Has Cardano Price Hit Overbought at $0.4 or there’s More to this Recovery?

The Cardano coin has been strongly bullish for the first half of November along with some other major altcoins like Solana (SOL), XRP, Avalanche (AVAX), Chainlink (LINK), and more.

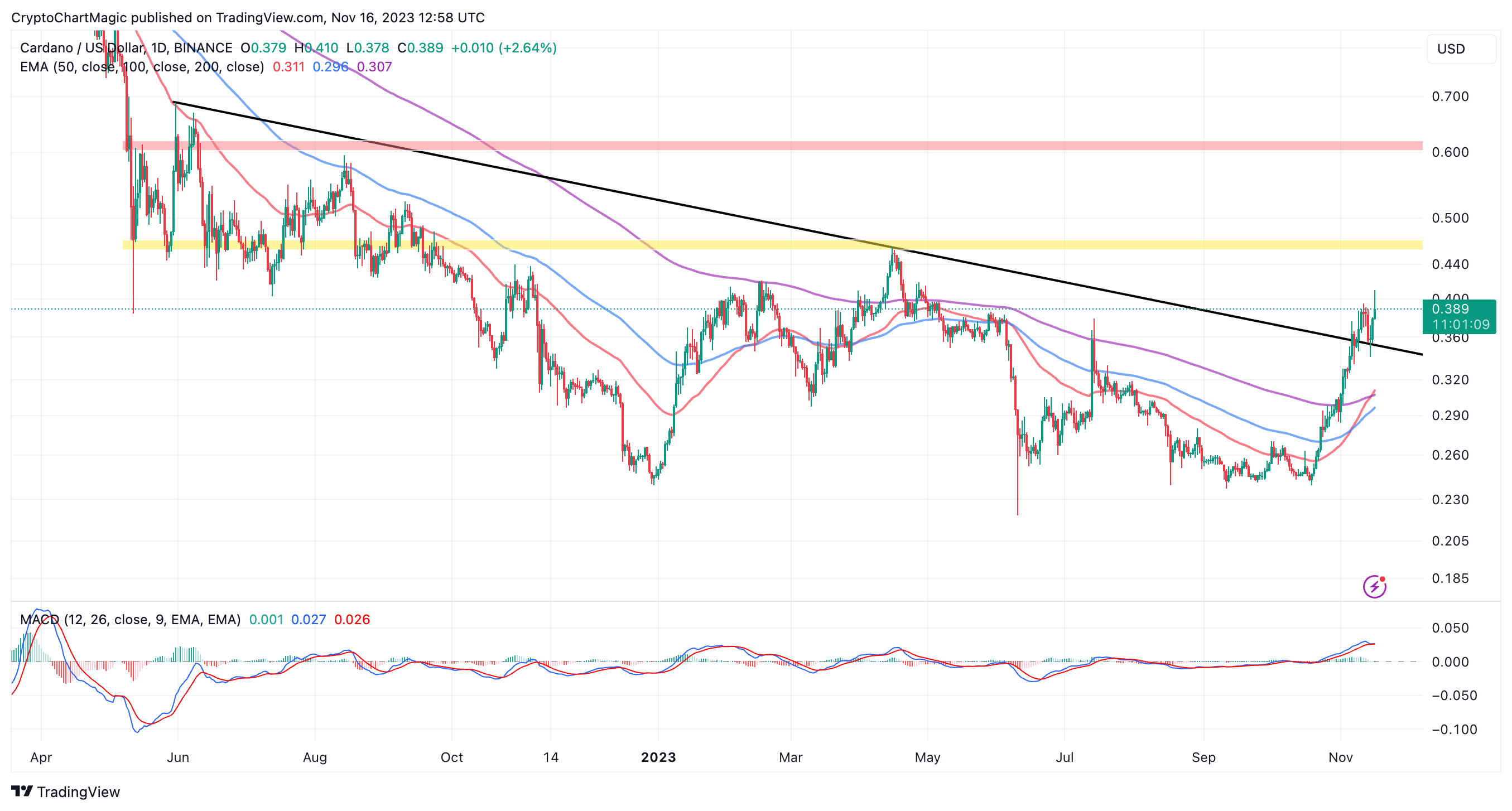

The ADA coin entered an aggressive recovery mode, when the prices jumped from $0.24 support on October 19th. This bullish reversal registered 54% growth as this altcoin reached the current trading value of $0.37. Amid this rally, the buyers have reclaimed the crucial daily EMAs(20, 50, 100, and 200) restoring the bullish trend among market participants.

Cardano Price Prediction: Is ADA Going to $0.75 By Year-End?

Cardano shows signs of a stronger bullish outlook as observed on the daily chart. In addition to trading above all three MAs, the token recently broke above a key multi-month falling trendline.

Traders often look out for such breaks as shown on the daily chart. They lead to highly profitable price swings, especially when you DCA at the beginning of the trend.

For now, the resistance at $0.4 is demanding attention as bears and bulls engage in a fierce fight to determine the direction Cardano price would take. Trading above this hurdle would be a bullish indicator likely to see ADA quickly close the gap to the next resistance at $0.45.

On the downside, failure to defeat the seller congestion at $0.4 may result in a longer consolidation—one that could destabilize ADA and encourage traders to close their positions earlier than expected due to the fear of being liquidated.

In that case, the support provided by the descending trendline may come in handy and stop the losses. However, if push comes to shove, investors may want to start acclimatizing to Cardano sweeping lower liquidity areas like $0.34 and $0.3.

The Moving Average Convergence Divergence (MACD) reveals that ADA has a higher chance of continuing with the uptrend than sweeping lows towards $0.34 and $0.3.

However, for this uptrend to $0.45 to materialize the blue MACD line must hold above the red signal line while the momentum indicator persistently moves north.

Trader and analyst @ali_charts shared his technical opinion about Cardano’s potential year-end target on Twitter (now X). According to Ali, “Cardano’s current consolidation trend eerily mirrors the 2018-2020 phase without the COVID-19 crash!”

He opines that if Cardano marches through resistance at $0.45 by the first week of December, the token could become even more attractive to traders and institutional investors, who could propel ADA to $0.75 by the end of the year.

Cardano DeFi TVL Grows To $263 Million

Institutional interest in Cardano continues to grow in tandem with the price. According to Defi Llama, a platform tracking protocols in the DeFi sector, the total value locked (TVL) which measures the dollar value of digital assets locked in the network’s ecosystem’s smart contracts has increased to $263 million from a 2023 low of $50 million.

An increase in the TVL balance is a direct indication of the long-term bullish outlook investors have for Cardano price. In other words, they are not interested in short-term gains, selling at the earlier sign of profit, but are willing to lock up their tokens for a longer period. This also reduces the selling pressure in the market, as investors move ADA tokens from exchanges to smart contracts.

Related Articles

- Breaking: Justin Sun’s Poloniex Exchange Suffers Over $100 Mln Asset Loss In Hacking Attack

- Uniswap Founder Hayden Adams Warns Crypto Community About Fake $2 Mln Scam

- Breaking: Ripple CEO Brad Garlinghouse Discloses Next Action Plan And Market Prediction

Recent Posts

- Price Analysis

Dogecoin Price Prediction Points to $0.20 Rebound as Coinbase Launches Regulated DOGE Futures

Dogecoin price has gone back to the spotlight as it responds to the growing derivatives…

- Price Analysis

Pi Coin Price Prediction as Expert Warns Bitcoin May Hit $70k After BoJ Rate Hike

Pi Coin price rose by 1.05% today, Dec. 18, mirroring the performance of Bitcoin and…

- Price Analysis

Cardano Price Outlook: Will the NIGHT Token Demand Surge Trigger a Rebound?

Cardano price has entered a decisive phase as NIGHT token liquidity rotation intersects with structural…

- Price Analysis

Will Bitcoin Price Crash to $74K as Japan Eyes Rate Hike on December 19?

Bitcoin price continues to weaken after breaking below its recent consolidation range, now trading within…

- Price Analysis

Bitwise Predicts Solana Price Will Hit New All-Time Highs in 2026

Solana price declined by 4% over the past 24 hours, breaking below the key $130…

- Price Analysis

Bitcoin Price Outlook: Capriole Founder Warns of a Drop Below $50K by 2028

Bitcoin price narratives continue to evolve as long-term downside risks regain attention. Bitcoin price discussions…