Chainlink Price Eyes $30 Rebound as FTSE Russell Collaboration and Supply Squeeze Fuel Optimism

Highlights

- Chainlink price structure supports a bullish rebound toward the projected $30 target.

- FTSE Russell partnership boosts institutional confidence in Chainlink’s real-world utility.

- Exchange reserves drop by 34M LINK, indicating tightening supply and accumulation strength.

Chainlink price has declined in recent sessions, with LINK price slipping below key near-term support. Yet, despite short-term weakness, broader sentiment remains anchored by growing confidence following Chainlink’s strategic partnership with FTSE Russell. Simultaneously, a tightening supply squeeze caused by deepening exchange outflows highlights strong holding conviction.

Chainlink Price Navigates a Falling Channel as Accumulation Builds Toward $30 Target

At the time of press, Chainlink value sits at $16.06, hovering near the lower boundary of a prolonged falling channel that has dictated market structure since mid-September. This setup reflects a tug-of-war between buyers defending structural supports and sellers capitalizing on every minor rally.

Yet, the ongoing compression within this channel often precedes a directional breakout, and in this case, the confluence around the $15.40–$14.00 accumulation zone offers a strong foundation for potential recovery.

This zone has repeatedly served as a liquidity pocket where long-term holders and whales accumulate positions, gradually absorbing sell pressure. Each retest reduces the control of sellers and builds structural tension for an upward break.

Notably, the Money Flow Index (MFI), now at 45.79, reinforces this thesis by signaling that capital inflows are stabilizing after a phase of heavy distribution. Such stabilization historically aligns with trend reversals as fresh inflows regain dominance.

Meanwhile, a breakout above $18 could spark a progressive shift toward $20.00, where active sellers have consistently paused prior rebounds. Should buyers overcome this threshold, the next visible liquidity zone lies near $23.50. Surpassing it could clear the path toward the $25 short-term projection, a level aligned with the 4-hour double-bottom structure previously noted. This progression aligns with the broader long-term LINK price projection, which projects an eventual 86% rally toward $30 before the close of Q4.

FTSE Russell Deal and Shrinking Reserves Reinforce Chainlink’s Supply Shock

Chainlink’s partnership with FTSE Russell marks a pivotal step in bridging traditional finance with blockchain infrastructure. Through this collaboration, FTSE Russell will publish global indices onchain via Chainlink’s DataLink. This enhances transparency and accessibility for institutional-grade data feeds. The move strengthens Chainlink’s ecosystem presence, adding a tangible use case that connects real-world assets to decentralized networks.

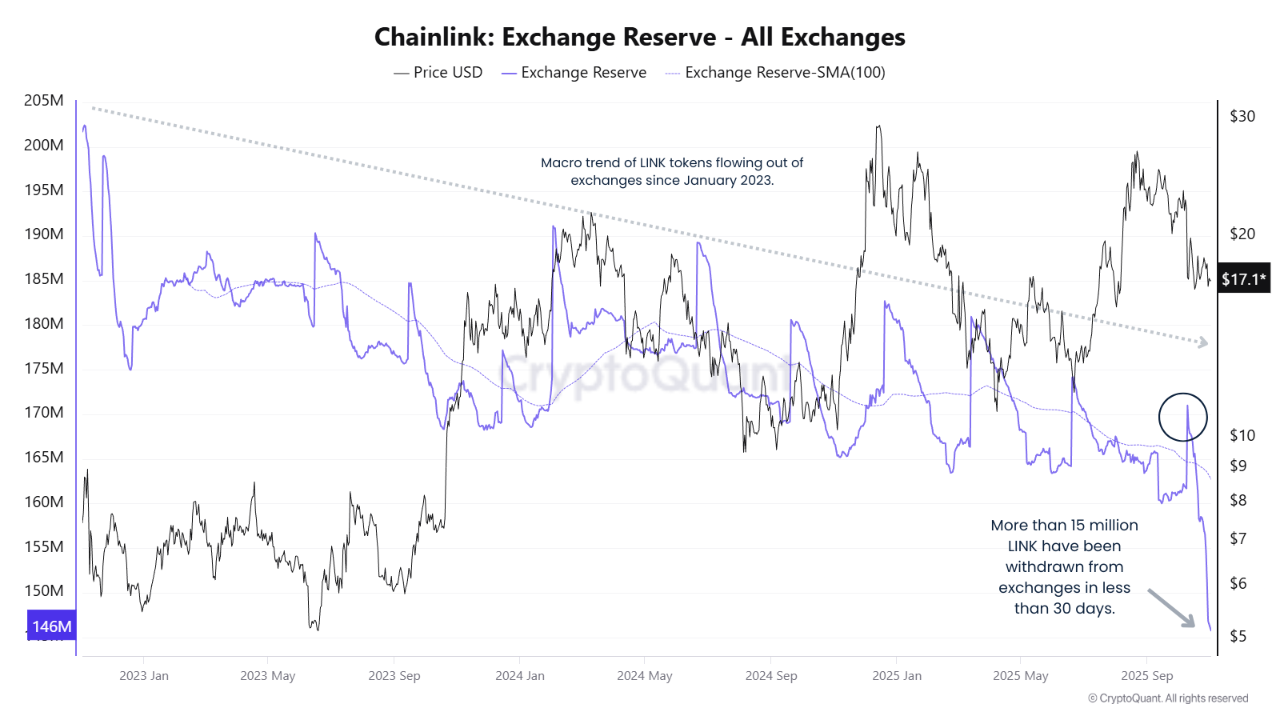

In parallel, CoinGlass reveals a significant contraction in LINK’s exchange reserves, underscoring strong long-term accumulation trends. Since early 2025, exchange balances have dropped from over 180 million LINK to nearly 146 million—a reduction of 34 million tokens.

This consistent decline signals waning sell pressure as holders shift assets into staking or long-term storage. Historically, such supply contractions precede extended price expansions when demand recovers.

Consequently, the combination of institutional adoption and shrinking liquidity positions Chainlink price for steady appreciation through Q4, potentially reinforcing the bullish case toward $30.

Conclusively, Chainlink’s technical setup and onchain signals collectively support a strong recovery narrative. The FTSE Russell partnership adds institutional depth, while the continued supply squeeze reflects firm investor conviction. These elements combine to create a bullish structure that could propel the Chainlink price toward the projected $30 target before the end of Q4. Therefore, the overall market outlook remains optimistic for a sustained rebound.

Frequently Asked Questions (FAQs)

1. What does the recent Chainlink price structure reveal?

2. What does Chainlink’s collaboration with FTSE Russell involve?

3. Why are Chainlink’s exchange reserves declining?

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise