EOS Price Analysis: A Declining Volume Indicates Consolidation; Time To Buy?

EOS price analysis indicates the continuation of a price correction. The spectacular rise in the price attracted the sellers and initiate a distribution near the supply zone.

As of press time, EOS/USD is exchanging hands at $1.70, down 5.14% for the day. The 24-hour trading volume declined more than 50% below $ 8 billion. A fall in price along with the volume is a weakening downside trend.

- EOS price edges lower for the second straight session.

- A decisive break below $1.70 would bring more losses to the coin.

- A red candlestick indicates the dominance of the sellers.

EOS price turns south

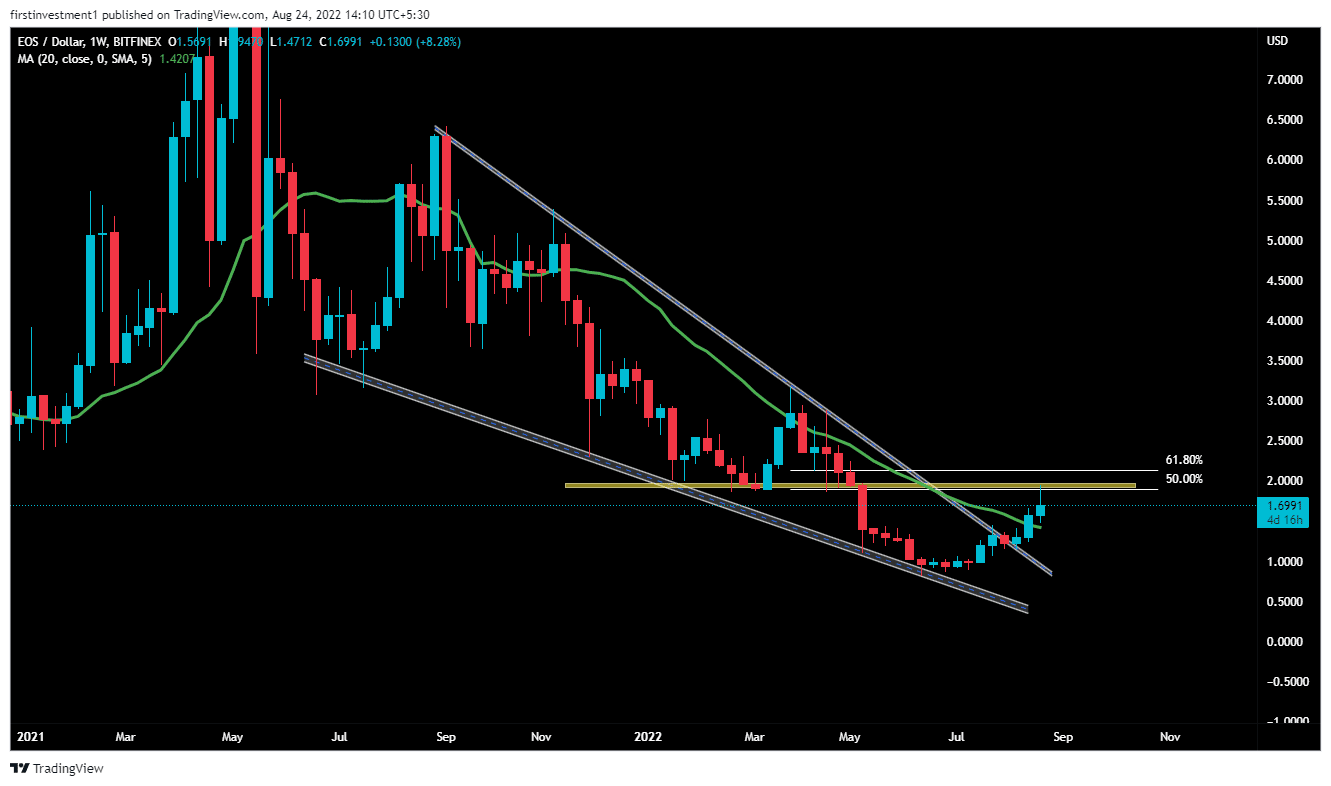

On the weekly chart, the EOS price gave a breakout of a “Falling Wedge” pattern. The falling wedge can be one of the most difficult chart patterns to accurately recognize and trade.

When lower highs and lower lows form, as in a falling wedge, security remains in a downtrend. The falling wedge is designed to spot a decrease in downside momentum and alert technicians to a potential trend reversal.

The price gave a breakout of the 200-day exponential moving average & trading above it. The asset is making lower lows and lower highs formation.

The recent price action implied a bearish impulse move from March 28 ($3.18) to June 13 ($0.80). Amid pullback the price test 50% Fibonacci retracement, which will act as a hurdle (resistance) in the coming days. If the price is able to break above ($1.95), then we can expect a good bullish momentum of ($2.4).

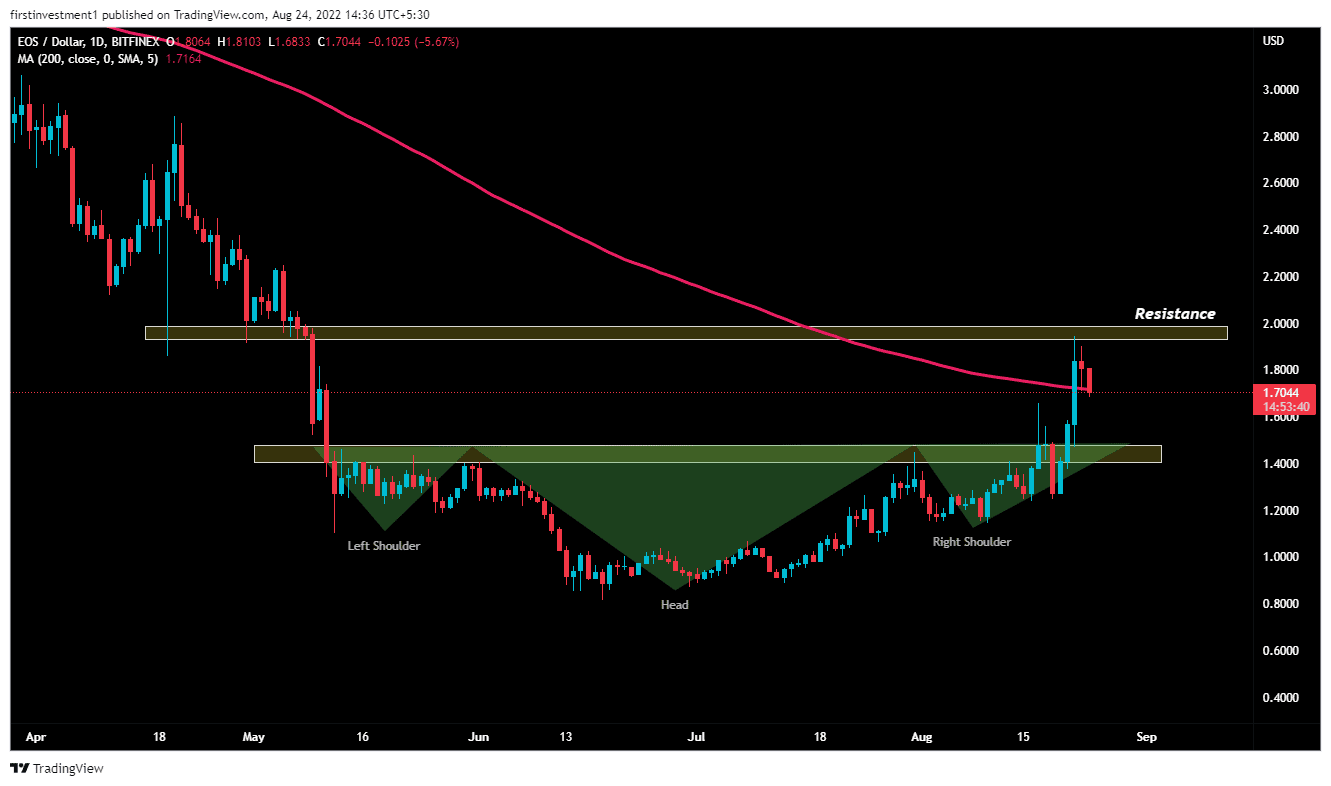

On the daily chart, EOS has given a breakout of an inverted “Head & Shoulder” pattern, & after that gave an impulse move of more than 50% from $1.26 to $1.94.

Further, the price gave a breakout of the 200-day exponential moving, but couldn’t sustain above that level due to resistance on the weekly chart, as mentioned above. If the price close below ($1.600), then we can expect a good fall, otherwise, a possible reversal is expected in the coming days.

Also read: https://Bombshell: Fed President Admits To Wanting Recession, Should You Panic

The nearest support is ($1.60), whereas the most immediate resistance is around ($1.80). There is a higher probability of the price breaking its resistance on higher levels.

But, due to the spike in sell orders if the price come closer to its support, then we can have a “Buy on dips” Opportunity.

On the other hand, a break below the $1.60 level could invalidate the bullish outlook. And the price could fall toward $1.50.

EOS is giving mixed signals on different time frames. Below $1.60 closing on the hourly time frame, we can put a trade on the sell side.

- Bitcoin Crashes to $72k as U.S.–Iran Tensions Rise After Talks Collapse

- Bringing Compute Power to the Masses in a Sustainable, Decentralized Manner

- Bitcoin Reserve: U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

- Epstein Files: How Jeffrey Epstein Had Ties to Bitcoin and Crypto’s Early Development

- Crypto Market Continues to Plunge, Could 2026 Be the Worst Year?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

- Solana Price Crashes Below $95 for the First Time Since 2024: How Low Will SOL Go Next?

- Ethereum Price Eyes a Rebound to $3,000 as Vitalik Buterin Issues a Warning on Layer-2s

- Pi Network Price Outlook as Bitcoin Faces a Strong Sell-Off Below $80k

- Bitcoin Price Prediction As US House Passes Government Funding Bill to End Shutdown

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks