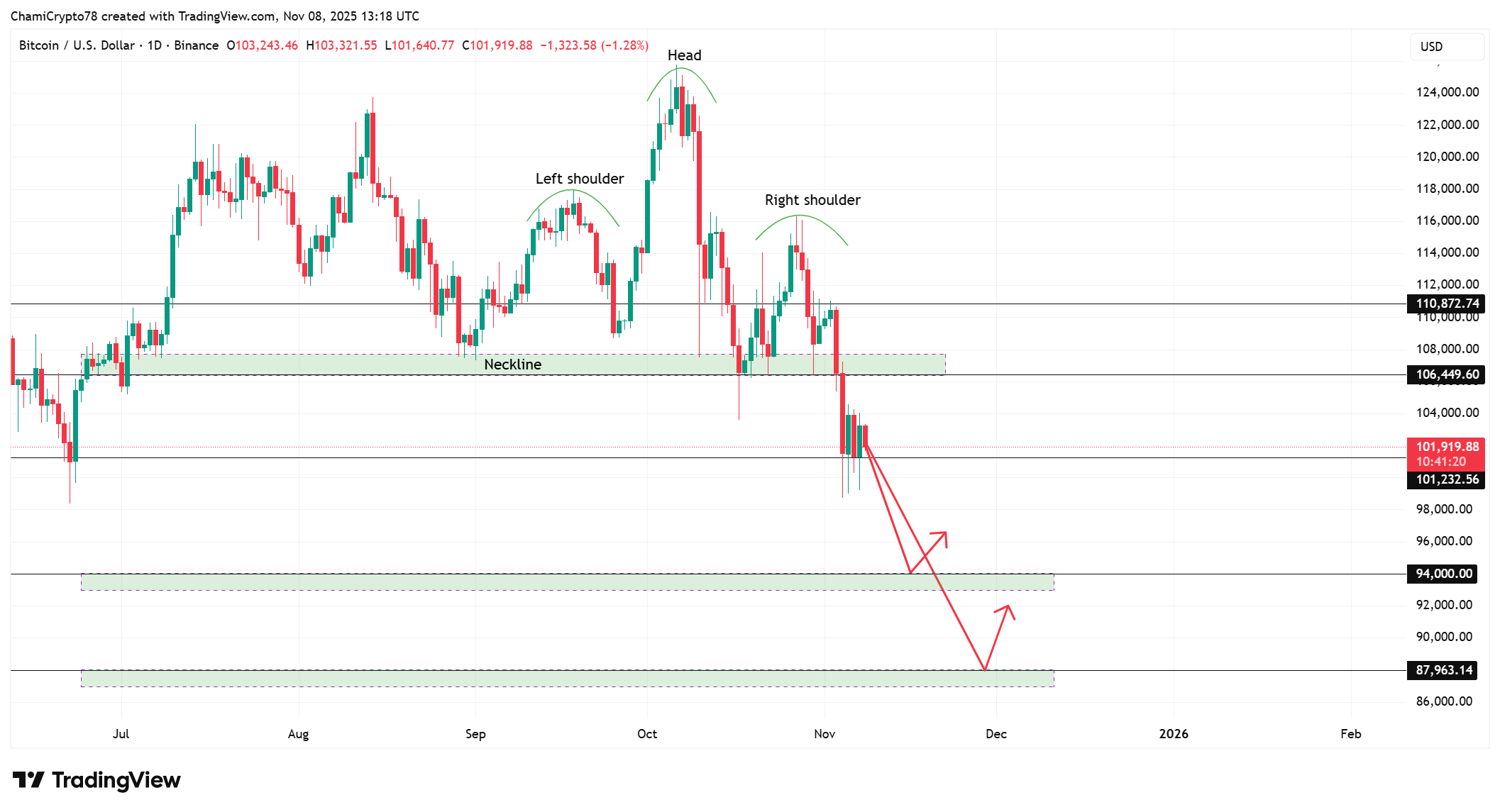

- Bitcoin confirms a bearish head-and-shoulders breakdown, signaling growing weakness below $103K.

- he approaching death cross reinforces downside risk as moving averages tighten near $110K.

- Analyst warns that failure to hold $98K could trigger cascading liquidations before any rebound.

Crypto treasury firms holding Bitcoin, Ethereum, and XRP are recording steep unrealized losses following the latest market downturn. The correction has erased billions from balance sheets of companies that invested heavily in digital assets, exposing the volatility risks of holding crypto as a treasury reserve. Throughout October, market valuations fell sharply, triggering renewed caution among institutional players.

This shift in sentiment has now spilled over into the broader market, with Bitcoin emerging as the key sentiment driver. As major firms weigh whether to hold or reduce exposure, the Bitcoin price prediction for the coming months hinges on whether bulls can reclaim control or risk deeper declines below the $98,000 mark.

Bitcoin Price Action Suggests Further Weakness Ahead

The current Bitcoin value sits at $101,971, showing continued struggle to hold above key technical thresholds after breaking from its multi-month structure. A clear head-and-shoulders pattern has developed since early October, marking a significant shift in market control.

The left shoulder formed as prices failed near $110,000, while the head extended toward $114,000 before sellers forced a sharp reversal. By November 4, Bitcoin breached its neckline following a 5% drop, confirming a bearish continuation pattern.

This technical breakdown signals that downward pressure may persist, especially as buyers fail to defend upper support zones. If the Bitcoin value remains below $103,000, the next likely targets sit near $94,000 and potentially $87,000, two regions that previously acted as major accumulation points.

However, short-term rebounds near these zones remain possible as bargain buyers step in, attempting to absorb ongoing sell pressure and stabilize the BTC coin price temporarily.

Death Cross Signal Adds Pressure on BTC

The looming death cross on the daily chart continues to strengthen the bearish tone surrounding the Bitcoin price. The 50-day moving average keeps edging lower, closing in on the 200-day line near $110,200 — a formation that often signals deeper corrections ahead.

Repeated rejections above the 50-day average highlight weakening buying conviction as short rallies face quick sell-offs.

Meanwhile, macroeconomic stress adds to the pressure. Bitcoin and Ethereum continue to slide as the U.S. government shutdown drags on, shaking investor confidence across both traditional and crypto markets.

With sentiment deteriorating, the BTC coin price risks another drop toward the $98,000–$94,000 range before any sustainable recovery attempt unfolds. Therefore, traders remain alert as each daily close near these levels grows increasingly critical.

Analyst Warns of Breakdown Toward $98K Before Stability Returns

According to a market analyst, Crypto King, the market’s recent drop toward $100,000 marks the start of a potentially deeper correction phase. The analyst highlights that increasing manipulation by large players and liquidity flushes continue to distort short-term trends.

He warns that if Bitcoin fails to hold above the $98,000 level, a cascading effect of liquidations could drive the BTC coin price sharply lower, possibly toward mid-$90,000 zones.

The expert adds that this breakdown reflects exhaustion among retail buyers and fading optimism following the failed push past $110,000. However, the expert remains cautiously optimistic about the BTC’s long-term price forecast, noting that cyclical corrections have historically preceded strong accumulation stages.

He emphasizes that patience and disciplined buying at deeper supports often set the foundation for recovery once volatility cools. Still, for now, his stance remains bearish, expecting additional weakness before the next sustainable uptrend begins.

To sum up, Bitcoin stands at a defining moment as technical and sentiment-driven pressures align. The head-and-shoulders breakdown and upcoming death cross strengthen the short-term bearish bias. However, deeper corrections could also create entry points for strategic accumulation, consistent with long-term cycle behavior. For now, the Bitcoin price outlook hinges on whether bulls can defend the $98,000 level or face a sharper slide toward $87,000 before recovery begins.

Frequently Asked Questions (FAQs)

1. What does the head-and-shoulders pattern indicate for Bitcoin?

2. Why is the death cross important in this context?

3. How does institutional activity affect current Bitcoin market behavior?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral