EOS Price Analysis: Will The Euphoria Continue Post $1.30; Buy Or Sell?

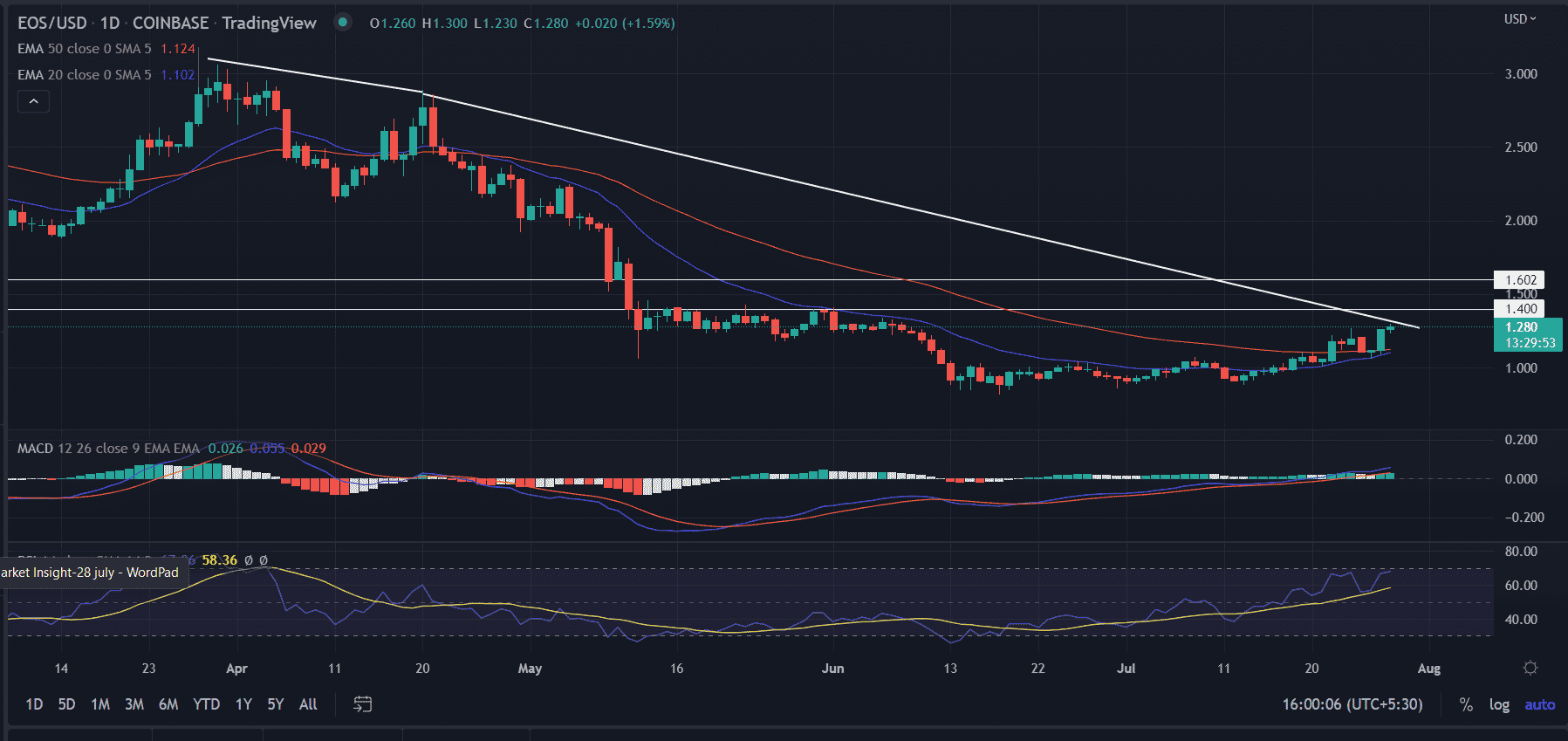

EOS price analysis shows the continuation of the upside momentum but with limited price action. The buyers meet the critical supply zone after surging more than 12% in the previous session. Currently, the EOS price is in consolidation mode. As the price comfortably trades above the crucial 20-day and 50-day moving averages, a higher probability of upside continuation can be anticipated.

- EOS price prints modest gains post spectacular single-day rise.

- The bulls hold near the critical resistance level amid the completion of a bullish rounded formation on the daily chart.

- An upside 0f 20% in the offer if the price manages to give a daily closing above $1.30.

As of writing, EOS/USD is trading at $1.28, up 2.4% for the day. The 24-hour trading volume is holding at $356,869,038 with 56% gains. A high price with high volume is a bullish sign.

EOS price looks for another leg up

On the daily chart, the EOS price analysis marks a period of consolidation near the session’s high. The descending trend line from the highs of $3.18 acts as a strong upside barricade for the EOS buyers. The price has completed a ‘rounded bottom’ formation. Thus, facing challenges near the $1.30 mark.

Now, a renewed buying pressure would push the price above the bearish trend line. If that happens, the EOS price would immediately meet the $1.40 resistance level. Further, an acceptance above the mentioned support-turned resistance level would mean the bulls are likely to take out the $1.60 horizontal resistance level next.

On the other hand, a break below the session low would discard the bullish arguments. In that case, the price could fall back to the previous day’s low at $1.09.

Technical indicators:

RSI: The RSI (14) is currently trading at 66 and it is shaping a curve that indicates a probable consolidation. More confirmation is needed to act upon in the current scenario.

MACD: The MACD is moving above the midline as the green line stays above the orange line. The rising histogram confirms the strength in the uptrend.

How to trade:

EOS coin price analysis indicates a positive bias on the daily chart. But faces a sideways movement for now. Investors should wait for a daily close above $1.30 and an uptick in RSI for fresh long positions.

Support: $1.23 and $1.15

Resistance: $1.35 and $1.40

- Bitcoin Crashes to $72k as U.S.–Iran Tensions Rise After Talks Collapse

- Bringing Compute Power to the Masses in a Sustainable, Decentralized Manner

- Bitcoin Reserve: U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

- Epstein Files: How Jeffrey Epstein Had Ties to Bitcoin and Crypto’s Early Development

- Crypto Market Continues to Plunge, Could 2026 Be the Worst Year?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

- Solana Price Crashes Below $95 for the First Time Since 2024: How Low Will SOL Go Next?

- Ethereum Price Eyes a Rebound to $3,000 as Vitalik Buterin Issues a Warning on Layer-2s

- Pi Network Price Outlook as Bitcoin Faces a Strong Sell-Off Below $80k

- Bitcoin Price Prediction As US House Passes Government Funding Bill to End Shutdown

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks