Chainlink Price Analysis: LINK Hovers Below $9.50; What’s Next?

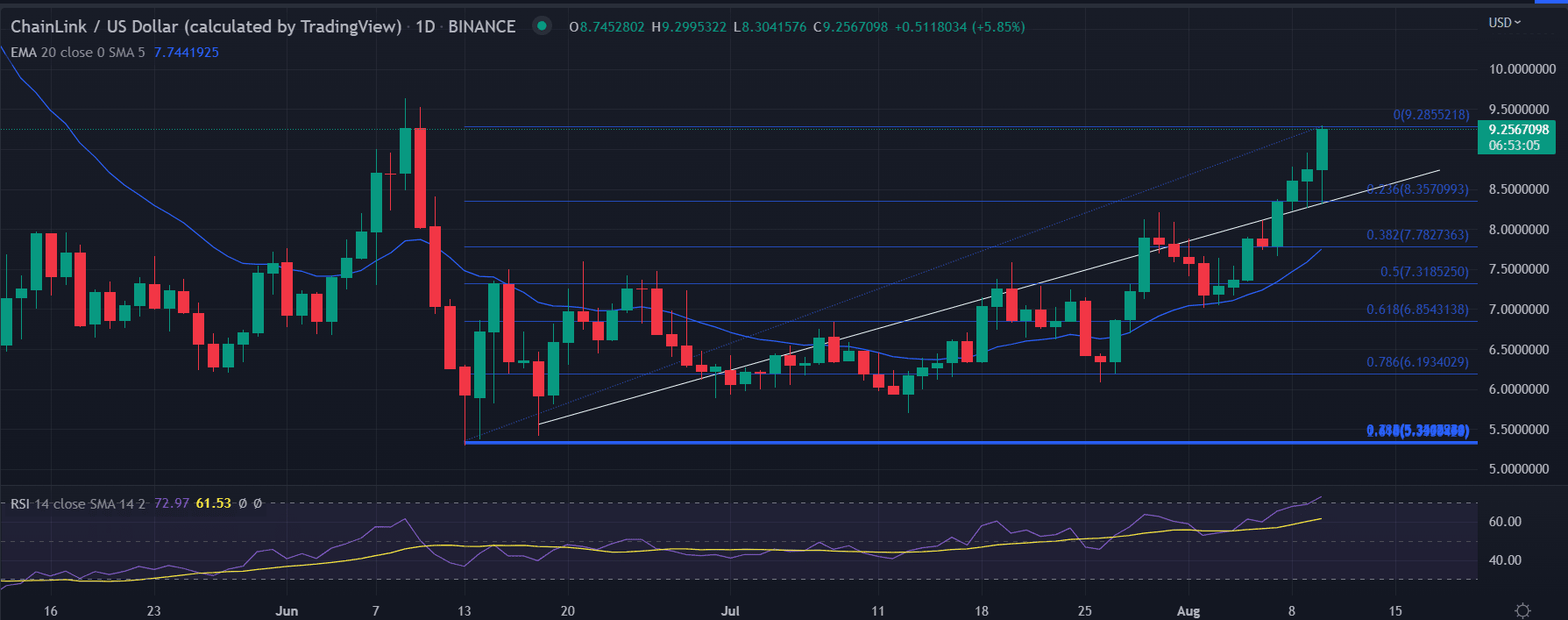

Chainlink price analysis shows a strong upside movement amid sustained buying pressure. The LINK/USD pair opens higher and stumble to test lows of $8.30. However, recovers sharply to test the highs of the session above $9.20 The formation of a green candlestick indicates the buyers are not in the mood to give up easily.

As the price continued to recover from the lower level it indicates the presence of buyers. It could be a good buying opportunity for the sidelined investors.

After the U.S cooler inflation data a broader cryptocurrency market recovery led to the gains in LINK. The Bitcoin price jumped 3.10% while Ethereum’s price rose to 7.12%.

As of press time, LINK/USD is exchanging hands at $9.26, up 6.96% for the day. The 24-hour trading volume of the token held at $719,514,339 with a gain of more than 16% according to CoinMarketCap data. A rise in volume with rising in price is a bullish sign.

This means the sellers are not participating aggressively and there could be a probable bounce back in the token.

- LINK price trades higher on Wednesday following softer U.S data.

- However, the price took support near the bullish trend line at $8.30.

- A quick recovery toward $11.0 might be possible.

LINK price moves north

Chainlink price analysis indicates the price has taken reliable support at the 0.23% Fibo. Retracement, at $8.30.

This level holds a significant level, as it also coincides with the bullish trend line, which is extending from the lows of $5.29.

Further, the formation of a strong green candlestick indicates the buyer’s participation near the lower levels as the buyers reflect interests in the token. To sustain the previous upside momentum, the bulls must close above the session’s high of $9.29. If that occurs, the next top destination for LINK buyers would be the high of May 6 at $11.02.

The RSI signals aggressive bids. It currently reads at 71, near the overbought market. Any downtick in the indicator could weaken the bullish outlook.

Also read: https://coingape.com/justin-sun-fires-back-at-vitalik-as-battle-of-ethereum-merge-heats-up/

On the other hand, a fall below the session’s low would induce selling. In that scenario, the bears could drag the price toward the $7.80 horizontal support level. Next, the price could meet the low of August 3 at $7.10.

The LINK coin has formed higher highs and higher lows formation since July 13.

The price appreciated nearly 60% from the lows of $5.29 made in June. This also marks the all-time low for the token. The below average volume near the lower levels indicates accumulation is happening for the next leg-up.

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15