Ethereum (ETH) Price: Analyst Predicts a Pullback Before $10K Surge Amid SEC ETF Approval

Highlights

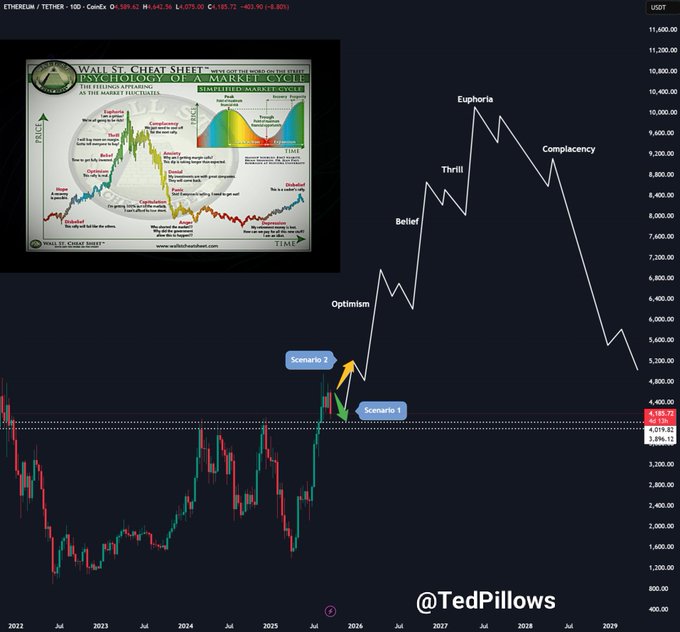

- Ted Pillows projects a correction before Ethereum’s next cycle rally.

- SEC approval streamlines Ethereum ETFs under generic listing rules.

- Institutional access to ETH price strengthens long-term adoption outlook.

Ethereum price continues to spark debate as cycle theories and regulatory approvals shape its path. According to analyst Ted Pillows, the market is unfolding within a recognizable structure defined by optimism, correction, and eventual euphoria. His chart illustrates phases of belief and thrill, suggesting both near-term weakness and long-term potential highs.

Ethereum Price Action Follows Cycle Roadmap

The current ETH market price trades at $4,149, reflecting a consolidation period after recent strength. Ted Pillows highlights that a corrective phase could push ETH price toward the $3,600–$3,800 range before recovering.

Specifically, this level aligns with prior support zones and fits the psychology of market cycles where optimism gives way to disbelief. Notably, his chart then projects Ethereum advancing into stages of belief and thrill, with targets nearing $10,000.

Meanwhile, this long-term ETH price forecast suggests that temporary setbacks remain part of a healthier uptrend. Importantly, any decisive break below $3,600 could trigger extended consolidation, delaying recovery.

However, higher lows since 2023 provide structural reinforcement, making deeper declines less likely. Therefore, the technical path reflects both immediate caution and eventual bullish conviction. Ultimately, the roadmap points to Ethereum price positioning for a cycle-defining breakout despite short-term volatility.

SEC Ethereum ETF Approval Reinforces Institutional Legitimacy

The SEC’s decision to approve Grayscale’s Ethereum ETFs under generic listing standards marks a turning point. By moving the Trust and Mini Trust ETFs under Rule 8.201-E, the SEC removed the need for repeated approvals.

Specifically, this creates efficiency for issuers and offers consistency for institutional participants. Notably, the rule shift brings Ethereum ETFs into the same category as commodity-based trust shares, increasing regulatory alignment.

Importantly, this streamlining allows Ethereum products to trade with fewer barriers, reinforcing mainstream accessibility. The decision therefore signals confidence in Ethereum’s role within regulated markets.

By eliminating bottlenecks, institutions gain clearer exposure routes to Ethereum price performance. As a result, Ethereum’s integration with traditional finance strengthens its long-term outlook significantly.

Clear Road Ahead?

Ethereum price faces short-term correction risk, but its trajectory remains constructive long term. Ted Pillows’ chart highlights a cycle-driven roadmap pointing toward eventual highs. SEC approval of Ethereum ETFs further secures institutional access, reinforcing broader adoption. Together, technical and regulatory forces align in support of a strong ETH price cycle.

Frequently Asked Questions (FAQs)

1. Why is Ethereum often analyzed using cycle psychology?

2. What does the SEC’s new generic rule mean for Ethereum ETFs?

3. How does SEC approval impact institutional access to Ethereum?

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card