Cardano Price Teeters as Whales Exit and Bearish Signal Emerges

Highlights

- Cardano price could be on the verge of a strong bearish breakdown in the coming weeks.

- Whales have continued to dump their ADA tokens this month.

- Cardano is about to form the highly risky death cross chart pattern on the daily chart.

Cardano price has moved into a bear market after plunging by over 32% from its highest point in August. ADA token may be on the verge of more downside as highly bearish technicals form, total value locked plunges, and whales dump.

Cardano Price Chart Analysis Points to a Steeper Dive

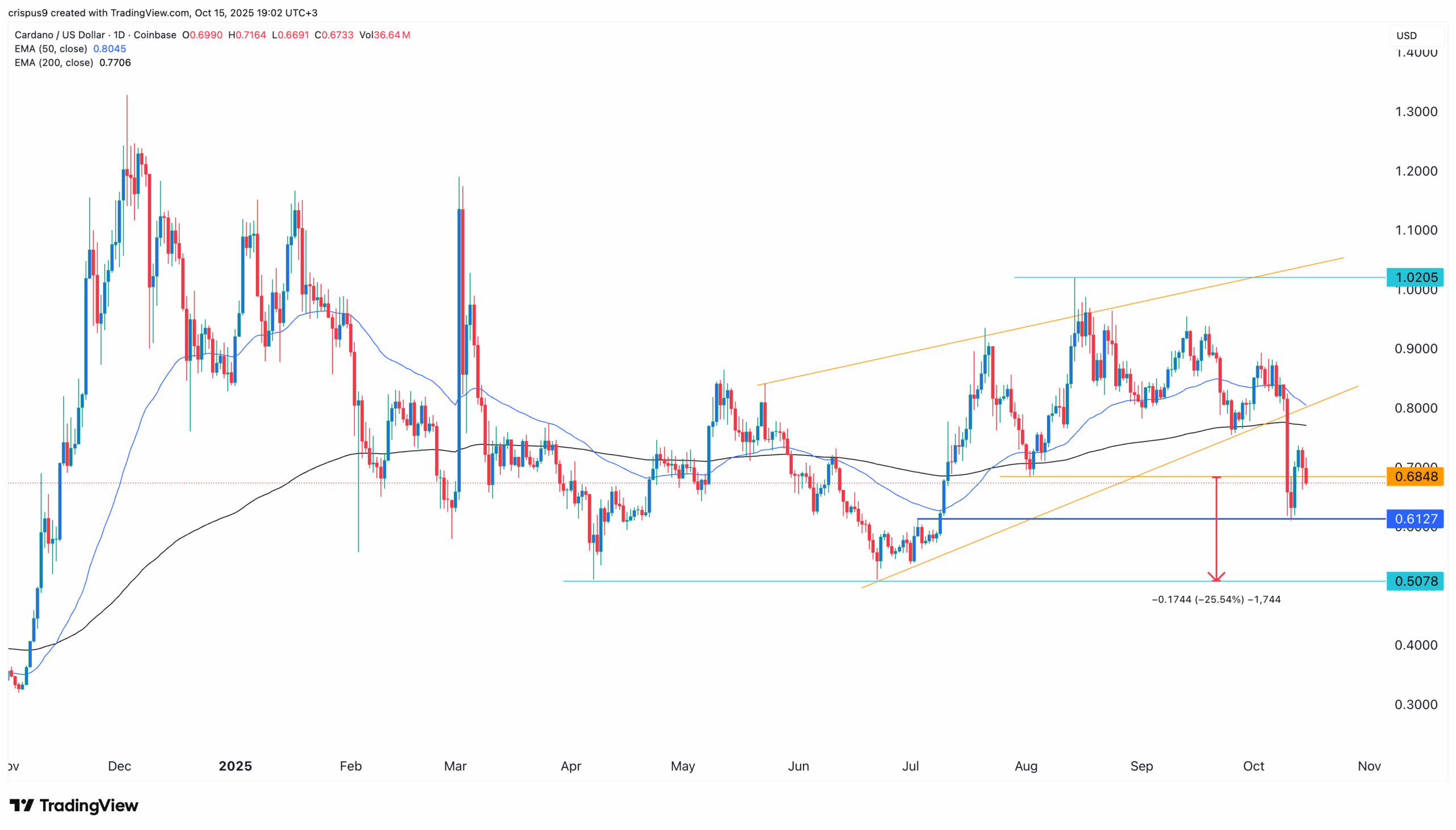

The daily chart shows that the Cardano price has plunged and formed numerous bearish chart pattern. It recently formed a rising wedge pattern, which happens when there are two ascending and converging trendlines.

It has also formed a head-and-shoulders pattern, which often leads to more downside over time. Most importantly, the spread between the 50-day and 200-day Exponential Moving Averages (EMA) has continued narrowing. This means that the token will likely form a death cross pattern, which also leads to more downside.

The coin is in the process of forming either a bearish flag or a pennant. That is a sign that it will continue falling in the near term, potentially to the next key support at $0.50, its lowest point in April and June this year. This price is about 25% below the current level.

The bearish ADA price forecast 2025 will become invalid if it jumps above the lower side of the ascending channel. If this happens, the token will likely jump to the resistance level at $1.

Whales are Selling and DeFi Activity is in Turmoil

Cardano price has some of the weakest fundamentals among the biggest cryptocurrencies. For example, while Ethereum, Solana, and BNB Smart Chain’s DeFi ecosystems are thriving, Cardano continues to languish.

Data shows that the total value locked (TVL) in the ecosystem has punged by 20% in the last 30 days to $288 million. In contrast, Solana has over $25 billion, while Cronos has $765 million.

Cardano’s stablecoin supply is just $36 million, a tiny amount considering that the industry has over $290 billion in assets. Also, the DEX volume in the last 24 hours was less than $4 million.

Worse, Cardano is yet to achieve most of the goals that Charles Hoskinson has made in the past few months. For example, the hinted integration with Chainlink is yet to happen. Also, Cardano has not yet integrated with Bitcoin, a process that was meant to unlock billions of dollars to its network.

These weak fundamentals likely explain why whales have dumped million of tokens. They sold ADA tokens worth over 350 million in the last week. Whale selling is one of the most bearish signs in the crypto market.

Frequently Asked Questions (FAQs)

1. What is the most likely Cardano price forecast?

2. Why are whales selling their ADA tokens?

3. Is ADA a good buy?

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Michael Saylor Says Strategy Won’t Sell Bitcoin Despite Unrealized Loss, Will Keep Buying Every Quarter

- BlackRock Bitcoin ETF (IBIT) Options Data Signals Rising Interest in BTC Over Gold Now

- XRP and RLUSD Holders to Access Treasury Yields as Institutional-Grade Products Expand on XRPL

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?