Ethereum (ETH) Price Prediction: ETH face 17% Upside Risk Amid Fed Testimony

Ethereum (ETH) price remains submissive in today’s session following two consecutive higher sessions. It seems price took a breather before taking a leap toward the swing highs of $3,057.81. Market uncertainty and volatility rule the cryptomarkets as investors await two key events.

- Ethereum’s (ETH) price remains on edge on Wednesday.

- ETH is expected to rally 17% as investors go for bargain hunting.

- A close below $2,800 will invalidate the bullish case.

Market participants will be closely watching for Federal Reserve Chairman Jerome Powell as he prepares for his two-day testimony before Congress today. Secondly, the second round of negotiations between Russia-Ukraine will dictate the market mood.

At the time of writing, ETH/USD is trading at $2,939.28, down 1.16% for the day. As per CoinMarketCap, the second-largest cryptocurrency by market cap holds the 24-hour trading volume at $18,967,477,022 with a loss of 11%.

In the latest update, the Ethereum team has announced a reduction in gas fees due to the ongoing Serenity upgrade, virtually good news for the blockchain. But ETH remains largely unfazed by the development.

ETH looks for bullish continuation

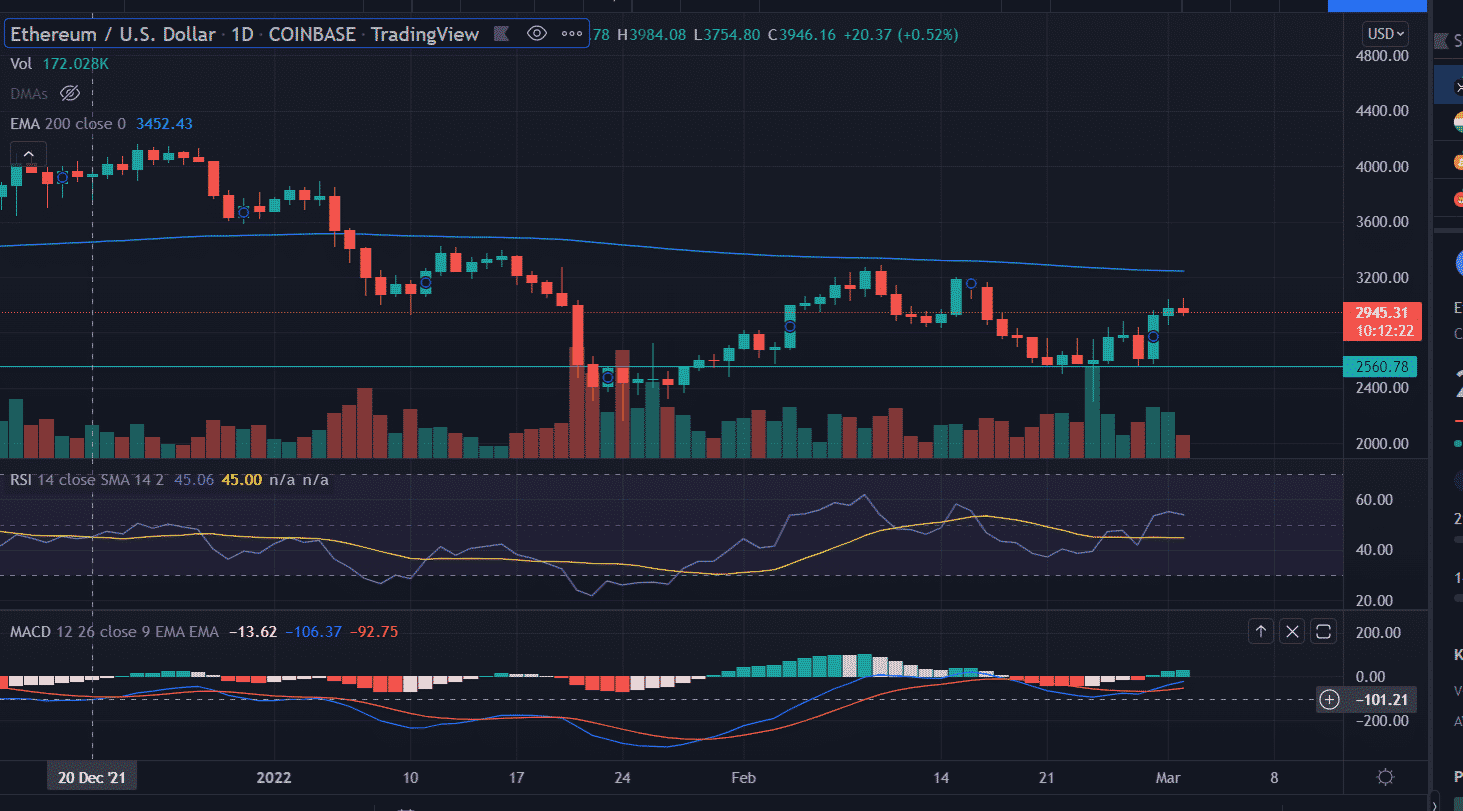

On the daily chart, Ethereum (ETH) price retraced nearly 30% from the swing highs of $3,284.75 and tested February lows at $2,300. Investors respected the demand zone extending from $2,159 and $2,300 as buying emerges near the mentioned levels.

Now, if the price sustains above the session’s high then next it would take out the critical 200-day EMA (Exponential Moving Average) at $3,246.

Furthermore, an acceptance above the mentioned moving average would aim for the January 12 highs of $3,420.08.

On the other side, a break below Tuesday’s low will initiate some fresh round of selling in the asset. The immediate downside target could be found around the horizontal support zone of $2,560.78.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) reads at 53 above the average line.

MACD: The Moving Average Convergence Divergence (MACD) hovers below the midline but with a bullish bias.

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter