Bullish RSI Divergence Hints 10% Relief Rally In Bitcoin Price

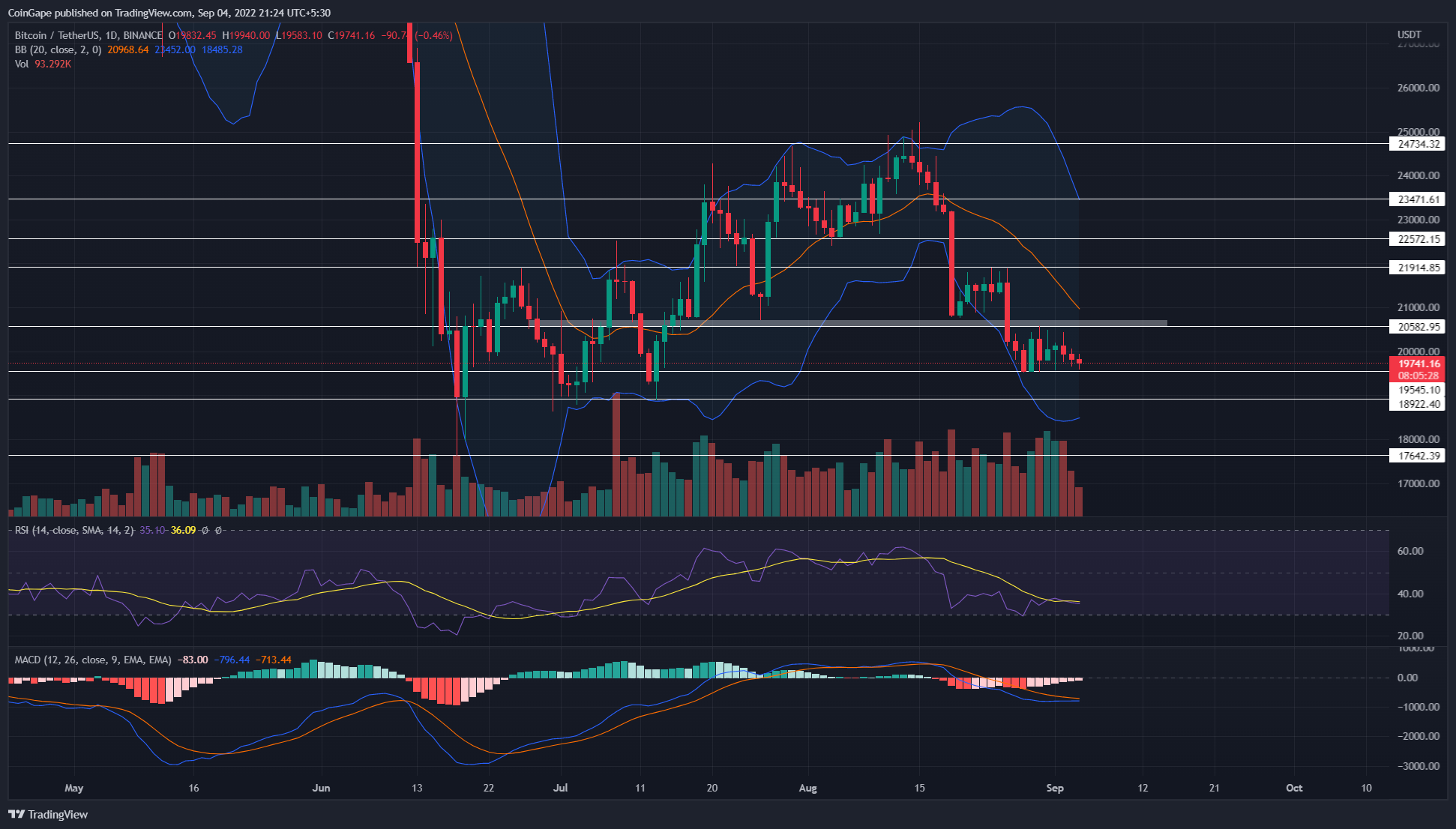

Today, the Bitcoin price is trading at the $19723 mark and had earlier retested the weekly support of $19500. The long tail-rejection attached to the daily candle back by decreasing volume increases the likelihood of bullish reversal. Can the potential bull run reclaim the $20600 mark?

Key points from Bitcoin price analysis:

- The BTC buyers obtained significant support at $19550

- The Bitcoin price action remained trapped in a narrow range

- The intraday trading volume in Bitcoin is $24.3 Billion, indicating a 13.5% loss

Following the August second-half sell-off, the Bitcoin price plunged to $19500 support and initiated a consolidation phase. This downfall has offset around 75% of gains recorded during the June to early august recovery and plummeted the prices by 22.5%.

Earlier this week, the Bitcoin price attempted to recover higher but failed to surpass the nearest resistance of $20750. As a result, the coin price entered a narrow consolidation between the $20750 and $19500.

Furthermore, the failed attempt mentioned above slumped the BTC price back to the $19500 mark. However, the decreasing volume during this bearish reversal reflects that the seller’s hand is weakening as we approach the lower support.

Such volume activity with a long lower price rejection indicates a higher possibility for a bullish reversal. Thus, if the buyers pierce the $20750 resistance, the Bitcoin price may witness a longer relief rally before continuing the bear trend.

A bullish reversal may surge prices by 10.5 or $14.5% to hit the $21900 or $22600 resistance, respectively. However, a bullish breakout above $22600 would weaken the bearish momentum and bolster buyers for a $25000 breakout.

On the flip side, if the Bitcoin price took an immediate reversal from the $20750 resistance, the consolidation range would extend longer and possibly breach the lower support.

A breakdown below $19500 will prolong the correction phase to $18865 or $18000.

Technical Indicator

Bollinger band: the coin price trading quite below the middle line reflects an aggressive selling in the market. Moreover, a possible reversal may face dynamic resistance from this midline.

RSI indicator: A bullish divergence in daily-RSI slope bolsters price reversal from the $19500

MACD indicator: the fast and slow slope drawn close to each other displays the buyers’ attempt to regain trend control. A potential bullish crossover between these will encourage the $20750 breakout.

- Resistance level- $207501 and $22000

- Support level- $19550 and $18865

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15