Ethereum Price Prediction: ETH Looks To Revisit February Lows At $2,300; Sell Or Hold?

Ethereum (ETH) price extends losses for the third straight day in a row. ETH is free-falling on Friday as the price fails to sustain the psychological $3,000 level. Now, it is interesting to watch if the price could hold the session’s low that is also a weekly support level.

- Ethereum (ETH) price trades with significant losses on Friday.

- ETH remains pressured below 50-day EMA at $2,969.

- Expect a further lower target at $2,300 if the price decisively closes below the weekly trend line.

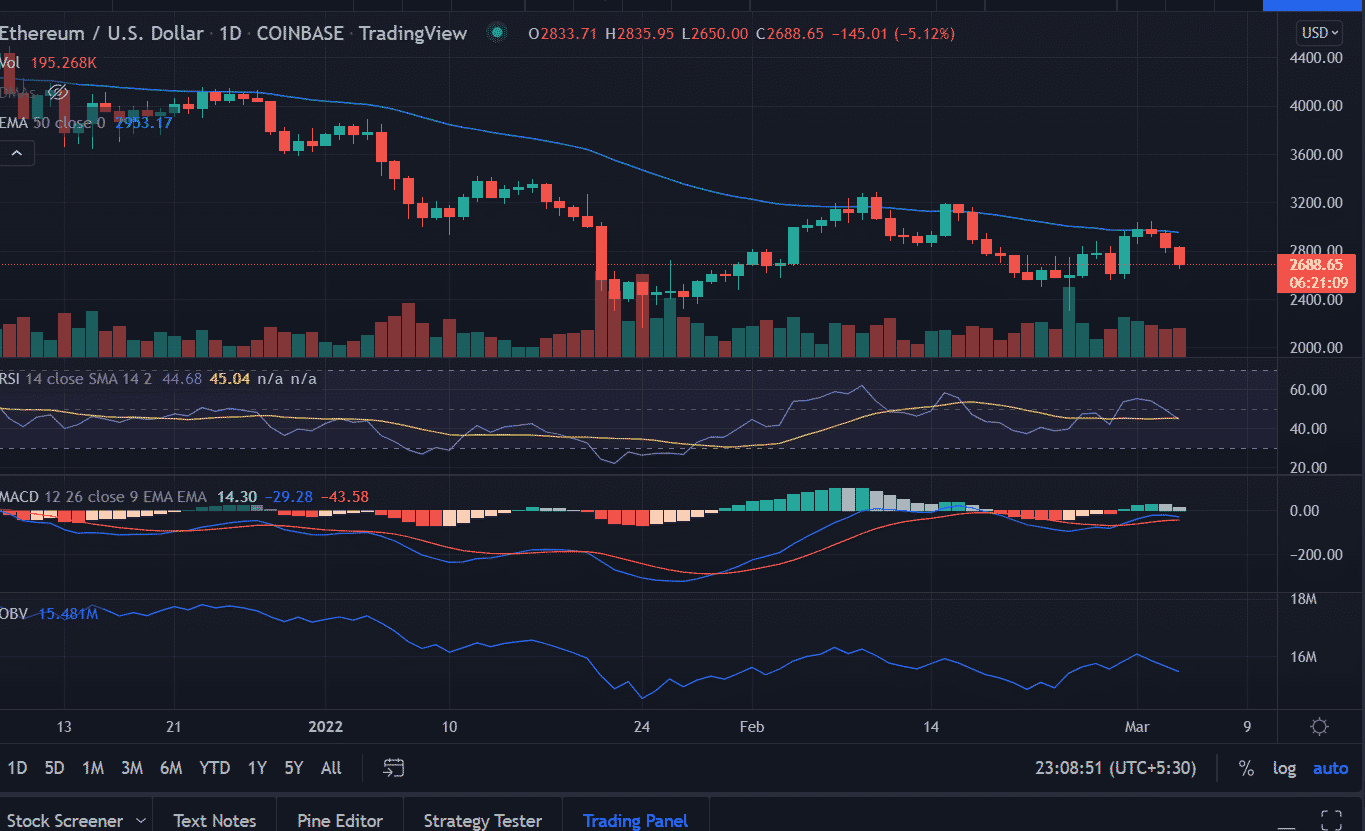

Ethereum price faces multiple rejections near the 50-day Exponential Moving Average (EMA). Recently, Ethereum once again found selling pressure on March 1st around the highs of $3,040.75. In the past four-session, the asset lost 12%.

The daily Relative Strength Index (RSI) reads at 45 with a bearish bias. Now, if the indicator falls below the average line then the price continues to fall. Another momentum indicator, the Moving Average Convergence Divergence (MACD) hovers below the midline with a negative bias.

Furthermore, trading volume is falling along with the price. On Balance Volume (OBV) indicator reveals investors are not convinced of the strength in the altcoin.

In conclusion, a daily close below $2,600 will next see February lows of $2,300.

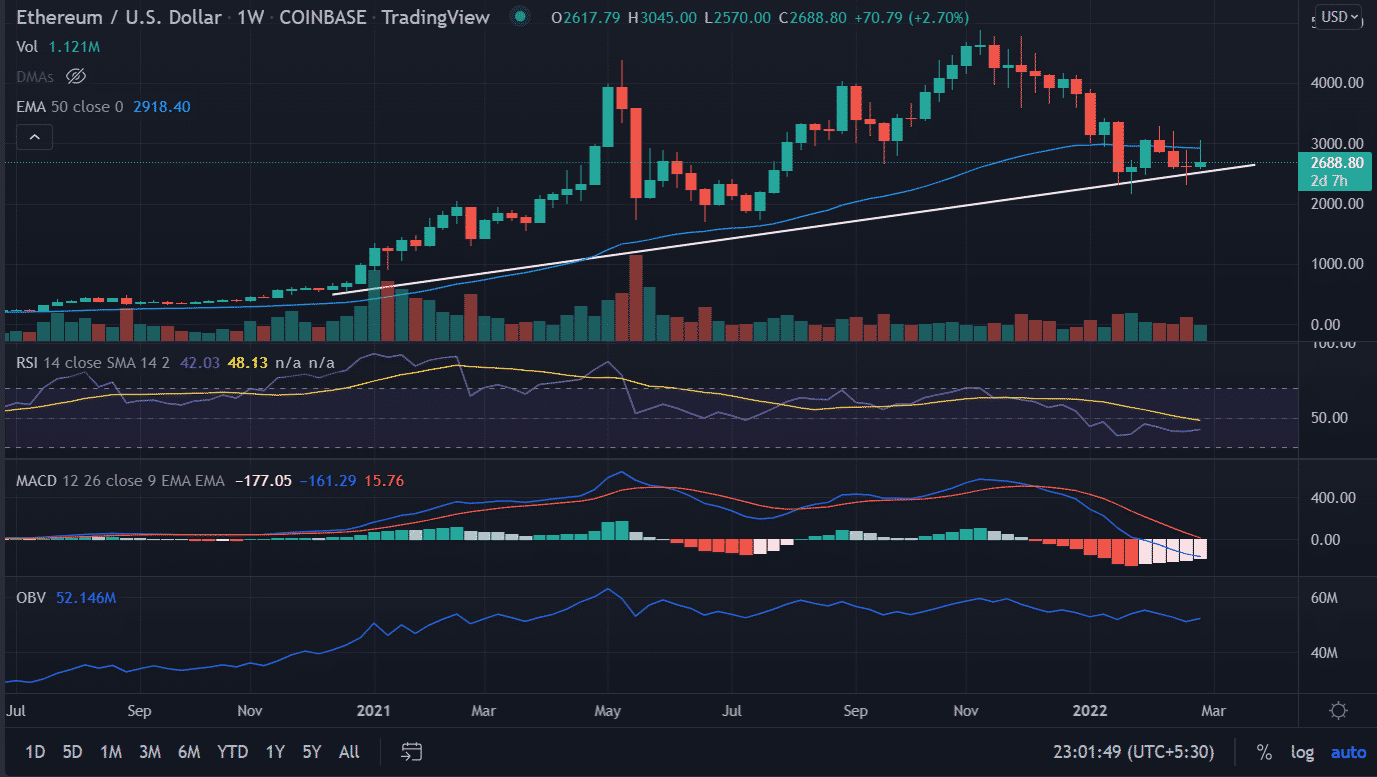

On the weekly chart, the ascending trendline acts as a support for the bulls. A spike in sell order would explore further lower levels toward January 24 lows at $2,159.

On the flip side, a shift in bearish sentiment will invalidate the mentioned bullish arguments. The first upside target is placed at Thursday’s high of $2,972.07. Next, market participants will keep moving to tag the $3,200 mark.

At the time of writing, ETH/USD is trading at $2,689.54, down 5.08% for the day. The second-largest cryptocurrency by market cap holds 24-hour trading volume at $13,762,406,457 with 8% gains as per the CoinMarketCap.

- Crypto Market Bill Nears Resolution as Ripple CLO Signals Compromise After Key Meeting

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?