Ethereum Price Analysis: Consolidates Below $1,600; Is Time To Accumulate?

Ethereum price analysis portrays a negative trend for the day. The price responded to the shift in the market structure and is currently favoring the bears.

- Ethereum price trades with substantial losses on the first trading day of the week.

- The price could test the liquidity resting below $1,450 amid sustained selling pressure.

- However, a daily close above $1,620 could lead to a recovery rally in ETH.

Ethereum price looks for consolidation

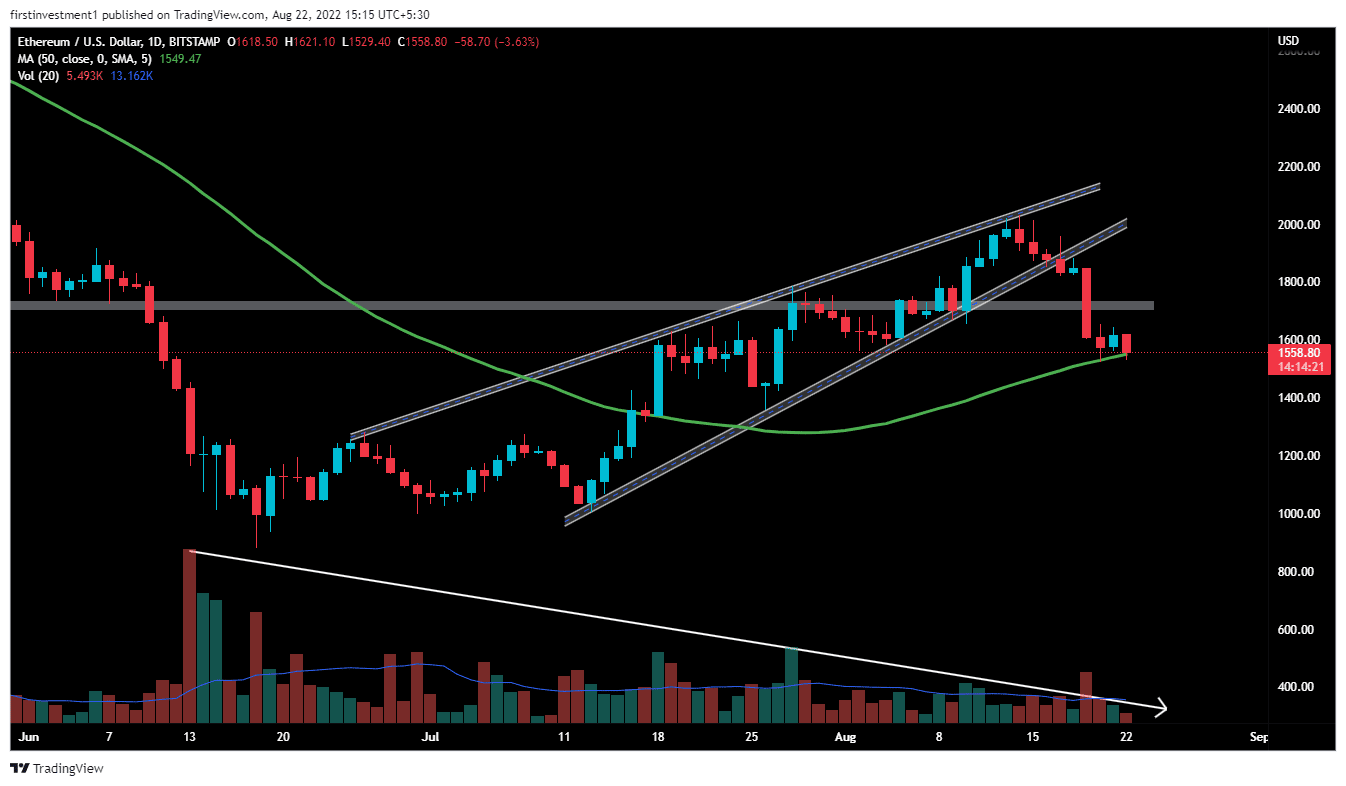

Ethereum price analysis on the daily chart shows a downside pattern.

ETH produces a breakdown of the “Rising Wedge” pattern, indicating weakness around the overall look. The price was not able to break its previous swing high and is taking support near the 50-day exponential moving average. More downside, if breaches the moving average.

The volumes are below the average line and declining, with the price moving upwards, which implies a worrisome. When the market is rising while volume is declining, big money is not the one buying, more likely slowly exiting positions.

If the price breaks below the support level ($1,528), then we can expect a good downside momentum of up to $1,350.

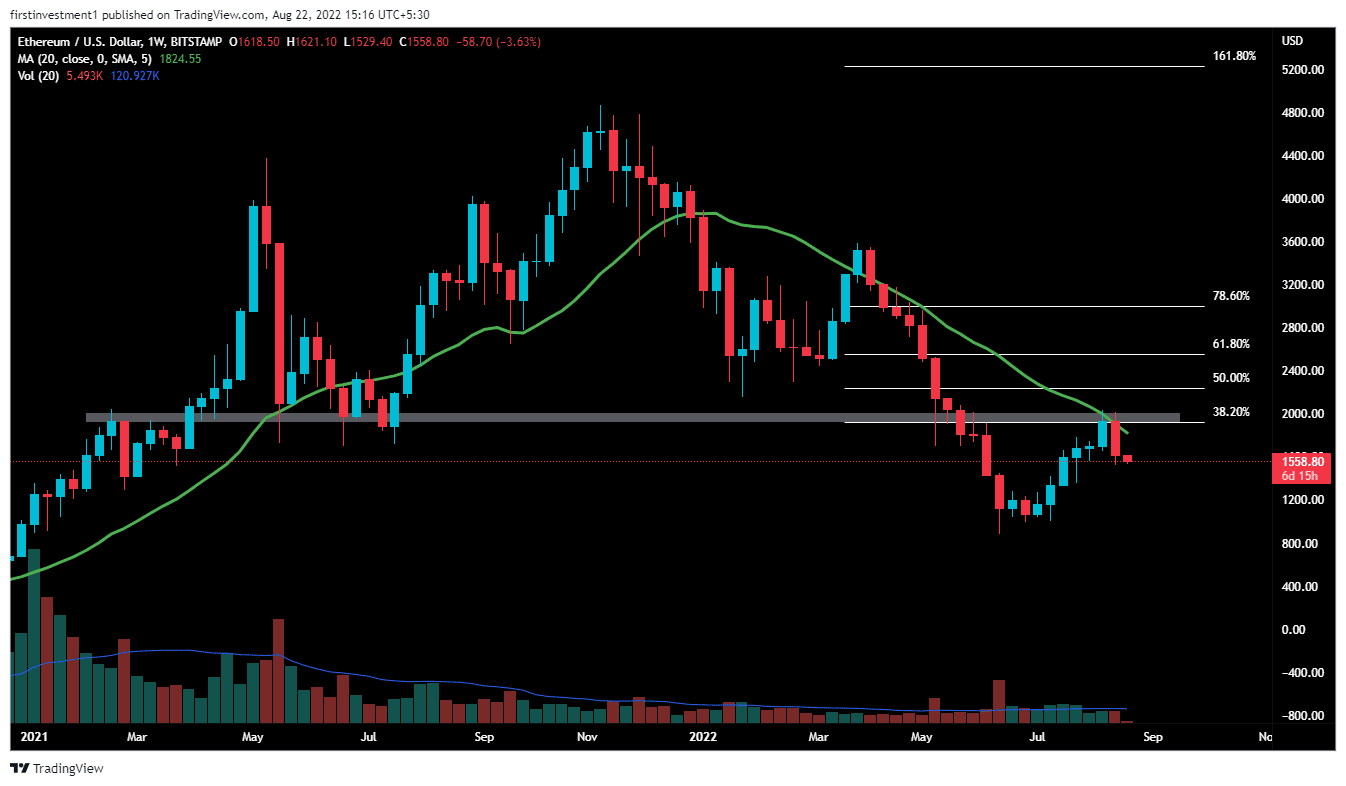

On the weekly charts, the ETH price closed above $2000 for the first time On March 29, 2021, and since then the price had made a high of $4867.

But, on May 22, 2022, the price broke the support of more than one-and-half years of $2,000, & started to fall from there up to $898, the fresh all-time low.

In the previous week, the price finally tested the $2000 level again, but the bulls could not sustain the gains, facing heavy resistance which was once acting as a support.

The price is taking resistance to the 20-day Exponential Moving Average (EMA). Along with a 38.6% Fibonacci retracement, which will act as immediate resistance for this week.

On the weekly basis, a bearish engulfing candlestick indicates the presence of sellers at the higher levels. A slippage below the $1,520 critical level would be a blessing for the bears. In that scenario, the price could find the lower targets near $1,340.

On the other hand, a resurgence of discount buying could push the price toward the $1,760 level which could invalidate the bearish outlook. And the price can be higher than $2,000 in the short term.

ETH is bearish on all time frames. Below $1,520 closing on the hourly time frame, we can put a trade on the sell side.

As of publication time, ETH/USD is exchanging hands at $1,578, down 2.45% for the day. The 24-hour trading volume is held at $18,589,056,100 with a loss of less than 1%. This indicates lower volatility over the last 24 hours.

- Robinhood Launches Public Testnet for Ethereum Layer 2 ‘Robinhood Chain’

- Binance Founder CZ Joins Scaramucci, Saylor to Confirm Crypto & Bitcoin Buying, “Not Selling”

- Crypto Market Bill Nears Resolution as Ripple CLO Signals Compromise After Key Meeting

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?