Bitcoin Price Prediction as Fed Decision Nears — Dump Before the Next Rally?

Highlights

- Bitcoin price could correct toward $104K or $92K before reversal.

- Trump suggests deeper cuts of up to 100 bps to boost the economy.

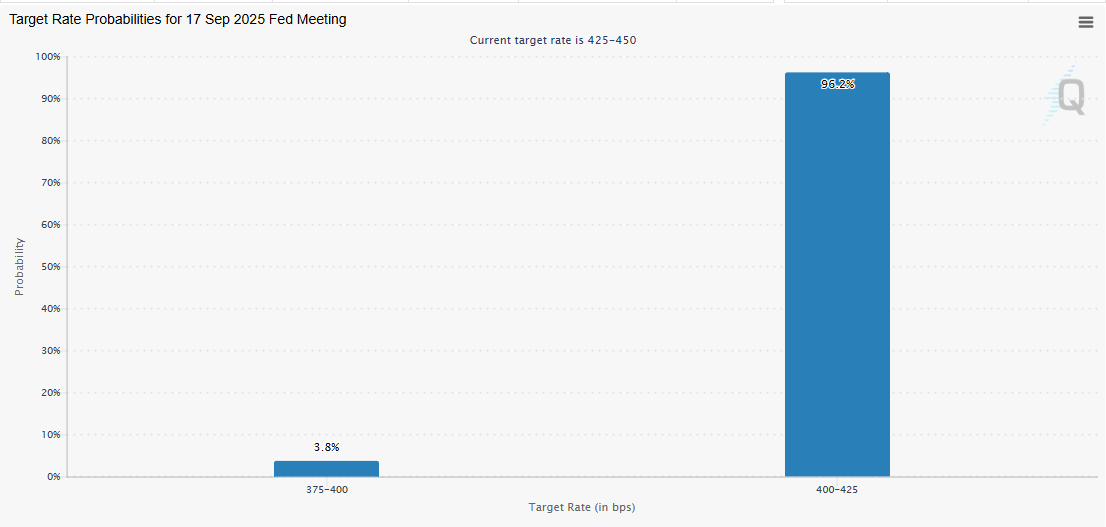

- Fed’s rate cut expected, with 96.2% chance of a 25 bps move.

Bitcoin price remains in focus as investors weigh upcoming Federal Reserve decisions and market expectations. With the Fed expected to deliver a rate cut, scenarios of both short-term dips and longer-term gains are being discussed. JP Morgan and other big analysts are expecting a market dump before reversal, adding weight to near-term caution.

Bitcoin Price Action: Scenarios Shaping the Road Ahead

Bitcoin’s current market value sits at $115,527, reflecting modest daily gains. Scenario one suggests BTC price could retreat toward the $104,000 region before any meaningful reversal.

Such a move would test support while flushing out weak positions, creating space for a stronger recovery. Long-term projections, however, still point toward Bitcoin setting fresh all-time highs once consolidation clears.

Therefore, despite near-term risks, confidence in the broader bullish cycle remains intact. Investors will likely track how quickly BTC regains momentum after any corrective dip.

In scenario two, Bitcoin price could extend its decline further toward the $92,000 area. This level aligns with an unfilled CME gap, which often acts as a magnet in corrective cycles.

If this deeper retracement occurs, market sentiment may temporarily weaken before recovery unfolds. However, such a flush could also provide the base for the next major rally.

A rebound from that zone could drive BTC price well beyond prior peaks, supporting projections of a powerful leg higher. Therefore, BTC long-term price prediction remains bullish regardless of the depth of this correction.

Fed’s Rate Cut: The Market’s Turning Point

The Federal Reserve is widely expected to cut interest rates at its upcoming FOMC meeting, with probabilities heavily favoring a 25 basis point move. The U.S. President Donald Trump has called for even deeper cuts, suggesting 50 to 100 basis points to accelerate economic support.

Markets are split on the short-term effects, with some analysts projecting volatility before stability returns. Historically, rate cuts have injected liquidity into financial systems, which often benefits assets like Bitcoin.

Therefore, expectations are growing that a rate cut could fuel the next upward surge in BTC price. Analysts also caution that initial corrections may still occur before markets stabilize.

The CME FedWatch analytics reinforces this outlook, showing a 96.2% chance of a 25 bps cut and only a 3.8% chance of 50 bps. Consequently, whether the cut is modest or aggressive, the decision is viewed as a decisive pivot. This turning point will likely define how quickly Bitcoin transitions from correction to fresh highs.

To sum up, Bitcoin price faces a decisive period with two clear corrective scenarios before recovery. Whether the drop halts at $104,000 or extends to $92,000, long-term projections remain positive. The Fed’s upcoming decision adds urgency, as the scale of the cut could accelerate the next rally. Ultimately, both scenarios support a bullish future for BTC price despite short-term volatility.

Frequently Asked Questions (FAQs)

1. Why are analysts expecting a market dump before a reversal?

2. How does a Fed rate cut impact the crypto market?

3. What role does CME FedWatch data play in forecasting Fed decisions?

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value