Bullish Pattern Sets PancakeSwap Coin Recovery To Exceed $5

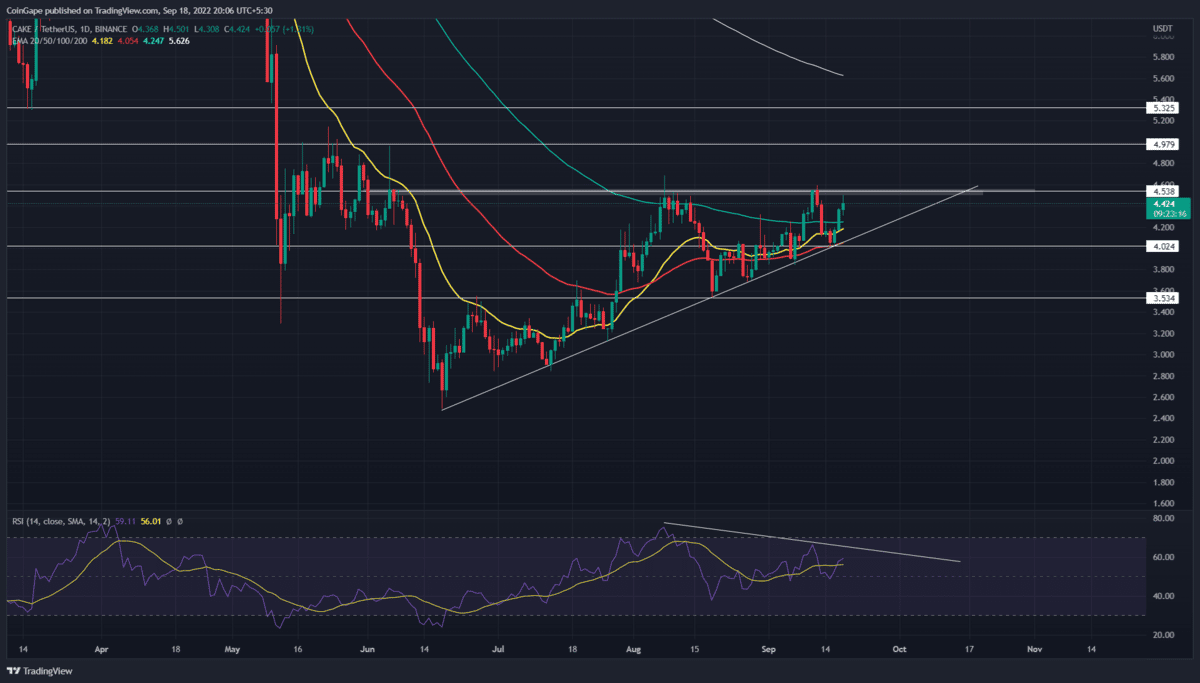

The ongoing recovery in PancakeSwap price follows an ascending triangle pattern. In theory, this bullish pattern indicates a gradual growth in bullish momentum, which receives a sudden boost once the neckline resistance is breached. Thus, the coin holders should keep a close eye on the $4.55 neckline and ascending trendline of the pattern as they will significantly impact the Cake token’s future price.

Key points:

- A support trendline maintains the Pancakeswap price recovery for past

- The 20-and-100-day EMA closing a bullish crossover could attract more buyers to the market.

- The intraday trading volume in the Litecoin coin is $50.1 Million, indicating a 53% gain.

Source- Tradingview

Source- Tradingview

Amid the recent correction in the crypto market, which plunged the Bitcoin price below $2000, the pancake price turned down from the $4.55 neckline. This downfall registered an 11.5% loss and slumped the prices to the combined support of $4, support trendline, and 50-day EMA.

The PancakeSwap coin price has rebounded from this trendline multiple times, indicating the traders are actively buying at this level. Thus, on September 16th, the altcoin rebounded from accumulated supports with a tweezer bottom candle pattern.

As a result, the coin price rose 11.5% higher and hit the neckline of $4.55. Earlier today, CAKE buyers attempted to breach the resistance, registering a 3% intraday gain, but now it represents a long-tail rejection candle.

This higher price rejection indicates the sellers are defending this level aggressively and could resume another bear cycle within the pattern. If this theory works out, the altcoin will retest the bullish commitment at the support trendline.

However, the bullish pattern would eventually encourage buyers to break the $4.55 resistance. The daily candle closing above this level will accelerate the buying momentum and lead pancakeswap recovery rally to $6.5 mark.

Conversely, a possible breakdown from the support trendline undermines the bullish theory and could pull the price below the $3.5 support.

Anyhow, it seems the price spread within the pattern is short enough to be considered a no-trading zone. Thus, interested buyers should wait for a breakout opportunity before entering the market.

Technical indicator

Relative strength index: the daily-RSI slope shows a bearish divergence concerning the last two retests to $4.55 resistance. This supports the trendline breakdown theory and indicates that buyers are getting weak at higher prices.

EMAs: the 50-day EMA dynamic support provides additional support for pancake price recovery.

- Resistance Levels: $4.5 and $5

- Support Levels: $4 and $3.85

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15