Cardano Price Rare Pattern Points to a 55% Crash as Key DeFi Metric Plunges

Highlights

- Cardano price has crashed in the past few months, a trend that may continue.

- The coin has formed an inverse cup-and-handle pattern on the daily chart.

- Cardano’s total value locked (TVL) has crashed to the lowest level in months.

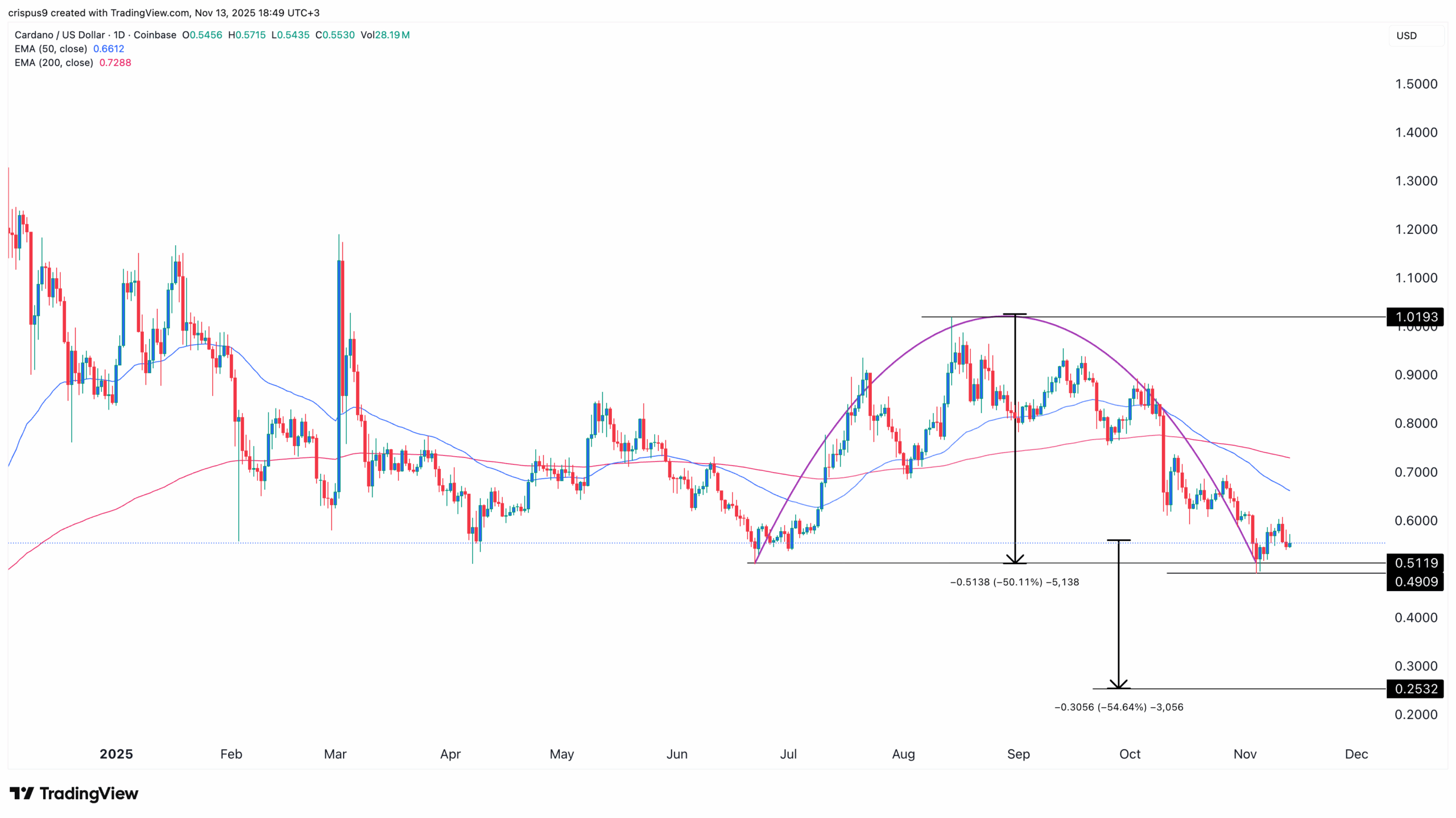

Cardano price has remained in a tight range in the past few days. ADA was trading at $0.5610 today, Nov. 13, down by over 50% from its highest level since August this year. It has now formed a giant inverse cup-and-handle pattern, pointing to more downside as its DeFi network crashes.

Cardano Price Has Formed an Inverse Cup & Handle Pattern

ADA price has been in a strong downward trend in the past few months, moving from a high of $1.0193 in August to $0.5600 today. It has moved below the 50-day and 200-day Exponential Moving Averages (EMA). The two averages have made a bearish crossover known as a death cross, which is one of the riskiest patterns in technical analysis.

Cardano price has also formed an inverse cup-and-handle pattern, which is a common bearish continuation signs. This pattern is made up of a horizontal line and a rounded top, which forms the cup section. It also has a consolidation or a brief comeback that forms the handle section.

One way to identify an asset’s target is to measure the distance from the upper side and the lower side. In this case, this distance is about 54%. One then measures the same distance from the cup’s lower side. By doing this, the most likely ADA price forecast 2025 is bearish, with the next key target being at $0.2532, which is about 55% below the current level.

On the flip side, a move above the 50-day Exponential Moving Average (EMA) at $0.6615 will invalidate the bearish Cardano price forecast and point to more upside.

Key Cardano DeFi Metric Has Plunged

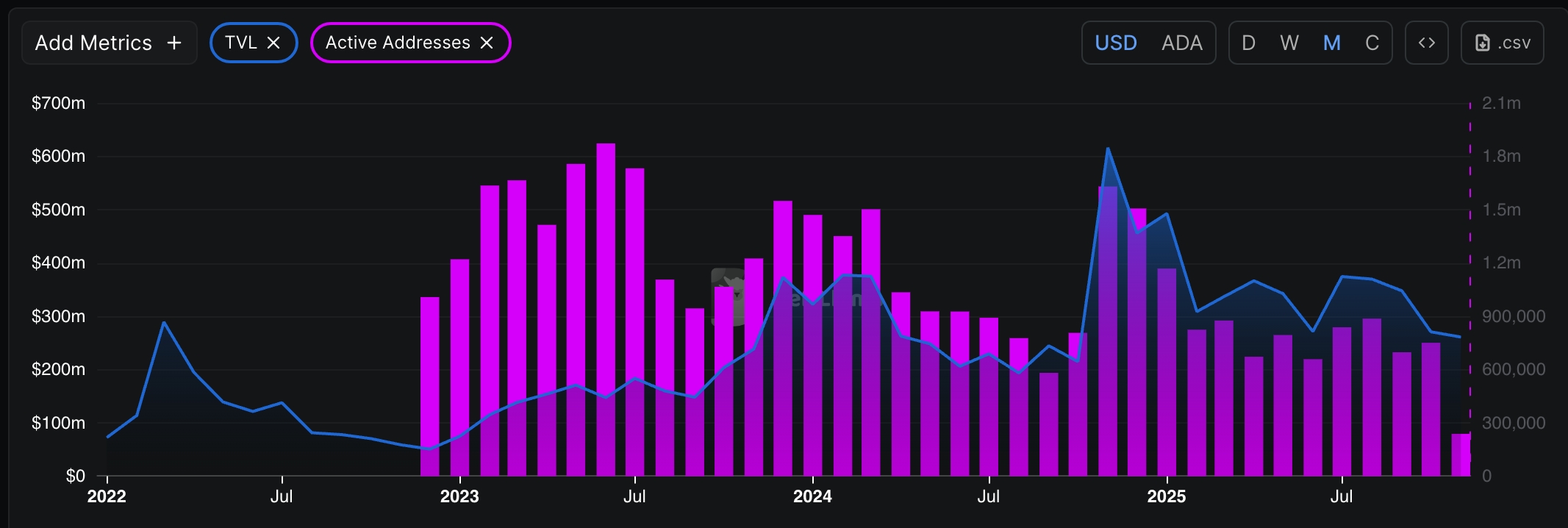

Cardano price is at risk of more downside also because of its weak fundamentals. Data compiled by DeFi Llama shows that the total value locked (TVL) in its network has plunged to $261 million from a high of $616 million in November last year.

The decline has happened across all protocols in its platform, including Liqwid, Minswap, and Indigo. Djed, its stablecoin, has a minimal market share with its market cap being just $18.9 million.

These numbers are a reflection that Cardano has not been received well by developers and users. In contrast, Solana, another top layer-1 network, has accumulated over $30 billion in assets.

Activity in Cardano’s DEX protocols has also waned recently. It stood at just $1.6 million in the last 24 hours, down from this month’s high of $12 million. At the same time, the number of active Cardano addresses has dropped to 238,000, down from 616,000 in November last year.

Charles Hoskinson and the team are betting on Midnight, the upcoming sidechain to boost its ecosystem growth. Midnight has already inked partnerships with top developers, which may lead to more activity in the network.

Frequently Asked Questions (FAQs)

1. What is the most likely Cardano price forecast?

2. Is ADA a good coin to buy today?

3. Why is Cardano’s DeFi ecosystem imploding?

- BlackRock Bitcoin ETF (IBIT) Options Data Signals Rising Interest in BTC Over Gold Now

- XRP and RLUSD Holders to Access Treasury Yields as Institutional-Grade Products Expand on XRPL

- Prediction Market News: Polymarket to Offer Attention Markets Amid Regulatory Crackdown

- How “Quiet Builders” Are Winning the Web3 Race

- XRP News: Ripple Taps Zand Bank to Boost RLUSD Stablecoin Use in UAE

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?