Death Cross Triggers Sell Signals for Cardano Price— Will ADA Retest $0.50?

Highlights

- Cardano price weakens after death cross confirmation, signaling extended bearish control.

- ADX shows fading trend strength as ADA nears $0.50, hinting at a possible rebound.

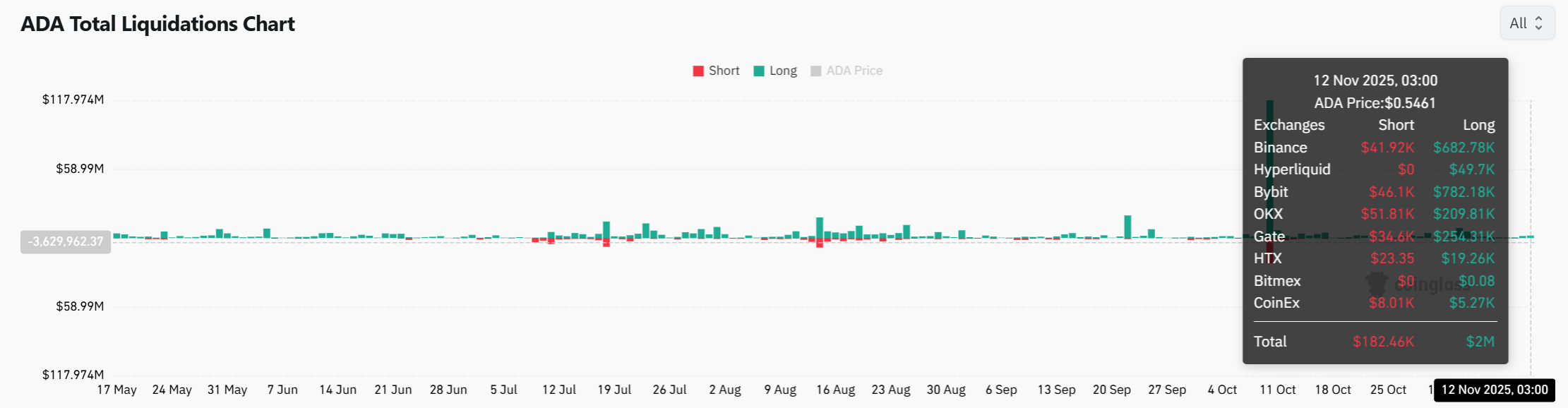

- Over $2 million in long liquidations intensify selling pressure, confirming bearish dominance.

The Cardano price has struggled to regain strength following a steep correction from recent highs. ADA has slipped below key support zones, reflecting weakening short-term sentiment across the broader market. The recent bearish cross between the 50-day and 200-day moving averages has raised caution among investors.

Despite minor rebounds, bears appear dominant, with the overall trend suggesting potential further retracements. Still, some market participants believe short-term consolidations could precede fresh buying pressure in the near term.

Death Cross Deepens Bearish Outlook for Cardano Price

The death cross, confirmed on November 3, marked a significant shift in sentiment for Cardano price performance. This technical signal emerged as the 50-day moving average crossed below the 200-day line, indicating that bearish conditions are strengthening.

The current ADA value trades at $0.548, well under both moving averages, confirming an extended downtrend. Specifically, this crossover historically signals prolonged selling phases, which aligns with ADA’s failure to reclaim the $0.60 resistance.

Furthermore, market structure shows lower highs and lower lows, reinforcing downward bias. The decline has also invalidated several short-term bullish setups, hinting at possible retests toward the $0.50 psychological mark if sellers sustain pressure.

Bearish Pennant Breakout Signals Lower Support Retest

On the 4-hour chart, Cardano has broken below a bearish pennant pattern after failing to hold the $0.555 support. The breakout signals a continuation of the downward structure, confirming renewed selling pressure within the channel.

Breaking below $0.540 could expose ADA to retesting the $0.500 floor, which has acted as critical demand since early November. The DMI indicator supports this bias, showing -DI at 21 and +DI at 18, highlighting that sellers remain dominant.

Meanwhile, the ADX reading at 14 reveals that although the trend is bearish, its strength remains weak. ADX measures the intensity of a trend, not its direction—readings below 20 reflect weak conviction or sideways trading.

Therefore, while bears currently lead, the weak ADX suggests that downward momentum may fade if volume fails to expand. If ADA stabilizes near $0.50 and volume increases, the long-term ADA price outlook could turn optimistic, paving the way for a gradual recovery.

Are Bears Fully in Control?

Liquidation data highlights intense selling pressure as over $2 million in long positions were wiped out within 24 hours. Binance and Bybit saw the heaviest liquidations, totaling $682K and $780K, respectively, as bullish traders were forced out by sharp declines.

In contrast, short liquidations only reached about $180K, signaling that bears remain in firm control. This imbalance shows how bearish pressure is overwhelming buyers, with leverage increasingly working against long traders.

Such dominance from shorts often fuels deeper pullbacks before a potential relief bounce. Therefore, if current conditions persist, the Cardano price could slip toward $0.50 before any meaningful recovery attempt.

To sum up, Cardano remains under visible bearish pressure, struggling to hold crucial support levels. Both technical patterns and liquidation data point to sustained seller control. Unless ADA closes above $0.60 soon, recovery chances remain slim. The overall trend suggests that buyers must reclaim strength to reverse the ongoing weakness.

Frequently Asked Questions (FAQs)

1. What does the death cross mean for Cardano?

2. What does ADX measure in technical analysis?

3. Why are long liquidations significant in crypto markets?

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch