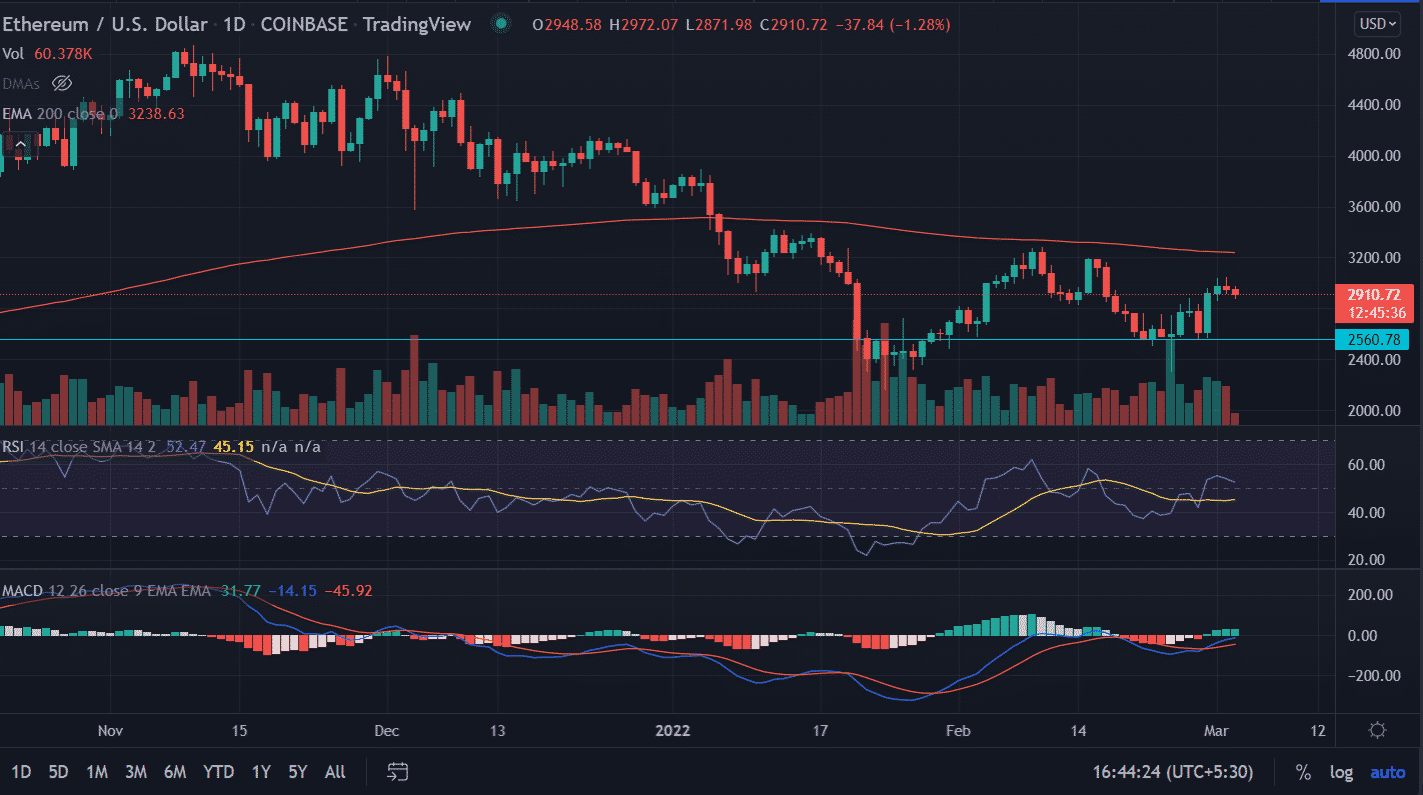

Ethereum (ETH) Price Prediction: ETH Bears Set Eyes On $2,560 ahead of Russia-Ukraine Peace Talks

Ethereum (ETH) price continues to slide down on Thursday as the long-term downtrend extends further. ETH opened lower but recovered quickly to test the session’s high at $2,972.07. However, the rally fizzled out quickly to break the critical $2,900 mark.

- Ethereum (ETH) price trades lower on Thursday amid market uncertainty and volatility.

- ETH remains pressured below 200-EMA at $3,245.

- A bearish pattern formed on March 2 could result in a 12% descent from the current levels.

As of press time, ETH/USD is exchanging hands at $2,904.32, down 1.56% for the day. The second-largest crypto currency’s 24-hour trading volume holds at $345,782,416,688 as per the CoinMarketCap.

ETH set to decline further

Ethereum (ETH) price finds it difficult to hold the critical $3,000 level as ETH fell more than 4% since it made high on Wednesday. The current price action shows bulls are not willing or interested in keeping up the upside momentum in the asset.

The formation of a ‘Doji’ candlestick in the previous session followed by red candlesticks is a perfect bearish ‘Evening star’ pattern. The Evening star pattern is formed when the price is in an uptrend with receding upside momentum or lack of confidence among investors.

Now, a decisive close below the $2,800 mark will trigger a fresh round of selling in the pair. The immediate downside target could be found at the horizontal support zone of $2,560.78.

Next, the price could revisit February lows placed at $2,300.

Alternatively, a resurgence in buying pressure would negate the bearish outlook at least in the short term, with the first resistance hurdle at the previous session’s high of $3,045.00. Further, if the bullish momentum continued then bulls will take out the 200-EMA (Exponential Moving Average) at $3,235.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) trades at 50 with a bearish tilt. Any downtick in the indicator would result in the continuation of the downside momentum.

MACD: The Moving Average Convergence Divergence (MACD) although hovers below midline but remains mildly bullish.

- Bitget Cuts Stock Perps Fees to Zero for Makers Ahead of Earnings Season, Expanding Access Across Markets

- South Korea’s Bithumb Probed by Lawmakers as CEO Blames Glitch for $40B Bitcoin Error

- Robinhood Launches Public Testnet for Ethereum Layer 2 ‘Robinhood Chain’

- Binance Founder CZ Joins Scaramucci, Saylor to Confirm Crypto & Bitcoin Buying, “Not Selling”

- Crypto Market Bill Nears Resolution as Ripple CLO Signals Compromise After Key Meeting

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks